XM Radio 2009 Annual Report Download - page 136

Download and view the complete annual report

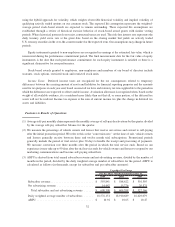

Please find page 136 of the 2009 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.depreciation expense would change, for example, a 10% decrease in the expected useful lives of satellites and

spacecraft control facilities during 2009 would have resulted in approximately $19,432 of additional depreciation

expense.

Revenue Recognition. We derive revenue primarily from subscribers, advertising and direct sales of

merchandise. Revenue from subscribers consists of subscription fees; revenue derived from our agreements with

daily rental fleet programs; non-refundable activation and other fees; and the effects of rebates. Revenue is

recognized as it is realized or realizable and earned.

We recognize subscription fees as our services are provided. Prepaid subscription fees are recorded as deferred

revenue and amortized to revenue ratably over the term of the applicable subscription plan.

At the time of sale, vehicle owners purchasing or leasing a vehicle with a subscription to our service typically

receive between a three-month and twelve-month prepaid subscription. Prepaid subscription fees received from

certain automakers are recorded as deferred revenue and amortized to revenue ratably over the service period which

commences upon retail sale and activation. We reimburse automakers for certain costs associated with the satellite

radio installed in the applicable vehicle at the time the vehicle is manufactured. The associated payments to the

automakers are included in Subscriber acquisition costs. These payments are included in Subscriber acquisition

costs because we are responsible for providing the service to the customers, including being obligated to the

customers in the case of an interruption of service.

Activation fees are recognized ratably over the estimated term of a subscriber relationship, estimated to be

approximately 3.5 years during 2009. The estimated term of a subscriber relationship is based on historical

experience. If we were to revise our estimate our recognition of activation fees would change, for example, a 10%

decrease to the estimated term of a subscriber relationship during 2009 would have resulted in approximately

$7,585 of additional activation fees.

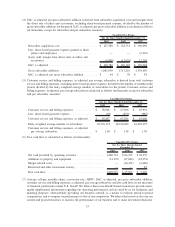

We record an estimate of rebates that are paid by us to subscribers as a reduction to revenue in the period the

subscriber activates service. For certain rebate promotions, a subscriber must remain active for a specified period of

time to be considered eligible. In those instances, the estimate is recorded as a reduction to revenue over the required

activation period. We estimate the effects of mail-in rebates based on actual take-rates for rebate incentives offered

in prior periods, adjusted as deemed necessary based on take-rate data available at the time. In subsequent periods,

estimates are adjusted when necessary. For instant rebate promotions, we record the consideration paid to the

consumer as a reduction to revenue in the period the customer participates in the promotion.

We recognize revenue from the sale of advertising as the advertising is broadcast. Agency fees are calculated

based on a stated percentage applied to gross billing revenue for our advertising inventory and are reported as a

reduction of advertising revenue. We pay certain third parties a percentage of advertising revenue. Advertising

revenue is recorded gross of such revenue share payments as we are the primary obligor in the transaction.

Advertising revenue share payments are recorded to revenue share and royalties during the period in which the

advertising is broadcast.

Equipment revenue and royalties from the sale of satellite radios, components and accessories is recognized

upon shipment, net of discounts and rebates. Shipping and handling costs billed to customers are recorded as

revenue. Shipping and handling costs associated with shipping goods to customers are reported as a component of

cost of equipment.

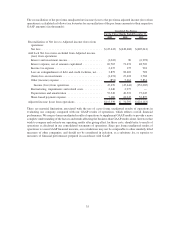

Revenue arrangements with multiple deliverables are divided into separate units of accounting when the

products and services meet certain criteria and consideration is allocated among the separate units of accounting

based on their relative fair values.

Share-based Payment. We recognize all share-based compensation payments in the financial statements

based on fair value using the Black-Scholes-Merton option-pricing model to value stock option awards and we treat

awards with graded vesting as a single award. Forfeitures are estimated at the time of grant and revised in

subsequent periods if actual forfeitures differ from initial estimates.

Fair value as determined using Black-Scholes-Merton model varies based on assumptions used for the

expected life, expected stock price volatility and risk-free interest rates. We estimate the fair value of awards granted

31