XM Radio 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

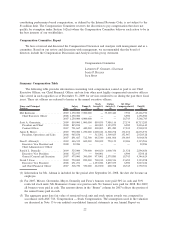

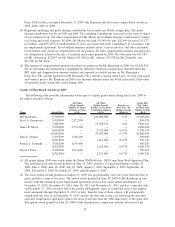

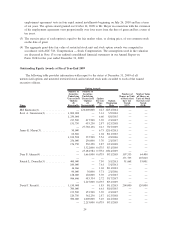

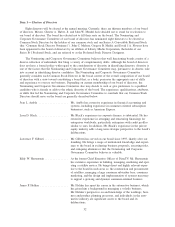

(1) Outstanding equity awards for Mr. Karmazin vest in four equal annual installments on December 31, 2010,

December 31, 2011, June 30, 2012 and December 31, 2012.

(2) Outstanding equity awards for Mr. Greenstein vest as follows: options granted at an exercise price of

$3.14 vested immediately on the date of grant on May 5, 2004; options granted at an exercise price of

$6.60 vested in three equal annual installments from the date of grant on August 8, 2005; options granted

at an exercise price of $3.70 vest in four equal annual installments from the date of grant on February 1,

2007; options granted at an exercise price of $2.87 vest in four equal annual installments from the date of

grant on January 23, 2008; and options granted at an exercise price of $0.43 vest in four equal annual

installments commencing on July 26, 2010.

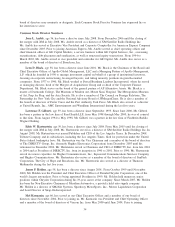

(3) Outstanding equity awards for Mr. Meyer vest as follows: options granted at an exercise price of $6.75

vested 50% on the date of grant on December 14, 2001 and 25% per year thereafter; options granted at an

exercise price of $1.04 vested in three equal annual installments on July 1, 2004, July 1, 2005 and July 1,

2006; options granted at an exercise price of $5.54 vest in four equal annual installments from the date of

grant on February 2, 2006; options granted at an exercise price of $3.70 vest in four equal annual install-

ments from the date of grant on February 1, 2007; options granted at an exercise price of $2.87 vest in

four equal annual installments from the date of grant on January 23, 2008; options granted at an exercise

price of $0.6735 vest in four equal annual installments from the date of grant on August 31, 2009; and

options granted at an exercise price of $0.5752 vest in four equal annual installments from the date of

grant on October 14, 2009.

(4) Outstanding equity awards for Ms. Altman vest as follows: options granted at an exercise price of $0.6735

vest in four equal annual installments from the date of grant on August 31, 2009; 107,333 restricted stock

awards vest on May 25, 2010; and of the remaining 171,733 restricted stock awards, 85,867 vested on

February 1, 2010 and 85,866 vest on February 1, 2011.

(5) Outstanding equity awards for Mr. Donnelly vest as follows: options granted at an exercise price of $7.50

vested 41.25% on the date of grant on May 1, 2001, 19.75% on October 15, 2001, 19.5% on April 15,

2002 and 19.5% on October 15, 2002; options granted at an exercise price of $7.61 vested immediately on

the date of grant on May 1, 2001; options granted at an exercise price of $1.04 vested in three equal

annual installments on July 1, 2004, July 1, 2005 and July 1, 2006; options granted at an exercise price of

$5.71 vest in four equal annual installments from the date of grant on February 1, 2006; options granted at

an exercise price of $3.70 vest in four equal annual installments from the date of grant on February 1,

2007; options granted at an exercise price of $2.72 vest in three equal annual installments from the date of

grant on May 17, 2007; options granted at an exercise price of $0.6735 vest in four equal annual install-

ments from the date of grant on August 31, 2009; and 91,668 restricted stock units vest on May 17, 2010.

(6) Outstanding equity awards for Mr. Frear vest as follows: options granted at an exercise price of $1.85

vested either in three equal annual installments on July 1, 2004, July 1, 2005, and July 1, 2006, on

March 15, 2004 as a result of the satisfaction of performance targets for the year ended December 31,

2003, or on March 15, 2005 as a result of the satisfaction of performance targets for the year ended

December 31, 2004; options granted at an exercise price of $6.61 vested in three equal annual installments

from the date of grant on August 10, 2005; options granted at an exercise price of $3.70 vest in four equal

annual installments from the date of grant on February 1, 2007; options granted at an exercise price of

$2.87 vest in four equal annual installments from the date of grant on January 23, 2008; options granted at

an exercise price of $3.10 vest in three equal annual installments from the date of grant on February 12,

2008; options granted at an exercise price of $0.6735 vested in four equal annual installments from the

date of grant on August 31, 2009; and of the 200,000 restricted stock units, 100,000 vested on March 5,

2010 and 100,000 vest on February 12, 2011.

(7) Vesting and payment of all restricted stock units reflected above will be accelerated upon the death of the

executive officer or upon a triggering event following a change in control, as defined under our stock

incentive plans, or upon the occurrence of an event that triggers immediate vesting of the outstanding

awards under the executive’s employment agreement.

(8) Amount is based on the closing price of our common stock of $0.60 on December 31, 2009.

25