XM Radio 2009 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At December 31, 2009, we were in compliance with all financial covenants.

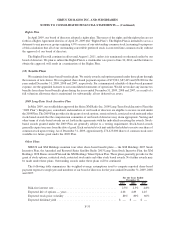

(12) Stockholders’ Equity

Common Stock, par value $0.001 per share

We were authorized to issue up to 9,000,000,000 and 8,000,000,000 shares of common stock as of

December 31, 2009 and 2008, respectively. There were 3,882,659,087 and 3,651,765,837 shares of common

stock issued and outstanding as of December 31, 2009 and 2008, respectively.

As of December 31, 2009, approximately 3,659,320,000 shares of common stock were reserved for issuance in

connection with outstanding convertible debt, preferred stock, warrants, incentive stock plans and common stock to

be granted to third parties upon satisfaction of performance targets. During the year ended December 31, 2009,

employees did not exercise any stock options.

To facilitate the offering of the Exchangeable Notes, we entered into share lending agreements with Morgan

Stanley Capital Services Inc. (“MS”) and UBS AG London Branch (“UBS”) under which we loaned MS and UBS

an aggregate of approximately 263,000,000 shares of our common stock in exchange for a fee of $.001 per share.

The obligations of MS to us under its share lending agreement are guaranteed by its parent company, Morgan

Stanley.

During the third quarter of 2009, Morgan Stanley Capital Services Inc. returned to us 60,000,000 shares of our

common stock borrowed in July 2008 to facilitate the offering of the Exchangeable Notes. The returned shares were

retired upon receipt.

The shares we loaned to the share borrowers are issued and outstanding for corporate law purposes, and holders

of borrowed shares (other than the share borrowers) have the same rights under those shares as holders of any of our

other outstanding common shares. Under GAAP as currently in effect, however, the borrowed shares are not

considered outstanding for the purpose of computing and reporting our net loss per common share. The accounting

method may change if, due to a default by either UBS or MS (or Morgan Stanley, as guarantor), the borrowed shares,

or the equivalent value of those shares, will not be returned to us as required under the share lending agreements.

In January 2004, SIRIUS signed a seven-year agreement with a sports programming provider. Upon execution

of this agreement, SIRIUS delivered 15,173,070 shares of common stock valued at $40,967 to that programming

provider. These shares of common stock are subject to transfer restrictions which lapse over time. We recognized

expense associated with these shares of $5,852 in each of the years ended December 31, 2009, 2008 and 2007,

respectively. As of December 31, 2009, there was a $7,420 remaining balance of common stock value included in

Other current assets and Other long-term assets in the amount of $5,852 and $1,568, respectively. As of

December 31, 2008, there was a $13,272 remaining balance of common stock value included in Other current

assets and Other long-term assets in the amount of $5,852 and $7,420, respectively.

Preferred Stock, par value $0.001 per share

We were authorized to issue up to 50,000,000 shares of undesignated preferred stock as of December 31, 2009.

There were 24,808,959 shares of Series A Convertible Preferred Stock (“Series A Preferred Stock”) issued and

outstanding as of December 31, 2009 and 2008. There were 12,500,000 shares of Convertible Perpetual Preferred

Stock, Series B (the “Series B Preferred Stock”), issued and outstanding as of December 31, 2009. There were no

shares of Preferred Stock, Series C Junior (the “Series C Junior Preferred Stock”), issued and outstanding at

December 31, 2009.

The Series A Preferred Stock is redeemable at the option of the holder at any time for an equal number of

shares of our common stock.

F-31

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)