XM Radio 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

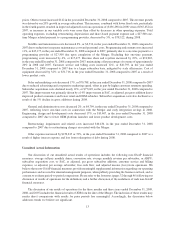

accompanying footnotes for more details. For the three months ended December 31, 2009 and 2008, our adjusted

income (loss) from operations was $115,339 and $31,797, respectively. Adjusted income (loss) from operations was

favorably impacted by an increase of 6%, or $39,671, in revenues and a decrease of 7%, or $43,871, in total

expenses included in adjusted income (loss) from operations. The increase in revenue was due mainly to increased

rates on multi-subscription packages, revenues earned on internet packages, the introduction of the U.S. Music

Royalty Fee and the sale of “Best of” programming, partially offset by decreased equipment revenue. The decreases

in expenses were primarily driven by lower subscriber acquisition costs, lower customer service and billing

expense, savings in programming and content expenses, and lower legal and consulting costs in general and

administrative expenses.

For the three months ended December 31, 2008 and 2007, our adjusted income (loss) from operations was

$31,797 and ($224,143), respectively. Adjusted income (loss) from operations was favorably impacted by an

increase of 16%, or $86,593, in revenues and a decrease of 22%, or $169,347, in total expenses included in adjusted

income (loss) from operations.

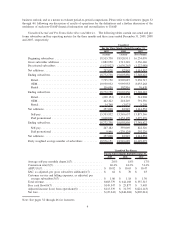

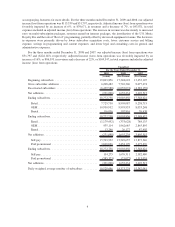

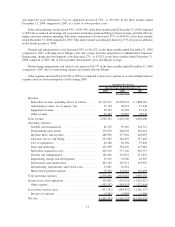

2009 2008 2007

For the Years Ended December 31,

Unaudited

(Actual) (Pro Forma) (Pro Forma)

Beginning subscribers ........................... 19,003,856 17,348,622 13,653,107

Gross subscriber additions ........................ 6,208,482 7,710,306 8,077,674

Deactivated subscribers .......................... (6,439,580) (6,055,072) (4,382,159)

Net additions .................................. (231,098) 1,655,234 3,695,515

Ending subscribers .............................. 18,772,758 19,003,856 17,348,622

Retail...................................... 7,725,750 8,905,087 9,238,715

OEM...................................... 10,930,952 9,995,953 8,033,268

Rental ..................................... 116,056 102,816 76,639

Ending subscribers .............................. 18,772,758 19,003,856 17,348,622

Retail...................................... (1,179,452) (333,628) 784,135

OEM...................................... 935,114 1,962,685 2,863,895

Rental ..................................... 13,240 26,177 47,485

Net additions .................................. (231,098) 1,655,234 3,695,515

Self-pay .................................... 15,703,932 15,549,657 13,873,346

Paid promotional ............................. 3,068,826 3,454,199 3,475,276

Ending subscribers .............................. 18,772,758 19,003,856 17,348,622

Self-pay .................................... 154,275 1,676,311 2,382,480

Paid promotional ............................. (385,373) (21,077) 1,313,035

Net additions .................................. (231,098) 1,655,234 3,695,515

Daily weighted average number of subscribers ......... 18,529,696 18,373,274 15,342,041

6