XM Radio 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.including the Liberty Media transactions, the negotiation and execution of amendments to our agreements with

various automakers, and the successful integration of the legacy SIRIUS and XM operations resulting in

significant synergies.

Mr. Frear was awarded a bonus for his contributions during the year, including his regular on-going

contributions as our chief financial officer, and his role in the company being cash flow positive for full year

2009, the reduction of operating expense growth, the reduction in subscriber acquisition costs per gross

addition, the successful restructuring of our capital structure, including the Liberty Media transactions, and the

successful integration of the legacy SIRIUS and XM operations resulting in significant synergies.

Ms. Altman was awarded a bonus for her contributions during the year, including her regular on-going

contributions as our chief administrative officer, managing the on-going personnel reductions, oversight of the

DC-based operations, and the successful integration of the legacy SIRIUS and XM operations resulting in

significant synergies.

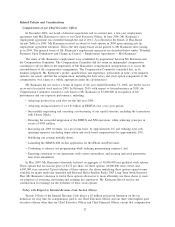

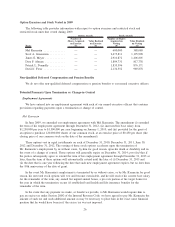

Based on the foregoing, the Compensation Committee approved the bonus amounts set forth in the

Summary Compensation Table for each of the above named executive officers.

2009 Retention-Based Short Term Incentive Program

In May 2009, the Compensation Committee approved grants of restricted stock units to certain

employees, including the named executive officers (other than Mr. Karmazin). These grants vested in periodic

installments over the course of 2009 and were issued for the purpose of retaining these employees. The

Compensation Committee considered these awards appropriate to try to keep intact our management and key

employees following the merger and in the face of challenging economic conditions. The awards to the named

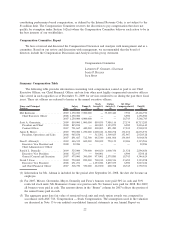

executive officers under this program are identified in the Grants of Plan-Based Awards Table for 2009. The

Compensation Committee does not anticipate approving a similar short-term incentive program for 2010.

Long-term Incentive Compensation

Objectives. The Compensation Committee grants long-term incentive awards to align compensation for

named executive officers over a multi-year period directly with the interests of our stockholders by motivating

and rewarding actions that create or increase long-term stockholder value. The Compensation Committee

determines the level of long-term incentive compensation based on an evaluation of competitive factors in

conjunction with total compensation provided to named executive officers and the objectives of the compen-

sation program described above.

Process. Our Compensation Committee grants long-term incentive compensation in the form of stock

options and restricted stock units because our Compensation Committee believes that these two forms of

awards reward stockholder value creation in different ways. Stock options (which have exercise prices equal to

the market price on the date of grant) reward named executive officers only if our stock price increases.

Restricted stock units have value on the date of grant. Restricted stock units are affected by all stock price

changes, so the value to named executive officers is affected by both increases and decreases in our stock

price.

Our long-term incentive program calls for stock options to be granted with exercise prices of not less than

fair market value of our common stock on the date of grant and, historically, to vest proportionally over four

years, if the employee is still employed by us, with exceptions to this vesting schedule made by the

Compensation Committee. We define fair market value as the stock price on the close of business on the day

of grant for existing employees and on the close of business the day before hiring for new employees.

Year 2009 Decisions. The long-term compensation awarded by the Compensation Committee to named

executive officers in 2009 under the programs described above is identified in the Grants of Plan-Based

Awards Table for 2009. The executives were awarded these long-term incentives in recognition of their prior

contributions and as an incentive for the executives to continue to enhance stockholder value. Each of

Messrs. Karmazin, Greenstein and Meyer received a long-term incentive award in the form of stock options as

part of an agreement to extend his employment in 2009 and Mr. Donnelly as part of his agreement to extend

19