XM Radio 2009 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207

|

|

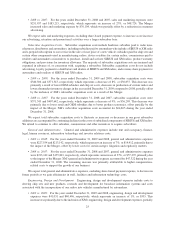

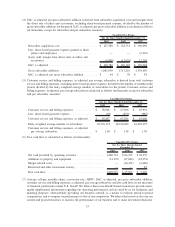

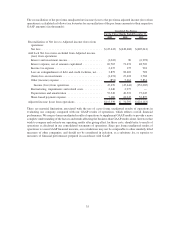

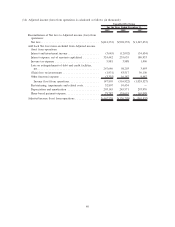

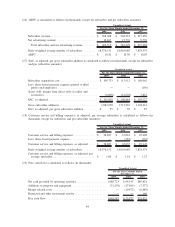

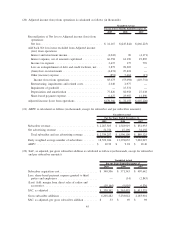

The reconciliation of the pro forma unadjusted net income (loss) to the pro forma adjusted income (loss) from

operations is calculated as follows (see footnotes for reconciliation of the pro forma amounts to their respective

GAAP amounts) (in thousands):

2009 2008 2007

For the Three Months Ended December 31,

Unaudited Pro Forma

Reconciliation of Net loss to Adjusted income (loss) from

operations:

Net loss ....................................... $(25,243) $(248,468) $(405,041)

Add back Net loss items excluded from Adjusted income

(loss) from operations:

Interest and investment income ...................... (1,043) 90 (6,978)

Interest expense, net of amounts capitalized ............ 69,765 71,274 48,703

Income tax expense .............................. 2,637 175 901

Loss on extinguishment of debt and credit facilities, net . . . 3,879 98,203 728

(Gain) loss on investments ......................... (1,474) 27,418 3,768

Other (income) expense ........................... (851) 5,664 5,834

Income (loss) from operations ..................... 47,670 (45,644) (352,085)

Restructuring, impairments and related costs ............ 2,640 2,977 —

Depreciation and amortization ...................... 57,549 49,519 75,045

Share-based payment expense ....................... 7,480 24,945 52,897

Adjusted income (loss) from operations ................. $115,339 $ 31,797 $(224,143)

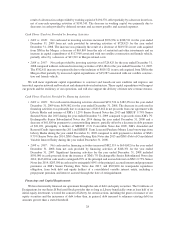

There are material limitations associated with the use of a pro forma unadjusted results of operations in

evaluating our company compared with our GAAP results of operations, which reflects overall financial

performance. We use pro forma unadjusted results of operations to supplement GAAP results to provide a more

complete understanding of the factors and trends affecting the business than GAAP results alone. Investors that

wish to compare and evaluate our operating results after giving effect for these costs, should refer to results of

operations as disclosed in our consolidated statements of operations. Since pro forma unadjusted results of

operations is a non-GAAP financial measure, our calculations may not be comparable to other similarly titled

measures of other companies; and should not be considered in isolation, as a substitute for, or superior to

measures of financial performance prepared in accordance with GAAP.

35