XM Radio 2009 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Liberty Media

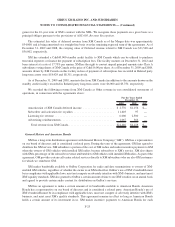

Liberty Media Corporation and its affiliate, Liberty Media, LLC (collectively, “Liberty Media”), is the holder

of our Convertible Perpetual Preferred Stock, Series B (the “Series B Preferred Stock”), has representatives on our

board of directors and is considered a related party. See Note 11, Debt, to our consolidated financial statements for

further information regarding indebtedness previously owed to Liberty Media.

Investment Agreement

On February 17, 2009, we entered into an Investment Agreement (the “Investment Agreement”) with Liberty

Media. Pursuant to the Investment Agreement, in March 2009 we issued to Liberty Radio, LLC 12,500,000 shares

of Series B Preferred Stock with a liquidation preference of $0.001 per share in partial consideration for certain loan

investments.

The Series B Preferred Stock is convertible into approximately 40% of our outstanding shares of common

stock (after giving effect to such conversion). Liberty Radio, LLC has agreed not to acquire more than 49.9% of our

outstanding common stock for three years from the date the Series B Preferred Stock was issued, except that Liberty

Radio, LLC may acquire more than 49.9% of our outstanding common stock at any time after the second

anniversary of such date pursuant to any cash tender offer for all of the outstanding shares of our common stock that

are not beneficially owned by Liberty Radio, LLC or its affiliates at a price per share greater than the closing price of

the common stock on the trading day preceding the earlier of the public announcement or commencement of such

tender offer. The Investment Agreement also provides for certain other standstill provisions during such three year

period.

We accounted for the Series B Preferred Stock by recording a $227,716 increase to additional paid-in capital,

excluding issuance costs, for the amount of allocated proceeds received and an additional $186,188 increase in paid-

in capital for the beneficial conversion feature, which was immediately recognized as a charge to retained earnings.

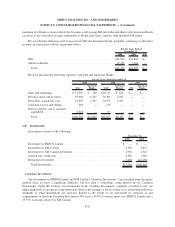

Loan Investments

On February 17, 2009, SIRIUS entered into a Credit Agreement (the “LM Credit Agreement”) with Liberty

Media Corporation, as administrative agent and collateral agent, and Liberty Media, LLC, as lender. The LM Credit

Agreement provided for a $250,000 term loan and $30,000 of purchase money loans. In August 2009, we repaid all

amounts due and terminated the LM Credit Agreement in connection with the issue and sale of SIRIUS’

9.75% Senior Secured Notes due 2015.

On February 17, 2009, XM entered into a Credit Agreement with Liberty Media Corporation, as administrative

agent and collateral agent, and Liberty Media, LLC, as lender. On March 6, 2009, XM amended and restated that

credit agreement (the “Second-Lien Credit Agreement”) with Liberty Media Corporation. In June 2009, XM repaid

all amounts due and terminated the Second-Lien Credit Agreement in connection with the issue and sale of its

11.25% Senior Secured Notes due 2013.

On March 6, 2009, XM amended and restated the $100,000 Term Loan, dated as of June 26, 2008 and the

$250,000 Credit Agreement, dated as of May 5, 2006. These facilities were combined as term loans into the

Amended and Restated Credit Agreement, dated as of March 6, 2009. Liberty Media, LLC, purchased $100,000

aggregate principal amount of such loans from the existing lenders. In June 2009, XM used a portion of the net

proceeds from the sale of its 11.25% Senior Secured Notes due 2013 to extinguish the Amended and Restated Credit

Agreement.

F-21

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)