XM Radio 2009 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

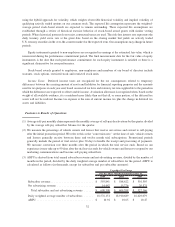

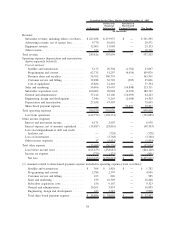

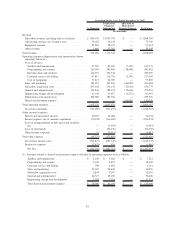

(4) SAC, as adjusted, per gross subscriber addition is derived from subscriber acquisition costs and margins from

the direct sale of radios and accessories, excluding share-based payment expense, divided by the number of

gross subscriber additions for the period. SAC, as adjusted, per gross subscriber addition is calculated as follows

(in thousands, except for subscriber and per subscriber amounts):

2009 2008 2007

For the Three Months Ended December 31,

Unaudited Pro Forma

Subscriber acquisition cost ........................ $ 127,588 $ 132,731 $ 190,090

Less: share-based payment expense granted to third

parties and employees ......................... — — (9,323)

(Less) Add: margin from direct sales of radios and

accessories .................................. (6,808) (12,628) 12,201

SAC, as adjusted ............................... $ 120,780 $ 120,103 $ 192,968

Gross subscriber additions ........................ 1,882,950 1,713,210 2,336,640

SAC, as adjusted, per gross subscriber addition ......... $ 64 $ 70 $ 83

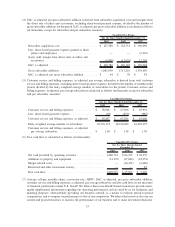

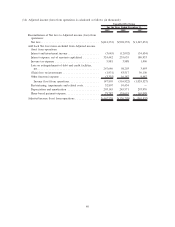

(5) Customer service and billing expenses, as adjusted, per average subscriber is derived from total customer

service and billing expenses, excluding share-based payment expense, divided by the number of months in the

period, divided by the daily weighted average number of subscribers for the period. Customer service and

billing expenses, as adjusted, per average subscriber is calculated as follows (in thousands, except for subscriber

and per subscriber amounts):

2009 2008 2007

For the Three Months Ended December 31,

Unaudited Pro Forma

Customer service and billing expenses ............ $ 58,981 $ 67,906 $ 65,991

Less: share-based payment expense ............... (94) (870) (985)

Customer service and billing expenses, as adjusted . . . $ 58,887 $ 67,036 $ 65,006

Daily weighted average number of subscribers ...... 18,576,151 18,910,689 16,629,079

Customer service and billing expenses, as adjusted,

per average subscriber. ...................... $ 1.06 $ 1.18 $ 1.30

(6) Free cash flow is calculated as follows (in thousands):

2009 2008 2007

For the Three Months Ended

December 31,

Unaudited Pro Forma

Net cash provided by operating activities .................. $180,723 $ 64,195 $ 30,957

Additions to property and equipment ..................... (31,176) (27,846) (18,954)

Merger related costs ................................. — (10,472) (6,680)

Restricted and other investment activity ................... — — 82

Free cash flow. ..................................... $149,547 $ 25,877 $ 5,405

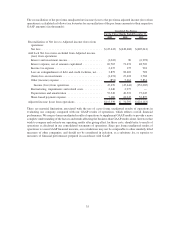

(7) Average self-pay monthly churn; conversion rate; ARPU; SAC, as adjusted, per gross subscriber addition;

customer service and billing expenses, as adjusted, per average subscriber; and free cash flow are not measures

of financial performance under U.S. GAAP. We believe these non-GAAP financial measures provide mean-

ingful supplemental information regarding our operating performance and are used by us for budgetary and

planning purposes; when publicly providing our business outlook; as a means to evaluate period-to-period

comparisons; and to compare our performance to that of our competitors. We believe that investors also use our

current and projected metrics to monitor the performance of our business and to make investment decisions.

33