XM Radio 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

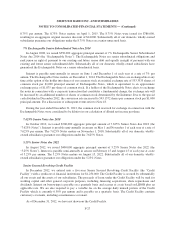

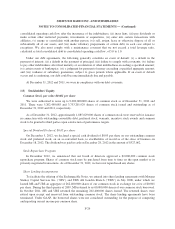

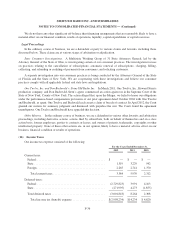

We recorded interest expense related to the amortization of the costs associated with the share lending

arrangement and other issuance costs for our Exchangeable Notes of $12,402, $11,189 and $10,095 for the years

ended December 31, 2012, 2011 and 2010, respectively. As of December 31, 2012, the unamortized balance of

the debt issuance costs was $27,652, with $27,099 recorded in Deferred financing fees, net, and $553 recorded in

Long-term related party assets. As of December 31, 2011, the unamortized balance of the debt issuance costs was

$40,054, with $39,253 recorded in Deferred financing fees, net, and $801 recorded in Long-term related party

assets. These costs will continue to be amortized until the debt is terminated.

Other

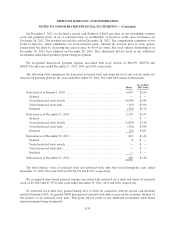

In January 2004, Sirius Satellite Radio Inc. signed a seven-year agreement with a sports programming

provider which expired in February 2011. Upon execution of this agreement, Sirius delivered 15,173,070 shares

of common stock valued at $40,967 to that programming provider. These shares of common stock were subject

to transfer restrictions which lapsed over time. We recognized share-based payment expense associated with

these shares of $1,568 and $5,852 in the years ended December 31, 2011 and 2010, respectively. As of

December 31, 2011, the value of the common stock was fully expensed.

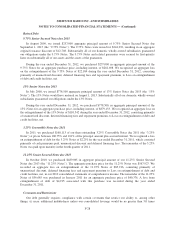

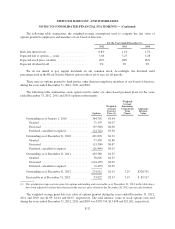

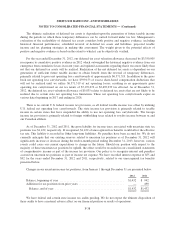

Preferred Stock, par value $0.001 per share

We were authorized to issue up to 50,000,000 shares of undesignated preferred stock as of December 31,

2012 and 2011. There were no shares of Series A Convertible Preferred Stock (“Series A Preferred Stock”)

issued and outstanding as of December 31, 2012 and 2011.

There were 6,250,100 and 12,500,000 shares of Series B Preferred Stock issued and outstanding as of

December 31, 2012 and 2011, respectively. In September 2012, Liberty Media converted 6,249,900 shares of the

Series B Preferred Stock into 1,293,467,684 shares of common stock. The Series B Preferred Stock is convertible

into shares of our common stock at the rate of 206.9581409 shares of common stock for each share of Series B

Preferred Stock, representing approximately 20% of our outstanding shares of common stock (after giving effect

to such conversion). As the holder of the Series B Preferred Stock, Liberty Radio LLC is entitled to a number of

votes equal to the number of shares of our common stock into which such shares of Series B Preferred Stock are

convertible. Liberty Radio LLC will also receive dividends and distributions ratably with our common stock, on

an as-converted basis. With respect to dividend rights, the Series B Preferred Stock ranks evenly with our

common stock and each other class or series of our equity securities not expressly provided as ranking senior to

the Series B Preferred Stock. With respect to liquidation rights, the Series B Preferred Stock ranks evenly with

each other class or series of our equity securities not expressly provided as ranking senior to the Series B

Preferred Stock, and ranks senior to our common stock. For a discussion of subsequent events refer to Note 18.

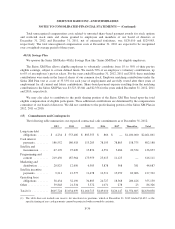

Warrants

We have issued warrants to purchase shares of common stock in connection with distribution, programming

and satellite purchase agreements. As of December 31, 2012 and 2011, approximately 18,455,000 and

22,506,000 warrants to acquire an equal number of shares of common stock were outstanding and fully vested.

Warrants were excluded from the calculation of diluted net income per common share as the effect would have

been anti-dilutive for the year ended December 31, 2012. The warrants expire at various times through 2015. At

December 31, 2012 and 2011, the weighted average exercise price of outstanding warrants was $2.55 and $2.63

per share, respectively. We did not incur warrant related expenses during the years ended December 31, 2012,

2011 or 2010.

F-30