XM Radio 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

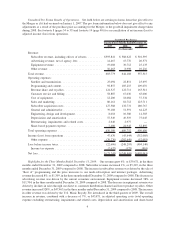

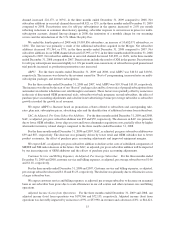

Unaudited Pro Forma Results of Operations. Set forth below are certain pro forma items that give effect to

the Merger as if it had occurred on January 1, 2007. The pro forma information below does not give effect to any

adjustments as a result of the purchase price accounting for the Merger, or the goodwill impairment charge taken

during 2008. See footnote 8 (pages 34 to 35) and footnote 14 (page 40) for a reconciliation of net income (loss) to

adjusted income (loss) from operations.

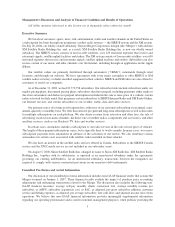

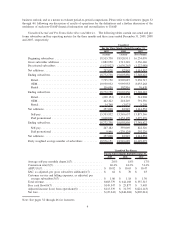

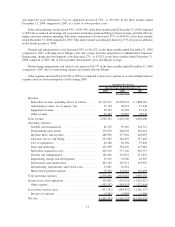

2009 2008 2007

For the Three Months Ended December 31,

Unaudited Pro Forma

(In thousands)

Revenue:

Subscriber revenue, including effects of rebates.......... $593,841 $ 588,622 $ 501,595

Advertising revenue, net of agency fees ............... 14,467 15,776 20,571

Equipment revenue............................... 19,008 30,712 25,133

Other revenue .................................. 56,463 8,998 10,216

Total revenue ..................................... 683,779 644,108 557,515

Operating expenses:

Satellite and transmission .......................... 25,094 22,851 23,697

Programming and content .......................... 92,857 105,215 109,076

Revenue share and royalties ........................ 124,527 122,711 163,541

Customer service and billing ....................... 58,887 67,036 65,006

Cost of equipment ............................... 12,200 18,084 37,334

Sales and marketing .............................. 80,161 81,712 123,711

Subscriber acquisition costs ........................ 127,588 132,731 180,767

General and administrative ......................... 39,108 51,591 64,223

Engineering, design and development ................. 8,018 10,380 14,303

Depreciation and amortization ...................... 57,549 49,519 75,045

Restructuring, impairments and related costs ............ 2,640 2,977 —

Share-based payment expense ....................... 7,480 24,945 52,897

Total operating expenses ............................ 636,109 689,752 909,600

Income (loss) from operations ........................ 47,670 (45,644) (352,085)

Other expense .................................. (70,276) (202,649) (52,055)

Loss before income taxes ............................ (22,606) (248,293) (404,140)

Income tax expense .............................. (2,637) (175) (901)

Net loss......................................... $(25,243) $(248,468) $(405,041)

Highlights for the Three Months Ended December 31, 2009. Our revenue grew 6%, or $39,671, in the three

months ended December 31, 2009 compared to 2008. Subscriber revenue increased 1%, or $5,219, in the three

months ended December 31, 2009 compared to 2008. The increase in subscriber revenue was driven by the sale of

“Best of” programming and the price increases to our multi-subscription and internet packages. Advertising

revenue decreased 8%, or $1,309, in the three months ended December 31, 2009 compared to 2008. The decrease in

advertising revenue was driven by the current economic environment. Equipment revenue decreased 38%, or

$11,704, in the three months ended December 31, 2009 compared to 2008. The decrease in equipment revenue was

driven by declines in sales through our direct to consumer distribution channel and lower product royalties. Other

revenue increased 528%, or $47,465, in the three months ended December 31, 2009 compared to 2008. The increase

in other revenue was driven by the U.S. Music Royalty Fee introduced in the third quarter of 2009. The overall

increase in revenue, combined with a decrease of 7%, or $43,871, in adjusted operating costs (total operating

expense excluding restructuring, impairments and related costs, depreciation and amortization and share-based

9