XM Radio 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

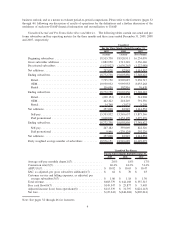

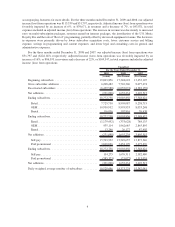

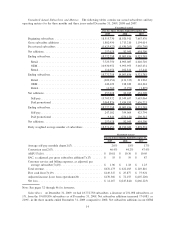

2009 2008 2007

For the Years Ended December 31,

Unaudited Pro Forma

Average self-pay monthly churn(1)(7) ...................... 2.0% 1.8% 1.7%

Conversion rate(2)(7)................................... 45.4% 47.5% 50.9%

ARPU(7)(10) ........................................ $ 10.73 $ 10.56 $ 10.66

SAC, as adjusted, per gross subscriber addition(7)(11) .......... $ 63 $ 74 $ 86

Customer service and billing expenses, as adjusted, per average

subscriber(7)(12) .................................... $ 1.05 $ 1.11 $ 1.18

Total revenue ........................................ $2,526,703 $2,436,740 $ 2,058,608

Free cash flow(7)(13) .................................. $ 185,319 $ (551,771) $ (504,869)

Adjusted income (loss) from operations(14) .................. $ 462,539 $ (136,298) $ (565,452)

Net loss ............................................ $ (441,333) $ (902,335) $(1,247,633)

Note: See pages 32 through 46 for footnotes.

Subscribers. At December 31, 2009, we had 18,772,758 subscribers, a decrease of 231,098 subscribers, or

1%, from the 19,003,856 subscribers as of December 31, 2008. The decrease was principally the result of 385,373

fewer paid promotional trials compared to December 31, 2008 due to the decline in North American auto sales. This

decline was partially offset by an increase of 154,275 in self-pay subscribers compared to December 31, 2008.

Deactivation rates for self-pay subscriptions in the year increased to 2.0% per month reflecting reductions in

consumer discretionary spending, subscriber response to our increase in prices for multi-subscription accounts,

channel line-up changes in 2008, the institution of a monthly charge for our upgraded streaming service and the

introduction of the U.S. Music Royalty Fee.

We ended 2008 with 19,003,856 subscribers, an increase of 1,655,234, or 10%, from the 17,348,622

subscribers as of December 31, 2007. Net subscriber additions decreased 2,040,281, or 55% during 2008 from

2007. Deactivation rates for self-pay subscriptions in the year increased slightly to 1.8%; deactivations due to non-

conversions of subscribers in paid promotional trial periods increased as production penetration rates increased.

ARPU. For the years ended December 31, 2009 and 2008, total ARPU was $10.73 and $10.56, respectively.

Increases in subscriber revenue were driven mainly by the sale of “Best of” programming, increased rates on our

multi-subscription packages and revenues earned on our internet packages, partially offset by lower advertising

revenue.

For the years ended December 31, 2008 and 2007, total ARPU was $10.56 and $10.66, respectively. The

decrease was driven by a change in the mix of discounted OEM promotional subscriptions, subscriber win-back

programs, second subscribers and a decline in net advertising revenue per average subscriber.

SAC, As Adjusted, Per Gross Subscriber Addition. For the years ended December 31, 2009 and 2008, SAC, as

adjusted, per gross subscriber addition was $63 and $74, respectively. The decrease was primarily driven by lower

OEM subsidies, fewer OEM installations relative to gross subscriber additions and lower aftermarket inventory

charges in the year ended December 31, 2009 compared to 2008.

For the years ended December 31, 2008 and 2007, SAC, as adjusted, per gross subscriber addition was $74 and

$86, respectively. The decrease was primarily driven by lower retail and OEM subsidies due to better product

economics and improved equipment margin.

Customer Service and Billing Expenses, As Adjusted, Per Average Subscriber. For the years ended

December 31, 2009 and 2008, customer service and billing expenses, as adjusted, per average subscriber was

$1.05 and $1.11, respectively. The decline was primarily due to decreases in personnel costs and customer call

center expenses.

7