XM Radio 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In the event that any payment we make, or benefit we provide, to Mr. Frear would require him to pay an

excise tax under Section 280G of the Internal Revenue Code, we have agreed to pay Mr. Frear the amount of

such tax and such additional amount as may be necessary to place him in the exact same financial position

that he would have been in if the excise tax was not imposed.

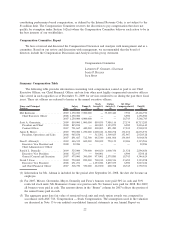

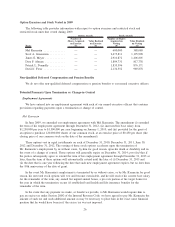

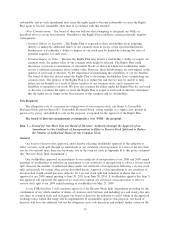

Potential Payments

If a triggering event and/or termination of employment had occurred as of December 31, 2009, we

estimate that the value of the benefits under the employment agreements would have been as follows:

Name Conditions for Payouts

Lump Sum

Severance

Payment

($)

Accelerated

Equity

Vesting(1)

($)

Continuation of

Insurance

Benefits(2)

($)

Tax

Gross-Up

($)

Total

($)

Mel Karmazin . . . . . . . Upon change-in-control or upon

termination due to death or

disability — 20,400,000 — — 20,400,000

Termination without cause or for

good reason 3,750,000 20,400,000 54,317 — 24,204,317

Scott A. Greenstein . . . Termination due to death or

disability — 4,720,583 — — 4,720,583

Termination without cause or for

good reason 850,000 4,720,583 17,569 — 5,588,152

James E. Meyer . . . . . . Termination due to death or

disability — 156,147 — — 156,147

Termination without cause or for

good reason 1,520,000 624,588 28,093 — 2,172,681

Termination for scheduled

retirement 3,040,000 — 38,258 — 3,078,258

Dara F. Altman . . . . . . Termination due to death or

disability — 167,440 — — 167,440

Termination without cause or for

good reason 1,383,628 — 49,447 — 1,433,075

Patrick L. Donnelly . . . Upon change-in-control or upon

termination due to death or

disability — 55,001 — — 55,001

Termination without cause or for

good reason 525,000 — 17,569 — 542,569

David J. Frear . . . . . . . Upon change-in-control or upon

termination due to death or

disability — 120,000 — — 120,000

Termination without cause or for

good reason 750,000 — 17,569 — 767,569

(1) Amounts were calculated based on the closing price of our common stock on December 31, 2009 of

$0.60. The accelerated vesting of options is valued at (a) the difference between the closing price and the

exercise price of the options multiplied by (b) the number of shares of common stock underlying the

options. The accelerated vesting of restricted stock and restricted stock units is valued at the closing price

times the number of shares of restricted stock and restricted stock units.

(2) Assumes that medical and dental benefits would be continued under COBRA for up to 18 months at cur-

rent rates; thereafter assumes rate of two times current employer costs unless otherwise indicated in the

employment agreement. Assumes that life insurance would be continued at rate of two times current

employer cost.

29