XM Radio 2009 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

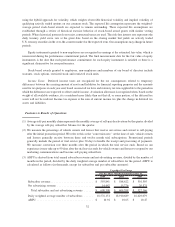

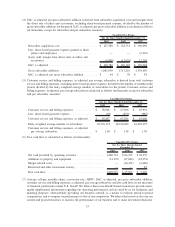

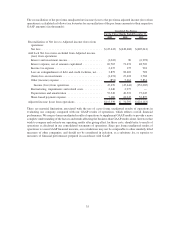

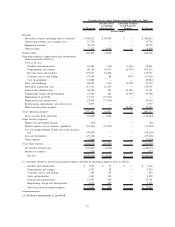

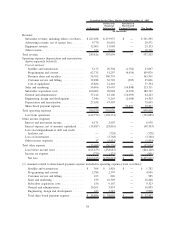

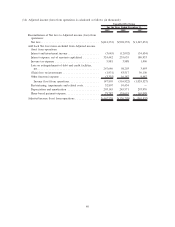

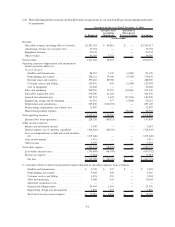

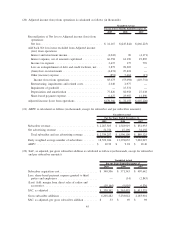

As Reported

Purchase Price

Accounting

Adjustments(a)

Allocation of Share-

based Payment

Expense Pro Forma

Unaudited for the Three Months Ended December 31, 2008

(In thousands)

Revenue:

Subscriber revenue, including effects of rebates . . . . $ 568,523 $ 20,099 $ — $ 588,622

Advertising revenue, net of agency fees . . . . . . . . . 15,776 — — 15,776

Equipment revenue . . . . . . . . . . . . . . . . . . . . . . . 30,712 — — 30,712

Other revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,172 1,826 — 8,998

Total revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 622,183 21,925 — 644,108

Operating expenses (depreciation and amortization

shown separately below)(1)

Cost of services:

Satellite and transmission . . . . . . . . . . . . . . . . . 24,481 (214) (1,416) 22,851

Programming and content . . . . . . . . . . . . . . . . . 89,214 20,755 (4,754) 105,215

Revenue share and royalties. . . . . . . . . . . . . . . . 103,217 19,494 — 122,711

Customer service and billing . . . . . . . . . . . . . . . 67,818 88 (870) 67,036

Cost of equipment . . . . . . . . . . . . . . . . . . . . . . 18,084 — — 18,084

Sales and marketing . . . . . . . . . . . . . . . . . . . . . . . 80,699 3,312 (2,299) 81,712

Subscriber acquisition costs . . . . . . . . . . . . . . . . . 113,512 19,219 — 132,731

General and administrative . . . . . . . . . . . . . . . . . . 64,586 306 (13,301) 51,591

Engineering, design and development. . . . . . . . . . . 12,404 281 (2,305) 10,380

Impairment of goodwill . . . . . . . . . . . . . . . . . . . . 15,331 (15,331) — —

Depreciation and amortization . . . . . . . . . . . . . . . . 82,958 (33,439) — 49,519

Restructuring, impairments and related costs . . . . . . 2,977 — — 2,977

Share-based payment expense . . . . . . . . . . . . . . . . — — 24,945 24,945

Total operating expenses . . . . . . . . . . . . . . . . . . . . . 675,281 14,471 — 689,752

(Loss) income from operations . . . . . . . . . . . . . . . (53,098) 7,454 — (45,644)

Other income (expense)

Interest and investment income . . . . . . . . . . . . . . . (90) — — (90)

Interest expense, net of amounts capitalized . . . . . . (61,196) (10,078) — (71,274)

Loss on extinguishment of debt and credit facilities,

net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (98,203) — — (98,203)

Loss on investments . . . . . . . . . . . . . . . . . . . . . . . (27,418) — — (27,418)

Other expense . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,664) — — (5,664)

Total other expense . . . . . . . . . . . . . . . . . . . . . . . . . (192,571) (10,078) — (202,649)

Loss before income taxes . . . . . . . . . . . . . . . . . . . (245,669) (2,624) — (248,293)

Income tax expense . . . . . . . . . . . . . . . . . . . . . . . (175) — — (175)

Net loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(245,844) $ (2,624) $ — $(248,468)

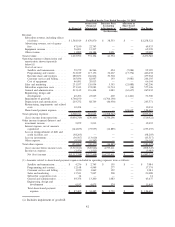

(1) Amounts related to share-based payment expense included in operating expenses were as follows:

Satellite and transmission . . . . . . . . . . . . . . . . . $ 1,349 $ 67 $ — $ 1,416

Programming and content . . . . . . . . . . . . . . . . . 4,672 82 — 4,754

Customer service and billing . . . . . . . . . . . . . . . 783 87 — 870

Sales and marketing . . . . . . . . . . . . . . . . . . . . . 2,165 134 — 2,299

General and administrative . . . . . . . . . . . . . . . . 12,995 306 — 13,301

Engineering, design and development . . . . . . . . . 2,023 282 — 2,305

Total share-based payment expense . . . . . . . . . . $ 23,987 $ 958 $ — $ 24,945

(a) Includes impairment of goodwill.

37