XM Radio 2009 Annual Report Download - page 133

Download and view the complete annual report

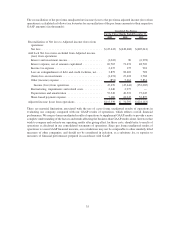

Please find page 133 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.result of a decrease in cash provided by working capital of $194,376, offset partially by a decrease in net loss,

net of non-cash operating activities of $190,345. The decrease in working capital was primarily due to

decreases in cash provided by deferred revenue and accounts payable and accrued expenses.

Cash Flows (Used in) Provided by Investing Activities

•2009 vs. 2008: Net cash used in investing activities increased $976,936 to $248,511 for the year ended

December 31, 2009 from net cash provided by investing activities of $728,425 for the year ended

December 31, 2008. The increase was primarily the result of a decrease of $819,521 in net cash acquired

from XM in the Merger, a decrease of $65,869 from the sale of restricted and other investments and an

increase in capital expenditures of $117,960 associated with our satellite construction and launch vehicle,

partially offset by a decrease of $23,519 in Merger-related costs.

•2008 vs. 2007: Net cash provided by investing activities was $728,425 for the year ended December 31,

2008 compared with net cash used in investing activities of $54,186 for the year ended December 31, 2007.

The $782,611 increase was primarily due to the inclusion of $819,521 in net cash acquired from XM in the

Merger offset partially by increased capital expenditures of $65,287 associated with our satellite construc-

tion and launch vehicle.

We will incur significant capital expenditures to construct and launch our new satellites and improve our

terrestrial repeater network and broadcast and administrative infrastructure. These capital expenditures will support

our growth and the resiliency of our operations, and will also support the delivery of future new revenue streams.

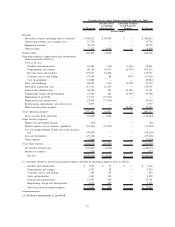

Cash Flows (Used in) Provided by Financing Activities

•2009 vs. 2008: Net cash used in financing activities decreased $451,726 to $182,276 for the year ended

December 31, 2009 from $634,002 for the year ended December 31, 2008. The decrease in cash used in

financing activities was primarily due to an increase of $413,462 in net proceeds from our agreement with

Liberty Media and issuance of XM’s 11.25% Senior Secured Notes due 2013 and SIRIUS’ 9.75% Senior

Secured Notes due 2015 during the year ended December 31, 2009 compared to proceeds from XM’s 7%

Exchangeable Senior Subordinated Notes due 2014 during the year ended December 31, 2008 and a

decrease of $61,880 in payments to a noncontrolling interest; partially offset by a decrease in debt payment

of $21,051, principally to holders of SIRIUS’ 21⁄2% Convertible Notes due 2009, XM’s Amended and

Restated Credit Agreement due 2011 and SIRIUS’ Term Loan and Purchase Money Loan borrowings from

Liberty Media during the year ended December 31, 2009 compared to debt payments to holders of XM’s

9.75% Senior Notes due 2014, XM’s Senior Floating Rate Notes due 2013 and XM’s Debt of Consolidated

Variable Interest Entity during the year ended December 31, 2008.

•2008 vs. 2007: Net cash used in financing activities increased $882,353 to $634,002 for the year ended

December 31, 2008 from net cash provided by financing activities of $248,351 for the year ended

December 31, 2007. Significant financing activities for the year ended December 31, 2008 included

$550,000 in cash proceeds from the issuance of XM’s 7% Exchangeable Senior Subordinated Notes due

2014; $613,400 in cash used to extinguish 99% of the principal and accrued interest on XM’s 9.75% Senior

Notes due 2014; $203,500 in cash used to extinguish 100% of the principal, accrued interest and prepayment

premiums on XM’s Senior Floating Rate Notes due 2013; and $309,400 for transponder repurchase

obligation, from both debt and equity holders of a consolidated variable interest entity, including a

prepayment premium and interest accrued through the date of extinguishment.

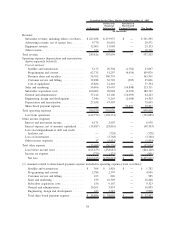

Financings and Capital Requirements

We have historically financed our operations through the sale of debt and equity securities. The Certificate of

Designations for our Series B Preferred Stock provides that so long as Liberty beneficially owns at least half of its

initial equity investment, we need the consent of Liberty for certain actions, including the grant or issuance of our

equity securities and the incurrence of debt (other than, in general, debt incurred to refinance existing debt) in

amounts greater than a stated threshold.

28