XM Radio 2009 Annual Report Download - page 164

Download and view the complete annual report

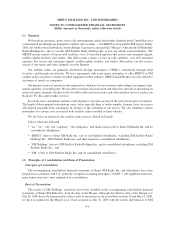

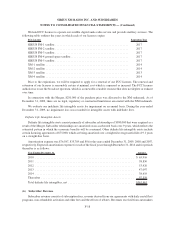

Please find page 164 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Holdings included as of July 31, 2008. We accounted for the Merger as an acquisition of XM Holdings under the

purchase method of accounting for business combinations. The acquisition cost approximated $5,836,363,

including transaction cost, and was allocated to the underlying net assets acquired, based on the respective

estimated fair values. This allocation included intangible assets, such as FCC licenses, customer relationships,

license agreements and trademarks. The excess of the purchase price over the estimated fair values of the net assets

acquired was recorded as goodwill. Because the Merger was consummated on July 28, 2008, the accompanying

financial statements and notes for periods prior to that date reflect only the financial results of Sirius Satellite Radio

Inc., as predecessor to Sirius XM Radio Inc, and are therefore not comparable to our financial results for 2009 and

the fourth quarter of 2008.

We have evaluated events subsequent to the balance sheet date and prior to filing of the Annual Report on

Form 10-K for the year ended December 31, 2009 through February 25, 2010 and determined there have not been

any events that have occurred that would require adjustment to our consolidated financial statements.

(3) Summary of Significant Accounting Policies

Use of Estimates

In presenting consolidated financial statements, management makes estimates and assumptions that affect the

amounts reported and accompanying notes. Additionally, estimates were used when recording the fair values of

assets acquired and liabilities assumed in the Merger. Estimates, by their nature, are based on judgment and

available information. Actual results could differ materially from those estimates.

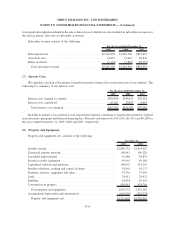

Significant estimates inherent in the preparation of the accompanying consolidated financial statements

include revenue recognition, asset impairment, useful lives of our satellites, share-based payment expense, and

valuation allowances against deferred tax assets. The economic conditions in the United States have impacted our

business. Such conditions could have a material impact to our accounting estimates.

Recent Accounting Pronouncements

In September 2009, Accounting Standards Codification (“ASC”) became the source of authoritative GAAP

recognized by the Financial Accounting Standards Board (“FASB”) for nongovernmental entities, except for

certain FASB Statements not yet incorporated into ASC. Rules and interpretive releases of the SEC under federal

securities laws are also sources of authoritative GAAP for registrants. The discussion below includes the applicable

ASC reference.

In July 2009, the FASB proposed an update to ASC 470 to incorporate the previously ratified EITF No. 09-1,

Accounting for Own-Share Lending Arrangements in Contemplation of Convertible Debt Issuance, into the ASC.

This proposed standard would require share-lending arrangements in an entity’s own shares to be initially measured

at fair value and treated as an issuance cost, excluded from basic and diluted earnings per share, and recognize a

charge to earnings if it becomes probable the counterparty will default on the arrangement. This guidance was

adopted as of January 1, 2010, as required, on a retrospective basis for all arrangements outstanding as of that date.

We will recognize an aggregate increase in the deferred financing costs associated with XM’S 7% Exchangeable

Senior Subordinated Notes due 2014 of approximately $378,000 as of the Merger date, offset by approximately

$30,000 of accumulated amortization through December 31, 2009.

We adopted ASC 855, Subsequent Events, which requires disclosure of events occurring after the balance sheet

date but before financial statements are issued or are available to be issued. We adopted this guidance effective

April 1, 2009, with no impact on our consolidated results of operations or financial position.

In June 2009, the FASB issued Statement No. 168, The FASB Accounting Standards Codification and the

Hierarchy of Generally Accepted Accounting Principles, which integrated existing accounting standards with other

authoritative guidance to provide a single source of authoritative GAAP for nongovernmental entities. Statement

F-10

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)