XM Radio 2009 Annual Report Download - page 182

Download and view the complete annual report

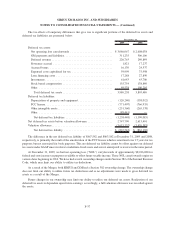

Please find page 182 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(f) 21⁄2% Convertible Notes due 2009

In February 2004, SIRIUS issued $250,000 in aggregate principal amount of 21⁄2% Convertible Notes due 2009

(the “21⁄2% Notes”). The remaining balance of the 21⁄2% Notes matured on February 17, 2009, and were paid in cash.

XM and XM Holdings Debt

(g) 10% Convertible Senior Notes due 2009

XM Holdings issued $400,000 aggregate principal amount of 10% Convertible Senior Notes due 2009 (the

“10% Convertible Notes”).

In February 2009, we exchanged $172,485 aggregate principal amount of the outstanding 10% Convertible

Notes for a like principal amount of XM Holdings’ 10% Senior PIK Secured Notes due 2011. We accounted for the

exchange as a modification of debt and recorded $2,008 to General and administrative expense in our consolidated

statements of operations and $10,990 of additional debt discount in our consolidated balance sheets.

In July 2009, XM used a portion of the net proceeds received from the issuance of its 11.25% Senior Secured

Notes due 2013 and cash on hand to purchase at par $179,065 aggregate principal amount of the 10% Convertible

Notes. We recorded a loss of $3,031 related to the unamortized discount to Loss on extinguishment of debt and

credit facilities in our consolidated statements of operations as a result of this transaction.

Interest was payable semi-annually at a rate of 10% per annum. The remaining balance of $48,450 of the

10% Convertible Notes matured on December 1, 2009 and were paid in cash.

(h) 10% Senior Secured Discount Convertible Notes due 2009

XM Holdings and XM, as co-obligors, had outstanding $33,249 aggregate principal amount of 10% Senior

Secured Discount Convertible Notes due 2009 (the “10% Discount Convertible Notes”). Interest was payable semi-

annually at a rate of 10% per annum. The 10% Discount Convertible Notes matured on December 31, 2009 and

were paid in cash.

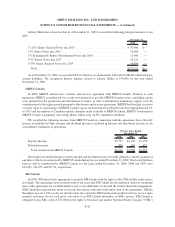

(i) 10% Senior PIK Secured Notes due 2011

In February 2009, XM Holdings exchanged $172,485 aggregate principal amount of outstanding 10% Con-

vertible Notes for a like principal amount of its 10% Senior PIK Secured Notes due 2011 (the “PIK Notes”). Interest

is payable on the PIK Notes semiannually in arrears on June 1 and December 1 of each year at a rate of 10% per

annum paid in cash from December 1, 2008 to December 1, 2009; at a rate of 10% per annum paid in cash and 2%

per annum paid in kind from December 1, 2009 to December 1, 2010; and at a rate of 10% per annum paid in cash

and 4% per annum paid in kind from December 1, 2010 to the maturity date.

The PIK Notes are fully and unconditionally guaranteed by XM 1500 Eckington LLC and XM Investment

LLC (together, the “Subsidiary Guarantors”) and are secured by a first-priority lien on substantially all of the

property of the Subsidiary Guarantors. XM Holdings may, at its option, redeem some or all of the PIK Notes at any

time at 100% of the principal amount prepaid, together with accrued and unpaid interest, if any.

We paid a fee equal to, at each exchanging noteholders’ election, either (i) 833 shares of our common stock (the

“Structuring Fee Shares”) for every $1 principal amount of 10% Convertible Notes exchanged or (ii) an amount in

cash equal to $0.05 for every $1 principal amount of 10% Convertible Notes exchanged. The total number of

Structuring Fee Shares delivered was 59,178,819, and the aggregate cash delivered was approximately $5,100.

In October 2009, we purchased $58,800 aggregate principal amount of the PIK Notes at a price of $60,499,

which included accrued interest of $2,287. We recorded a net loss of $3,669, related to the unamortized discount and

the discount on the purchase, to Loss on extinguishment of debt and credit facilities, net, in our consolidated

statements of operations as a result of this transaction.

F-28

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)