XM Radio 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Liberty Media

In February 2009, we entered into an Investment Agreement (the “Investment Agreement”) with an affiliate

of Liberty Media Corporation, Liberty Radio, LLC (collectively, “Liberty Media”). Pursuant to the Investment

Agreement, in March 2009 we issued to Liberty Radio, LLC 12,500,000 shares of our Convertible Perpetual

Preferred Stock, Series B-1 (the “Series B Preferred Stock”), with a liquidation preference of $0.001 per share in

partial consideration for certain loans. Liberty Media has representatives on our board of directors. In September

2012, Liberty Media converted 6,249,900 shares of the Series B Preferred Stock into 1,293,467,684 shares of our

common stock. For a discussion of subsequent events refer to Note 18.

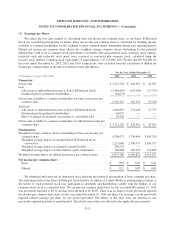

Liberty Media has advised us that as of December 31, 2012 and 2011, respectively, it also owned the

following:

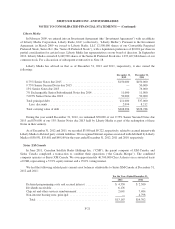

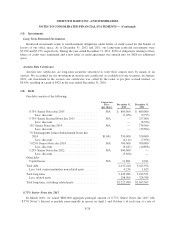

December 31,

2012

December 31,

2011

8.75% Senior Notes due 2015 .................................. $150,000 $150,000

9.75% Senior Secured Notes due 2015 ........................... — 50,000

13% Senior Notes due 2013 .................................... — 76,000

7% Exchangeable Senior Subordinated Notes due 2014 .............. 11,000 11,000

7.625% Senior Notes due 2018 ................................. 50,000 50,000

Total principal debt .......................................... 211,000 337,000

Less: discounts ............................................ 2,094 8,212

Total carrying value of debt .................................... $208,906 $328,788

During the year ended December 31, 2012, we redeemed $50,000 of our 9.75% Senior Secured Notes due

2015 and $76,000 of our 13% Senior Notes due 2013 held by Liberty Media as part of the redemption of these

Notes in their entirety.

As of December 31, 2012 and 2011, we recorded $3,980 and $9,722, respectively, related to accrued interest with

Liberty Media to Related party current liabilities. We recognized Interest expense associated with debt held by Liberty

Media of $30,931, $35,681 and $40,169 for the years ended December 31, 2012, 2011 and 2010, respectively.

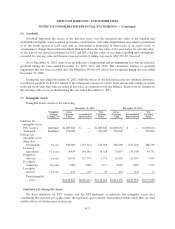

Sirius XM Canada

In June 2011, Canadian Satellite Radio Holdings Inc. (“CSR”), the parent company of XM Canada, and

Sirius Canada completed a transaction to combine their operations (“the Canada Merger”). The combined

company operates as Sirius XM Canada. We own approximately 46,700,000 Class A shares on a converted basis

of CSR, representing a 37.9% equity interest and a 25.0% voting interest.

We had the following related party current asset balances attributable to Sirius XM Canada at December 31,

2012 and 2011:

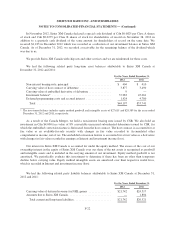

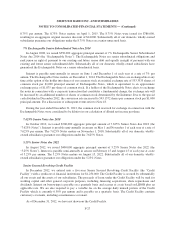

For the Years Ended December 31,

2012 2011

Deferred programming costs and accrued interest ............... $ 4,350 $ 2,500

Dividends receivable ...................................... 6,176 —

Chip set and other services reimbursement ..................... 2,641 7,404

Non-interest bearing note, principal .......................... — 4,798

Total ................................................ $13,167 $14,702

F-21