XM Radio 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The principal effects of the Reverse Stock Split Amendment will be that:

• depending on the ratio for the reverse stock split selected by our board of directors, each two or

twenty-five shares of common stock owned by a stockholder, or any whole number of shares of

common stock between two and twenty-five as determined by the board of directors, will be combined

into one new share of common stock;

• the number of shares of common stock issued and outstanding (including the shares issuable upon

conversion of our preferred stock) will be reduced from approximately 6.5 billion shares to a range of

approximately 3.25 billion shares to 260 million shares, depending upon the reverse stock split ratio

selected by the board of directors;

• the number of authorized shares of common stock will be reduced from 9 billion to a range of

approximately 4.5 billion to 700 million dependent on the reverse stock split ratio chosen by the board

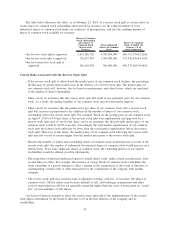

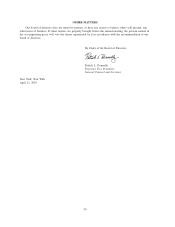

of directors. The table below illustrates the number of authorized shares of common stock that will

correspond to each range of reverse stock split ratios:

Range of Reverse Stock Split Ratios

Total Authorized Shares of Common Stock

after Reverse Stock Split

One-for-two to one-for-nine .......................... 4,500,000,000

One-for-ten to one-for-nineteen ....................... 1,300,000,000

One-for-twenty to one-for-twenty-five................... 700,000,000

• because the number of issued and outstanding shares of common stock will decrease as result of the

reverse stock split, the number of authorized but unissued shares of common stock may increase on a

relative basis. These additional shares of authorized common stock would be available for issuance at

the discretion of our board of directors from time to time for corporate purposes such as raising

additional capital and settling outstanding obligations, acquisitions of companies or assets and sales of

stock or securities convertible into or exercisable for common stock. We believe that the availability of

the additional shares would provide us with additional flexibility to meet business and financing needs

as they arise;

• based upon the reverse stock split ratio selected by our board of directors, proportionate adjustments

will be made to the per share exercise price and/or the number of shares issuable upon the exercise or

conversion of all outstanding options, restricted stock awards, restricted stock units, warrants, convert-

ible or exchangeable securities entitling the holders to purchase, exchange for, or convert into, shares of

common stock, which will result in approximately the same aggregate price being required to be paid

for such options and restricted stock awards and units upon exercise immediately preceding the reverse

stock split; and

• the number of shares reserved for issuance or pursuant to the securities or plans described in the

immediately preceding bullet will be reduced proportionately based upon the reverse stock split ratio

selected by our board of directors.

41