XM Radio 2009 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

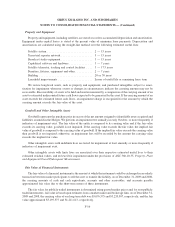

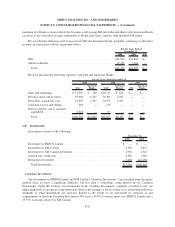

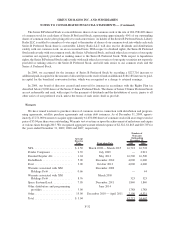

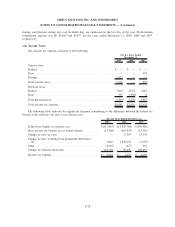

(11) Debt

Our debt consists of the following:

Conversion

Price

(per share) 2009 2008

December 31,

SIRIUS Debt

83⁄4% Convertible

Subordinated Notes due 2009(a) ................... $28.46 $ — $ 1,744

31⁄4% Convertible Notes due 2011(b) ................ $ 5.30 230,000 230,000

Less: discount ............................. (1,371) (1,935)

Senior Secured Term Loan due 2012(c) .............. N/A 244,375 246,875

95⁄8% Senior Notes due 2013(d) .................... N/A 500,000 500,000

Less: discount ............................. (3,341) (3,518)

9.75% Senior Secured Notes due 2015(e) ............ N/A 257,000 —

Less: discount ............................. (11,695) —

21⁄2% Convertible Notes due 2009(f) ................ $ 4.41 — 189,586

XM and XM Holdings Debt

10% Convertible Senior Notes due 2009(g) ........... $10.87 — 400,000

Less: discount ............................. — (16,449)

10% Senior Secured Discount Convertible Notes due

2009(h) ................................... $ 0.69 — 33,249

Add: premium ............................. — 34,321

10% Senior PIK Secured Notes due 2011(i) .......... N/A 113,685 —

Less: discount ............................. (7,325) —

11.25% Senior Secured Notes due 2013(j) ............ N/A 525,750 —

Less: discount ............................. (32,259) —

13% Senior Notes due 2013(k) .................... N/A 778,500 778,500

Less: discount ............................. (76,601) (90,018)

9.75% Senior Notes due 2014(l) ................... N/A 5,260 5,260

7% Exchangeable Senior Subordinated Notes due

2014(m) ................................... $1.875 550,000 550,000

Less: discount ............................. (9,707) (10,474)

Senior Secured Term Loan due 2009 ................ N/A — 100,000

Senior Secured Revolving Credit Facility due 2009 ..... N/A — 250,000

Add: premium ............................. — 151

Other debt:

Capital leases ................................. N/A 14,304 23,215

Total debt ..................................... 3,076,575 3,220,507

Less: current maturities ...................... 13,882 399,726

Total long-term ................................. 3,062,693 2,820,781

Less: related party............................ 263,566 —

Total long-term, excluding related party ............... $2,799,127 $2,820,781

F-26

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)