XM Radio 2009 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

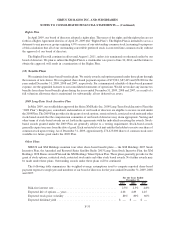

The Series B Preferred Stock is convertible into shares of our common stock at the rate of 206.9581409 shares

of common stock for each share of Series B Preferred Stock, representing approximately 40% of our outstanding

shares of common stock (after giving effect to such conversion). As holder of the Series B Preferred Stock, Liberty

Radio LLC is entitled to a number of votes equal to the number of shares of our common stock into which each such

Series B Preferred Stock share is convertible. Liberty Radio LLC will also receive dividends and distributions

ratably with our common stock, on an as-converted basis. With respect to dividend rights, the Series B Preferred

Stock ranks evenly with our common stock, the Series A Preferred Stock, and each other class or series of our equity

securities not expressly provided as ranking senior to the Series B Preferred Stock. With respect to liquidation

rights, the Series B Preferred Stock ranks evenly with each other class or series of our equity securities not expressly

provided as ranking senior to the Series B Preferred Stock, and will rank senior to our common stock and the

Series A Preferred Stock.

In 2009, we accounted for the issuance of Series B Preferred Stock by recording a $227,716 increase to

additional paid-in capital for the amount of allocated proceeds received and an additional $186,188 increase to paid-

in capital for the beneficial conversion feature, which was recognized as a charge to retained earnings.

In 2009, our board of directors created and reserved for issuance in accordance with the Rights Plan (as

described below) 9,000 shares of the Series C Junior Preferred Stock. The shares of Series C Junior Preferred Stock

are not redeemable and rank, with respect to the payment of dividends and the distribution of assets, junior to all

other series of our preferred stock, unless the terms of such series shall so provide.

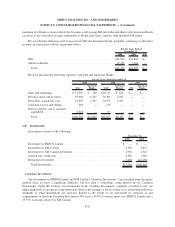

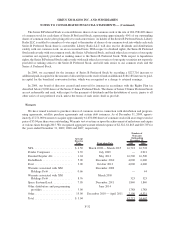

Warrants

We have issued warrants to purchase shares of common stock in connection with distribution and program-

ming agreements, satellite purchase agreements and certain debt issuances. As of December 31, 2009, approx-

imately 47,271,000 warrants to acquire approximately 61,678,000 shares of common stock with an average exercise

price of $3.04 per share were outstanding. Warrants vest over time or upon the achievement of milestones and expire

at various times through 2015. We recognized aggregate warrant related expense of $2,522, $1,865 and $10,707 for

the years ended December 31, 2009, 2008 and 2007, respectively.

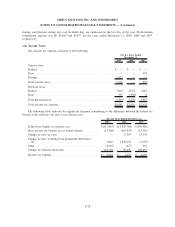

Average

Exercise

Price Expiration Date 2009 2008

Number of

Warrants

Outstanding

December 31,

NFL ........................ $ 2.50 March 2008 — March 2015 16,718 16,718

Penske Companies .............. 2.39 July 2009 — 2,921

DaimlerChrysler AG ............ 1.04 May 2012 16,500 16,500

RadioShack ................... 5.00 December 2010 4,000 6,000

Ford ........................ 3.00 October 2012 4,000 4,000

Warrants associated with XM

Holdings Debt ............... 0.66

December 2009

—44

Warrants associated with XM

Holdings Debt ............... 8.76

March 2010

325 325

Space Systems/Loral ............ 7.05 December 2011 1,840 1,840

Other distributors and programming

providers ................... 3.00

June 2014

1,788 1,788

Other ........................ 15.00 December 2010 — April 2011 2,100 4,531

Total ........................ $ 3.04 47,271 54,667

F-32

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)