XM Radio 2009 Annual Report Download - page 126

Download and view the complete annual report

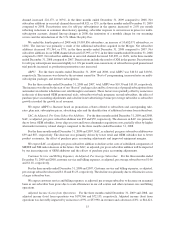

Please find page 126 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.December 31, 2009 compared to 2008, due to lower costs associated with development, tooling and testing of radios

as well as lower personnel costs.

Restructuring, impairments and related costs decreased 11%, or $337, in the three months ended December 31,

2009 compared to 2008 mainly due to fewer restructuring charges associated with the Merger.

Other expenses decreased 65%, or $125,702, in the three months ended December 31, 2009 compared to 2008

driven mainly by a decrease in loss on extinguishment of debt and credit facilities of $94,324 and a decrease of

$28,892 in loss on investments, partially offset by an increase in interest expense of $5,162.

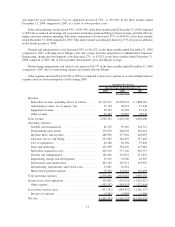

Highlights for the Three Months Ended December 31, 2008. Our revenue grew 149%, or by $372,367, in the

three months ended December 31, 2008 compared to 2007. The inclusion of XM’s results for the fourth quarter of

2008 drove $315,551 of the increase. Adjusted income (loss) from operations was $72,155 in the fourth quarter of

2008 quarter compared to ($107,220) in the fourth quarter of 2007. Total operating expenses, excluding goodwill

impairment, restructuring, depreciation and share-based payment expense, increased by 54%, or $192,992, in the

quarter. $262,908 of the increase was attributable to the Merger.

Satellite and transmission costs increased by 373%, or $19,306, in the three months ended December 31, 2008

compared to 2007 due to the inclusion of XM’s satellite and transmission costs for the fourth quarter of 2008.

Programming and content costs increased by 42%, or $26,479, in the three months ended December 31, 2008

compared to 2007, as a result of the inclusion of XM’s programming costs for the fourth quarter of 2008. Revenue

share and royalties increased by 82%, or $46,455, in the three months ended December 31, 2008 compared to 2007,

as a result of the inclusion of XM’s revenue share and royalties costs. Customer service and billing costs increased

132%, or $38,530, in the three months ended December 31, 2008 compared to 2007. $36,002 of the increase was

attributable to the Merger.

Sales and marketing cost increased 42%, or $23,833, in the three months ended December 31, 2008 compared

to 2007. The increase was attributable to the merger, partially offset by reduced advertising and cooperative

marketing spend. Subscriber acquisition costs increased 13%, or $13,450, over the prior year’s quarter, of which,

$37,343 was attributable to the Merger, partially offset by improved product economics and lower retail and OEM

subsidies.

General and administrative costs increased 74%, or $27,374, over the prior year’s quarter, $24,006 of which

was attributable to the Merger. Engineering, design and development costs increased 56%, or $4,458. The Merger

drove $6,467 of the increase. The offsetting decrease was due lower product development costs and savings at

SIRIUS as result of the Merger.

Restructuring, impairments and related costs increased $2,977 in the three months ended December 31, 2008

compared to 2007 due to restructuring charges associated with the Merger.

Other expenses increased 1,127%, or $176,872, in the three months ended December 31, 2008 compared to

2007 driven mainly by an increase in loss on extinguishment of debt and credit facilities of $98,203, an increase in

interest expense of $41,309, and an increase of $27,418 in loss on investments due to the inclusion of XM’s

expenses attributable to the Merger.

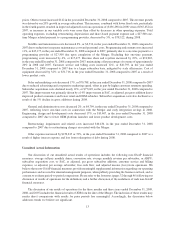

Year Ended December 31, 2009 Compared with Year Ended December 31, 2008 and Year Ended

December 31, 2008 Compared with Year Ended December 31, 2007 — Actual

Total Revenue

Subscriber Revenue. Subscriber revenue includes subscription fees, activation and other fees and the effects

of rebates.

•2009 vs. 2008: For the years ended December 31, 2009 and 2008, subscriber revenue was $2,287,503 and

$1,548,919, respectively, an increase of 48%, or $738,584. The Merger was responsible for approximately

$670,870 of the increase and the remaining increase was primarily attributable to the sale of “Best of”

programming, increased internet and multi-subscription rates and higher average subscribers.

21