XM Radio 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

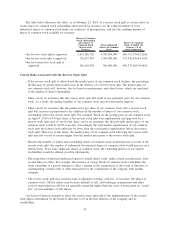

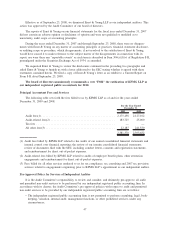

The table below illustrates the effect, as of February 23, 2010, of a reverse stock split at certain ratios on

(i) the shares of common stock outstanding and reserved for issuance, (ii) the reduced number of total

authorized shares of common stock under our certificate of incorporation, and (iii) the resulting number of

shares of common stock available for issuance:

Shares of Common

Stock Outstanding

plus Shares of

Common Stock

Reserved for

Issuance

Total Authorized

Shares of Common

Stock

Shares of Common

Stock Available for

Issuance (% of

total authorized)

One-for-two stock split is approved .... 3,633,286,720 4,500,000,000 866,713,279(19.26)%

One-for-ten stock split is approved..... 726,657,344 1,300,000,000 573,342,656(44.10)%

One-for-twenty-five stock split is

approved . ..................... 290,662,938 700,000,000 409,337,062(58.48)%

Certain Risks Associated with the Reverse Stock Split

• If the reverse stock split is effected and the market price of our common stock declines, the percentage

decline may be greater than would occur in the absence of a reverse stock split. The market price of

our common stock will, however, also be based on performance and other factors, which are unrelated

to the number of shares outstanding.

• There can be no assurance that the reverse stock split will result in any particular price for our common

stock. As a result, the trading liquidity of our common stock may not necessarily improve.

• There can be no assurance that the market price per share of our common stock after a reverse stock

split will increase in proportion to the reduction in the number of shares of our common stock

outstanding before the reverse stock split. For example, based on the closing price of our common stock

on April 9, 2010 of $.99 per share, if the reverse stock split were implemented and approved for a

reverse stock split ratio of one-for-ten, there can be no assurance that the post-split market price of our

common stock would be $9.90 or greater. Accordingly, the total market capitalization of our common

stock after the reverse stock split may be lower than the total market capitalization before the reverse

stock split. Moreover, in the future, the market price of our common stock following the reverse stock

split may not exceed or remain higher than the market price prior to the reverse stock split.

• Because the number of issued and outstanding shares of common stock would decrease as result of the

reverse stock split, the number of authorized but unissued shares of common stock would increase on a

relative basis. If we issue additional shares of common stock, the ownership interest of our current

stockholders would be diluted, possibly substantially.

• The proportion of unissued authorized shares to issued shares could, under certain circumstances, have

an anti-takeover effect. For example, the issuance of a large block of common stock could dilute the

stock ownership of a person seeking to effect a change in the composition of the board of directors or

contemplating a tender offer or other transaction for the combination of the company with another

company.

• The reverse stock split may result in some stockholders owning “odd lots” of less than 100 shares of

common stock. Odd lot shares may be more difficult to sell, and brokerage commissions and other

costs of transactions in odd lots are generally somewhat higher than the costs of transactions in “round

lots” of even multiples of 100 shares.

Our board of directors intends to effect the reverse stock split only if the implementation of the reverse

stock split is determined by the board of directors to be in the best interests of the company and its

stockholders.

42