XM Radio 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

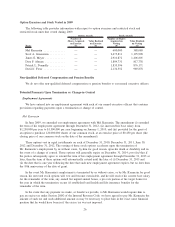

employment agreement vests in four equal annual installments beginning on July 26, 2010 and has a term

of ten years. The option award granted on October 14, 2009 to Mr. Meyer in connection with the extension

of his employment agreement vests proportionally over four years from the date of grant and has a term of

ten years.

(3) The exercise price of each option is equal to the fair market value, or closing price, of our common stock

on the date of grant.

(4) The aggregate grant date fair value of restricted stock unit and stock option awards was computed in

accordance with ASC 718, Compensation — Stock Compensation. The assumptions used in the valuation

are discussed in Note 13 to our audited consolidated financial statements in our Annual Report on

Form 10-K for the year ended December 31, 2009.

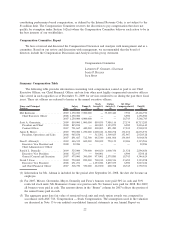

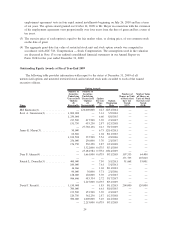

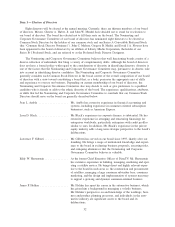

Outstanding Equity Awards at Fiscal Year-End 2009

The following table provides information with respect to the status at December 31, 2009 of all

unexercised options and unvested restricted stock and restricted stock units awarded to each of the named

executive officers.

Name

Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable

Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable

Option

Exercise

Price

($)

Option

Expiration

Date

Number of

Shares or Units

of Stock that

have not

Vested

(#)(7)

Market Value

of Shares or

Units of Stock

that have not

Vested

($)(8)

Option Awards

Mel Karmazin(1) ................. — 120,000,000 0.43 12/31/2014 — —

Scott A. Greenstein(2) ............. 1,000,000 — 3.14 5/5/2014 — —

1,250,000 — 6.60 8/8/2015 — —

217,500 217,500 3.70 2/1/2017 — —

151,750 455,250 2.87 1/23/2018 — —

— 27,768,136 0.43 7/27/2019 — —

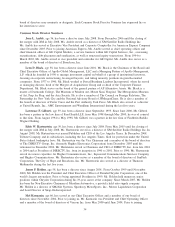

James E. Meyer(3) . . . ............. 50,000 — 6.75 12/14/2011 — —

66,666 — 1.04 8/11/2013 — —

1,012,500 337,500 5.54 2/2/2016 — —

256,000 256,000 3.70 2/1/2017 — —

176,750 530,250 2.87 1/23/2018 — —

— 3,322,000 0.6735 8/31/2019 — —

— 25,184,984 0.5752 10/14/2019 — —

Dara F. Altman(4) . . . ............. — 1,661,000 0.6735 8/31/2019 107,333 64,400

— — — — 171,733 103,040

Patrick L. Donnelly(5) ............. 400,000 — 7.50 5/1/2011 91,668 55,001

100,000 — 7.61 5/1/2011 — —

16,666 — 1.04 8/11/2013 — —

90,000 30,000 5.71 2/1/2016 — —

128,000 128,000 3.70 2/1/2017 — —

966,666 483,334 2.72 5/17/2017 — —

— 2,215,000 0.6735 8/31/2019 — —

David J. Frear(6) ................. 1,150,000 — 1.85 8/11/2013 200,000 120,000

700,000 — 6.61 8/10/2015 — —

153,500 153,500 3.70 2/1/2017 — —

120,750 362,250 2.87 1/23/2018 — —

500,000 1,000,000 3.10 2/12/2018 — —

— 2,215,000 0.6735 8/31/2019 — —

24