XM Radio 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

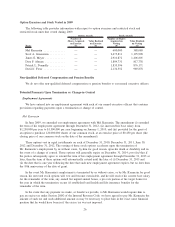

Form 10-K for the year ended December 31, 2009. Mr. Karmazin did not receive equity-based awards in

2005, 2006, 2007 or 2008.

(4) Represents matching and profit sharing contributions by us under our 401(k) savings plan. The profit

sharing contribution was $0 in 2008 and 2009. The matching contributions were paid in the form of shares

of our common stock. All other compensation for Mr. Meyer also includes amounts reimbursed for tempo-

rary living and travel expenses. In 2009, Mr. Meyer was paid $55,000 for rent, $22,449 for travel, $5,177

for utilities, and $63,389 for reimbursement of taxes associated with these expenditures in accordance with

his employment agreement. Travel-related expenses include airfare, taxi/car services, and other incidental

travel-related costs which are reimbursed based on receipts. All other compensation includes amounts paid

for commissions related to the sale of restricted stock units granted in 2009. The total paid was $19,784

for Mr. Greenstein, $23,267 for Mr. Meyer, $11,656 for Ms. Altman, $13,978 for Mr. Donnelly, and

$16,300 for Mr. Frear.

(5) The amount of compensation reported for federal tax purposes for Mr. Karmazin in 2009 was $1,620,316.

We are providing this information to highlight the difference between compensation reported under the

SEC rules and compensation amounts realized and reported as taxable income on Mr. Karmazin’s

Form W-2. The amount reported on Mr. Karmazin’s W-2 includes, among other items: (1) total cash wages

and bonuses paid to Mr. Karmazin in 2009, less amounts deferred under our 401(k) plan and (2) the value

of restricted stock awards that vested during 2009.

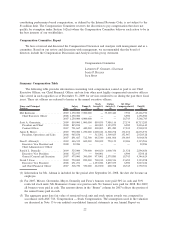

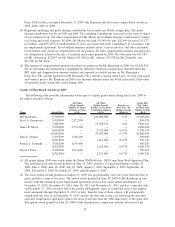

Grants of Plan-Based Awards in 2009

The following table provides information with respect to equity grants made during fiscal year 2009 to

the named executive officers.

Name Grant Date

All Other

Stock Awards:

Number of Shares

of Stock or Units

(#)(1)

All Other

Option Awards:

Number of Securities

Underlying Options

(#)(2)

Exercise or

Base Price of

Option Awards

($/Sh)(3)

Grant Date

Fair Value

of Stock and

Option Awards

($)(4)

Mel Karmazin ....... 6/30/2009 — 120,000,000 0.43 35,209,440

Scott A. Greenstein . . . 5/19/2009 2,322,500 — — 850,035

7/28/2009 — 27,768,136 0.43 7,986,116

James E. Meyer ...... 5/19/2009 2,732,300 — — 1,000,022

8/31/2009 — 3,322,000 0.6735 1,500,278

10/14/2009 — 25,184,984 0.5752 10,000,000

Dara F. Altman ...... 5/19/2009 1,366,200 — — 500,029

8/31/2009 — 1,661,000 0.6735 750,139

Patrick L. Donnelly . . . 5/19/2009 1,639,400 — — 600,020

8/31/2009 — 2,215,000 0.6735 1,000,336

David J. Frear ....... 5/19/2009 1,912,600 — — 700,012

8/31/2009 — 2,215,000 0.6735 1,000,336

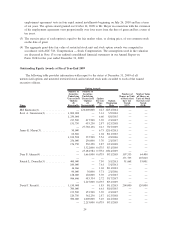

(1) All grants during 2009 were made under the Sirius XM Radio Inc. 2009 Long-Term Stock Incentive Plan.

The restricted stock unit awards granted on May 19, 2009 vested in 10 equal installments on May 20,

2009, June 2, 2009, June 16, 2009, July 20, 2009, August 3, 2009, September 1, 2009, September 30,

2009, November 2, 2009, November 16, 2009, and December 1, 2009.

(2) The stock option awards granted on August 31, 2009 vest proportionally over four years from the date of

grant and have a term of ten years. The option award granted on June 30, 2009 to Mr. Karmazin in con-

nection with the extension of his employment agreement vests in four equal annual installments on

December 31, 2010, December 31, 2011, June 30, 2012 and December 31, 2012 and has a term that ends

on December 31, 2014; provided that if the parties subsequently agree to extend the term of his employ-

ment agreement through December 31, 2013 or later, then the term of these options will automatically

extend until the later of (i) December 31, 2015 and (ii) the date that is one year following the date that

such new employment agreement expires but in no event later than the 10th anniversary of the grant date.

The option award granted on July 28, 2009 to Mr. Greenstein in connection with the extension of his

23