XM Radio 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

business outlook, and as a means to evaluate period-to-period comparisons. Please refer to the footnotes (pages 32

through 46) following our discussion of results of operations for the definitions and a further discussion of the

usefulness of such non-GAAP financial information and reconciliation to GAAP.

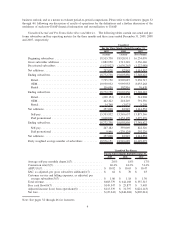

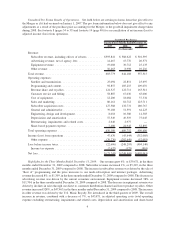

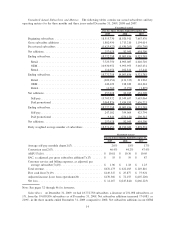

Unaudited Actual and Pro Forma Subscribers and Metrics. The following tables contain our actual and pro

forma subscriber and key operating metrics for the three months and three years ended December 31, 2009, 2008

and 2007, respectively:

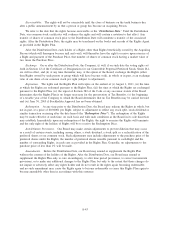

2009 2008 2007

For the Three Months Ended December 31,

Unaudited

(Actual) (Actual) (Pro Forma)

Beginning subscribers ........................... 18,515,730 18,920,911 16,234,070

Gross subscriber additions ........................ 1,882,950 1,713,210 2,336,640

Deactivated subscribers .......................... (1,625,922) (1,630,265) (1,222,088)

Net additions .................................. 257,028 82,945 1,114,552

Ending subscribers .............................. 18,772,758 19,003,856 17,348,622

Retail...................................... 7,725,750 8,905,087 9,238,715

OEM...................................... 10,930,952 9,995,953 8,033,268

Rental ..................................... 116,056 102,816 76,639

Ending subscribers .............................. 18,772,758 19,003,856 17,348,622

Retail...................................... (200,154) (131,333) 314,908

OEM...................................... 442,422 218,249 791,356

Rental ..................................... 14,760 (3,971) 8,288

Net additions .................................. 257,028 82,945 1,114,552

Self-pay .................................... 15,703,932 15,549,657 13,873,346

Paid promotional ............................. 3,068,826 3,454,199 3,475,276

Ending subscribers .............................. 18,772,758 19,003,856 17,348,622

Self-pay .................................... 247,182 359,069 822,326

Paid promotional ............................. 9,846 (276,124) 292,226

Net additions .................................. 257,028 82,945 1,114,552

Daily weighted average number of subscribers ......... 18,576,151 18,910,689 16,629,079

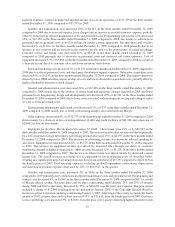

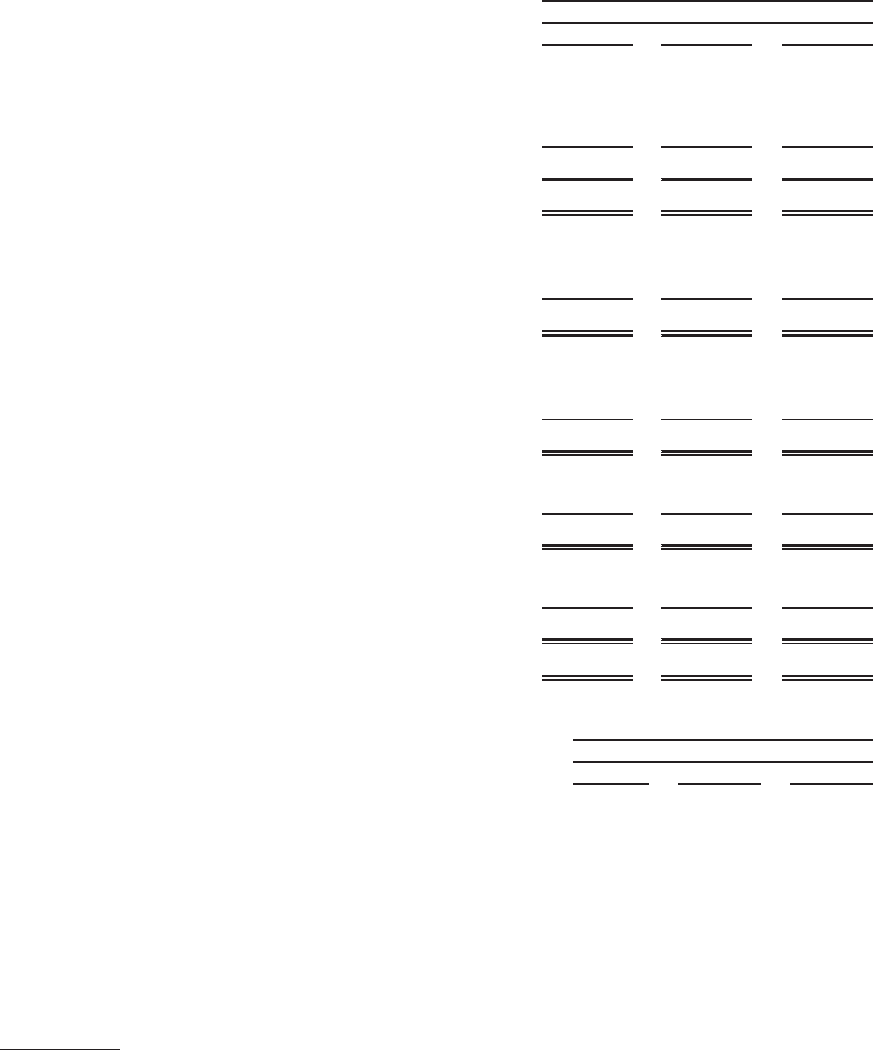

2009 2008 2007

For the Three Months Ended December 31,

Unaudited Pro Forma

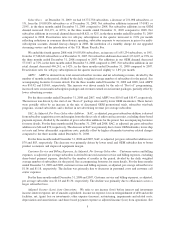

Average self-pay monthly churn(1)(7). . ................. 2.0% 1.8% 1.7%

Conversion rate(2)(7) ............................... 46.4% 44.2% 51.4%

ARPU(3)(7)...................................... $ 10.92 $ 10.65 $ 10.47

SAC, as adjusted, per gross subscriber addition(4)(7) ....... $ 64 $ 70 $ 83

Customer service and billing expenses, as adjusted, per

average subscriber(5)(7) ........................... $ 1.06 $ 1.18 $ 1.30

Total revenue ..................................... $683,779 $ 644,108 $ 557,515

Free cash flow(6)(7) ............................... $149,547 $ 25,877 $ 5,405

Adjusted income (loss) from operations(8) ............... $115,339 $ 31,797 $(224,143)

Net loss......................................... $(25,243) $(248,468) $(405,041)

Note: See pages 32 through 46 for footnotes.

4