XM Radio 2009 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Investments

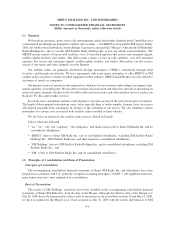

Marketable Securities — Marketable securities consist of certificates of deposit, auction rate certificates and

investments in debt and equity securities of other entities. Our investment policy objectives are the preservation of

capital, maintenance of liquidity to meet operating requirements and yield maximization. Marketable securities are

classified as available-for-sale securities and carried at fair market value. Unrealized gains and losses on

available-for-sale securities are included in Accumulated other comprehensive (loss) income, net of tax, as a

separate component of Stockholders’ equity (deficit). Realized gains and losses, dividends and interest income,

including amortization of the premium or discount arising at purchase, are included in Interest and investment

income. The specific-identification method is used to determine the cost of all securities and the basis by which

amounts are reclassified from Accumulated other comprehensive (loss) income into earnings.

We received proceeds from the sale or maturity of marketable securities of $0, $5,469 and $15,031 for the

years ended December 31, 2009, 2008 and 2007, respectively. We recorded $473 of net unrealized gains on

marketable securities for the year ended December 31, 2009 and $1,040 of net unrealized losses on marketable

securities for the year ended December 31, 2008.

Restricted Investments — We have certificates of deposit, money market funds and interest-bearing accounts

which are restricted as to their withdrawal. We received proceeds from the release of restricted investments of $0,

$60,400 and $25,160 for the years ended December 31, 2009, 2008 and 2007, respectively.

Equity Method Investments — Investments in which we have the ability to exercise significant influence but

not control are accounted for pursuant to the equity method of accounting. We recognize our proportionate share of

earnings or losses of our affiliates as they occur as a component of Other (expense) income in our consolidated

statements of operations. We evaluate our equity method investments for impairment whenever events, or changes

in circumstances, indicate that the carrying amounts of such investments may not be recoverable. The difference

between the carrying value and the estimated fair values of our equity method investments is recognized as an

impairment loss when the loss is deemed to be other than temporary.

Cost Method Investments — Investments in equity securities that do not have readily determinable fair values

and in which we do not have a controlling interest or are unable to exert significant influence are recorded at cost.

ASC 820, Fair Value Measurements and Disclosures, establishes a fair value hierarchy for input into valuation

techniques as follows: i) Level 1 input — unadjusted quoted prices in active markets for identical instrument;

ii) Level 2 input — observable market data for the same or similar instrument but not Level 1; and iii) Level 3

input — unobservable inputs developed using management’s assumptions about the inputs used for pricing the

asset or liability. We use Level 3 inputs to fair value our investments in auction rate certificates issued by student

loan trusts and the 8% convertible unsecured subordinated debentures issued by XM Canada. These investments are

not material to our consolidated results of operations or financial position.

Investments are periodically reviewed for impairment and a write down is recorded whenever declines in fair

value below carrying value are determined to be other than temporary. In making this determination, we consider,

among other factors, the severity and duration of the decline as well as the likelihood of a recovery within a

reasonable timeframe.

F-15

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)