XM Radio 2009 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Property and Equipment

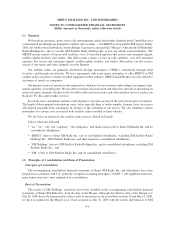

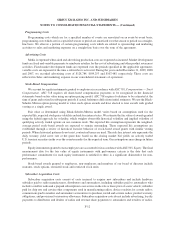

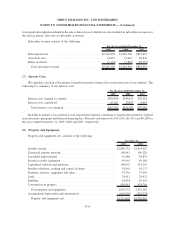

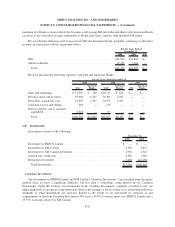

Property and equipment, including satellites, are stated at cost less accumulated depreciation and amortization.

Equipment under capital leases is stated at the present value of minimum lease payments. Depreciation and

amortization are calculated using the straight-line method over the following estimated useful lives:

Satellite system ............................. 2—15years

Terrestrial repeater network .................... 5—15years

Broadcast studio equipment .................... 3—15years

Capitalized software and hardware ............... 3—7years

Satellite telemetry, tracking and control facilities .... 3—17.5 years

Furniture, fixtures, equipment and other ........... 2—7years

Building .................................. 20or30years

Leasehold improvements ...................... Lesser of useful life or remaining lease term

We review long-lived assets, such as property and equipment, and purchased intangibles subject to amor-

tization for impairment whenever events or changes in circumstances indicate the carrying amount may not be

recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an

asset to estimated undiscounted future cash flows expected to be generated by the asset. If the carrying amount of an

asset exceeds the estimated future cash flows, an impairment charge is recognized for the amount by which the

carrying amount exceeds the fair value of the asset.

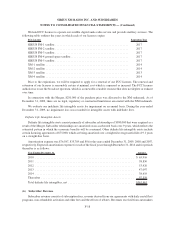

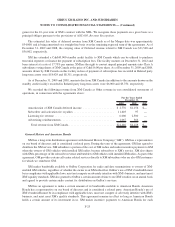

Goodwill and Other Intangible Assets

Goodwill represents the purchase price in excess of the net amount assigned to identifiable assets acquired and

liabilities assumed in the Merger. We perform an impairment test annually in early October, or more frequently if

indicators of impairment exist. The fair value of the entity is compared to its carrying value and if the fair value

exceeds its carrying value, goodwill is not impaired. If the carrying value exceeds the fair value, the implied fair

value of goodwill is compared to the carrying value of goodwill. If the implied fair value exceeds the carrying value

then goodwill is not impaired; otherwise, an impairment loss will be recorded by the amount the carrying value

exceeds the implied fair value.

Other intangible assets with indefinite lives are tested for impairment at least annually or more frequently if

indicators of impairment exist.

Other intangible assets with finite lives are amortized over their respective estimated useful lives to their

estimated residual values, and reviewed for impairment under the provisions of ASC 360-10-35, Property, Plant

and Equipment/Overall/Subsequent Measurement.

Fair Value of Financial Instruments

The fair value of a financial instrument is the amount at which the instrument could be exchanged in an orderly

transaction between market participants to sell the asset or transfer the liability. As of December 31, 2009 and 2008,

the carrying amounts of cash and cash equivalents, accounts and other receivables, and accounts payable

approximated fair value due to the short-term nature of these instruments.

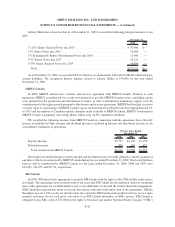

The fair value for publicly traded instruments is determined using quoted market prices and, for non-publicly

traded instruments, fair value is based upon estimates from a market maker and brokerage firm. As of December 31,

2009 and 2008, the carrying value of our long-term debt was $3,076,575 and $3,220,507, respectively; and the fair

value approximated $3,195,375 and $1,211,613, respectively.

F-16

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)