XM Radio 2009 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(j) 11.25% Senior Secured Notes due 2013

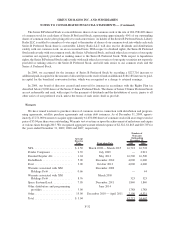

In June 2009, XM issued $525,750 aggregate principal amount of 11.25% Senior Secured Notes due 2013 (the

“11.25% Notes”). Interest is payable semi-annually in arrears on June 15 and December 15 of each year at a rate of

11.25% per annum. The 11.25% Notes mature on June 15, 2013. The 11.25% Notes were issued for $488,398,

resulting in an aggregate original issuance discount of $37,352.

XM Holdings and the domestic subsidiaries of XM that guarantee certain of the indebtedness of XM and its

restricted subsidiaries guarantee XM’s obligations under the 11.25% Notes. The 11.25% Notes and related

guarantees are secured by first-priority liens on substantially all of the assets of XM Holdings, XM and the

guarantors.

(k) 13% Senior Notes due 2013

In July 2008, XM issued $778,500 aggregate principal amount of 13% Senior Notes due 2013 (the

“13% Notes”). Interest is payable semi-annually in arrears on February 1 and August 1 of each year at a rate

of 13% per annum, are unsecured and mature on August 1, 2013.

(l) 9.75% Senior Notes due 2014

XM has outstanding $5,260 aggregate principal amount of 9.75% Senior Notes due 2014 (the “XM

9.75% Notes”). Interest on the XM 9.75% Notes is payable semi-annually on May 1 and November 1 at a rate

of 9.75% per annum. The XM 9.75% Notes are unsecured and mature on May 1, 2014. XM, at its option, may

redeem the XM 9.75% Notes at declining redemption prices at any time on or after May 1, 2010, subject to certain

restrictions. Prior to May 1, 2010, XM may redeem the XM 9.75% Notes, in whole or in part, at a price equal to

100% of the principal amount thereof, plus a make-whole premium and accrued and unpaid interest to the date of

redemption.

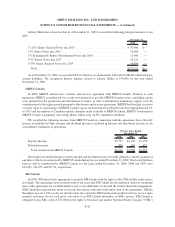

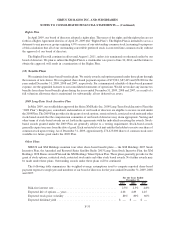

In March 2009, XM executed and delivered a Third Supplemental Indenture (the “XM 9.75% Notes

Supplemental Indenture”). The XM 9.75% Notes Supplemental Indenture amended the indenture to eliminate

substantially all of the restrictive covenants, eliminated certain events of default and modified or eliminated certain

other provisions contained in the indenture and the XM 9.75% Notes.

(m) 7% Exchangeable Senior Subordinated Notes due 2014

In August 2008, XM issued $550,000 aggregate principal amount of 7% Exchangeable Senior Subordinated

Notes due 2014 (the “Exchangeable Notes”). The Exchangeable Notes are senior subordinated obligations of XM

and rank junior in right of payment to its existing and future senior debt and equally in right of payment with its

existing and future senior subordinated debt. XM Holdings, XM Equipment Leasing LLC and XM Radio Inc. have

guaranteed the Exchangeable Notes on a senior subordinated basis.

The Exchangeable Notes are not guaranteed by SIRIUS or Satellite CD Radio, Inc. Interest is payable semi-

annually in arrears on June 1 and December 1 of each year at a rate of 7% per annum. The Exchangeable Notes

mature on December 1, 2014. The Exchangeable Notes are exchangeable at any time at the option of the holder into

shares of our common stock at an initial exchange rate of 533.3333 shares of common stock per $1,000 principal

amount of Exchangeable Notes, which is equivalent to an approximate exchange price of $1.875 per share of

common stock.

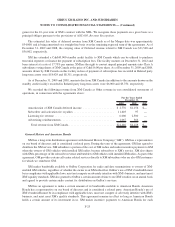

Expired Credit Arrangements

LM Term Loan and LM Purchase Money Loan

In February 2009, SIRIUS entered into a Credit Agreement (the “LM Credit Agreement”) with Liberty Media

Corporation, as administrative agent and collateral agent. The LM Credit Agreement provided for a $250,000 term

F-29

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)