XM Radio 2009 Annual Report Download - page 117

Download and view the complete annual report

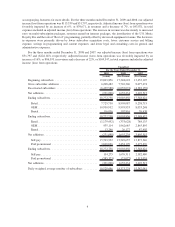

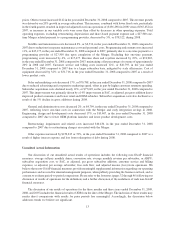

Please find page 117 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Highlights for the Year Ended December 31, 2009. Our revenue grew 4%, or $89,963, in the year ended

December 31, 2009 compared to 2008. Subscriber revenue grew 3%, or $75,995, in the year ended December 31,

2009 compared to 2008. Advertising revenue decreased 26%, or $18,179, in the year ended December 31, 2009

compared to 2008. The decrease in advertising revenue was driven by the current economic environment.

Equipment revenue decreased 27%, or $19,046, in the year ended December 31, 2009 compared to 2008. The

decrease in equipment revenue was driven by declines in sales through our direct to consumer distribution channel

and lower product and component sales offset by higher product royalties. Other revenue increased 131%, or

$51,193, in the year ended December 31, 2009 compared to 2008. The increase in other revenue was driven by the

U.S. Music Royalty Fee introduced in the third quarter of 2009. The overall increase in revenue, combined with a

decrease of 20%, or $508,874, in adjusted operating costs (total operating expense excluding restructuring,

impairments and related costs, depreciation and amortization and share-based payment expense), resulted in

improved adjusted income (loss) from operations of $462,539 in the year ended December 31, 2009 compared to

($136,298) in 2008.

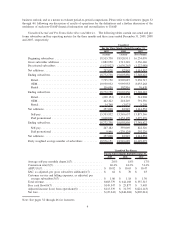

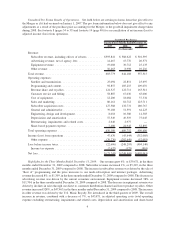

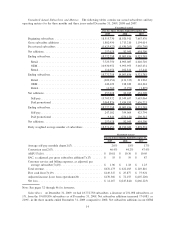

Satellite and transmission costs decreased 17%, or $17,015, in the year ended December 31, 2009 compared to

2008 due to reductions in repeater maintenance costs, non-cash repeater lease charges and personnel costs.

Programming and content costs decreased 17%, or $76,168, in the year ended December 31, 2009 compared to

2008, due mainly to a $27,500 one-time payment recognized in 2008 to a programming provider upon completion

of the Merger, reductions in personnel and on-air talent costs as well as savings on certain content agreements.

Revenue share and royalties increased 2%, or $9,028, in the year ended December 31, 2009 compared to 2008.

Customer service and billing costs decreased 5%, or $11,790, in the year ended December 31, 2009 compared to

2008 due to scale efficiencies. Cost of equipment decreased 39%, or $25,916, in the year ended December 31, 2009

compared to 2008 as a result of a decrease in direct to customer sales, lower inventory write-downs and lower

product and component sales.

Sales and marketing costs decreased 32%, or $110,097, in the year ended December 31, 2009 compared to

2008 due to reduced advertising and cooperative marketing spend as well as reductions to personnel costs and third

party distribution support expenses. Subscriber acquisition costs decreased 30%, or $175,456, in the year ended

December 31, 2009 compared to 2008. This improvement was driven by fewer OEM installations relative to gross

subscriber additions, improved OEM subsidies and chip set cost, decreased production of certain radios and lower

aftermarket inventory reserves as compared to 2008. Subscriber acquisition costs also decreased as a result of the

19% decline in gross additions during the year ended December 31, 2009 compared to 2008.

General and administrative costs decreased 32%, or $85,112, mainly due to the absence of certain legal and

regulatory charges incurred in 2008 and lower personnel costs. Engineering, design and development costs

decreased 31%, or $16,348, in the year ended December 31, 2009 compared to 2008, due to lower costs associated

with development, tooling and testing of radios as well as lower personnel costs.

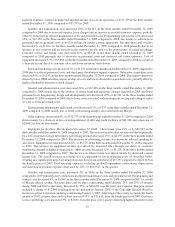

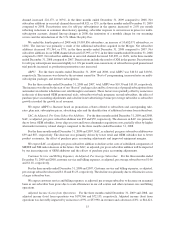

Restructuring, impairments and related costs increased 214%, or $22,373, mainly due to a loss of $24,196 on

capitalized installment payments for the launch of a satellite, which are expected to provide no future benefit due to

the counterparty’s bankruptcy filing, offset partially by a decrease in personnel related restructuring costs.

Other expenses increased 53%, or $201,732, in the year ended December 31, 2009 compared to 2008 driven

mainly by the increase in loss on extinguishment of debt and credit facilities of $169,443 and an increase in interest

expense of $88,787, partially offset by a decrease of $45,448 in loss on investments. The loss on the extinguishment

of debt and credit facilities was incurred on the full repayment of SIRIUS’ Credit Agreement with Liberty Media

and XM’s Amended and Restated Credit Agreement and termination of XM’s Second-Lien Credit Agreement.

Interest expense increased due primarily to the issuance of XM’s 13% Senior Notes due 2013 and the 7%

Exchangeable Senior Subordinated Notes due 2014 in the third quarter of 2008.

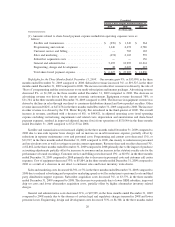

Highlights for the Year Ended December 31, 2008. Our revenue grew 18%, or by $378,132, in the year ended

December 31, 2008. Subscriber revenue grew 20%, or $369,613, in the year ended December 31, 2008 compared to

2007. Advertising revenue decreased 5%, or $3,407, in the year ended December 31, 2008 compared to 2007. The

decrease in advertising revenue was driven by the economic environment. Equipment revenue increased 20%, or

$11,784, in the year ended December 31, 2008 compared to 2007. The increase in equipment revenue was driven by

higher product royalties and increased sales through our direct to consumer distribution channel at higher average

12