XM Radio 2009 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIRIUS Debt

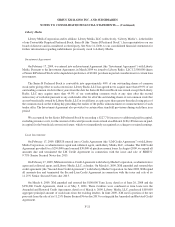

(a) 83⁄4% Convertible Subordinated Notes due 2009

In 1999, SIRIUS issued 83⁄4% Convertible Subordinated Notes due 2009 (the “83⁄4% Notes”). The remaining

balance of the 83⁄4% Notes matured on September 29, 2009 and were repaid in cash.

(b) 31⁄4% Convertible Notes due 2011

In October 2004, SIRIUS issued $230,000 in aggregate principal amount of 31⁄4% Convertible Notes due 2011

(the “31⁄4% Notes”), which are convertible, at the option of the holder, into shares of our common stock at any time at

a conversion rate of 188.6792 shares of common stock for each $1,000 principal amount, or $5.30 per share of

common stock, subject to certain adjustments. The 31⁄4% Notes mature on October 15, 2011 and interest is payable

semi-annually on April 15 and October 15 of each year. The obligations under the 31⁄4% Notes are not secured by

any of our assets.

(c) Senior Secured Term Loan due 2012

In June 2007, SIRIUS entered into a term credit agreement with a syndicate of financial institutions. The term

credit agreement provides for a senior secured term loan (the “Senior Secured Term Loan”) of $250,000, which has

been fully drawn. Interest under the Senior Secured Term Loan is based, at our option, on (i) adjusted LIBOR plus

2.25% or (ii) the higher of (a) the prime rate and (b) the Federal Funds Effective Rate plus 1/2 of 1.00%, plus 1.25%.

The current interest rate is 2.56%. The Senior Secured Term Loan amortizes in equal quarterly installments of

0.25% of the initial aggregate principal amount for the first four and a half years, with the balance of the loan

thereafter being repaid in four equal quarterly installments. The Senior Secured Term Loan matures on

December 20, 2012.

The Senior Secured Term Loan is guaranteed by certain of our wholly owned subsidiaries, including Satellite

CD Radio, Inc. (the “Guarantor”), and is secured by a lien on substantially all of SIRIUS’ and the Guarantor’s

assets, including SIRIUS’ four in-orbit satellites, one ground spare satellite and the shares of the Guarantor.

The Senior Secured Term Loan contains customary affirmative covenants and event of default provisions. The

negative covenants contained in the Senior Secured Term Loan are substantially similar to those contained in the

indenture governing SIRIUS’ 95⁄8% Senior Notes due 2013.

(d) 95⁄8% Senior Notes due 2013

In August 2005, SIRIUS issued $500,000 in aggregate principal amount of 95⁄8% Senior Notes due 2013 (the

“95⁄8% Notes”), which mature on August 1, 2013 with interest payable semi-annually on February 1 and August 1 of

each year. The obligations under the 95⁄8% Notes are not secured by any of our assets.

(e) 9.75% Senior Secured Notes due 2015

In August 2009, SIRIUS issued $257,000 aggregate principal amount of 9.75% Senior Secured Notes due 2015

(the “9.75% Notes”). Interest is payable semi-annually in arrears on March 1 and September 1 of each year,

commencing on March 1, 2010, at a rate of 9.75% per annum. The 9.75% Notes mature on September 1, 2015. The

9.75% Notes were issued for $244,292, resulting in an aggregate original issuance discount of $12,708.

The domestic subsidiaries of SIRIUS that guarantee certain of the indebtedness of SIRIUS and its restricted

subsidiaries guarantee SIRIUS’ obligations under the 9.75% Notes. The 9.75% Notes and related guarantees are

secured by first-priority liens on substantially all of the assets of SIRIUS and the guarantors other than certain

excluded assets (including cash, accounts receivable and certain inventory).

F-27

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)