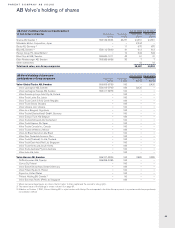

Volvo 2001 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

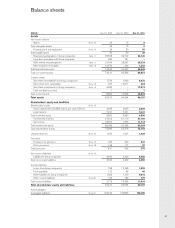

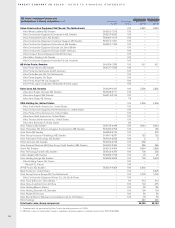

PARENT COMPANY AB VOLVO · NOTES TO FINANCIAL STATEMENTS

94

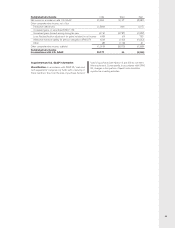

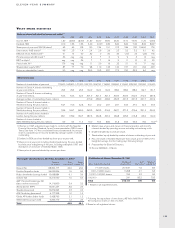

1999 2000 2001

Wages, salaries and withholding taxes 37 30 30

Other liabilities 86 95 50

Accrued expenses and prepaid income 72 55 99

Total 195 180 179

No collateral is provided for current liabilities.

Of the contingent liabilities amounting to 150,295

(133,856; 104,742), 149,829 (133,548; 104,415)

pertained to subsidiaries.

Guarantees for various credit programs are included

in amounts corresponding to the credit limits. These

guarantees amount to 147,246 (130,691; 101,885), of

which guarantees on behalf of subsidiaries totaled

146,786 (130,686; 101,863). At the end of each year,

the utilized portion amounted to 72,804 (58,448;

41,296) including 72,793 (58,140; 40,969) pertaining

to subsidiaries.

Note 20 Other current liabilities

Note 21 Contingent liabilities

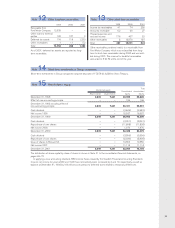

Provisions for pensions and similar benefits correspond

to the actuarially calculated value of obligations not

insured with third parties or secured through transfers of

funds to pension foundations. The amount of pensions

falling due within one year is included. AB Volvo has

insured the pension obligations with third parties. Of the

amount reported, 10 (0; 0) pertains to contractual

obligations within the framework of the PRI (Pension

Registration Institute) system.

In 1996, two Groupwide pension foundations for

employees were formed to secure commitments in

accordance with the ITP plan. The Volvo 1995 Pension

Foundation pertained to pension funds earned through

1995 and the Volvo 1996 Pension Foundation pertained

to funds earned beginning in 1996. During 2000 these

two foundations merged into one foundation. Pension

funds amounting to 0 (0; 33) have been transferred

from AB Volvo to the Volvo Pension Foundation.

AB Volvo’s pension costs in 2001 amounted to

93 (70; 54), after withdrawal from the Volvo Pension

Foundation of 0 (24; 30).

The accumulated benefit obligation of all AB Volvo’s

pension obligations at year-end 2001 amounted to 702,

which has been secured in part through provisions for

pensions and in part through funds in pension founda-

tions. Net asset value in the Pension Foundation, marked

to market, accruing to AB Volvo was 10 lower than cor-

responding pension obligations. A provision was recorded

to cover this deficit.

The accounting for surplus funds in Alecta is shown in

Note 22 to the consolidated financial statements, on

pages 70–71.

Other provisions comprise provisions for taxes in the amount of 24 (68; 68).

Long-term debt matures as follows:

2003 1,054

2004 3,329

2005 or later 72

Total 4,455

Long-term liabilities to Group companies include loans

of 0 (3,104; 3,023) from Volvo Treasury and 3,329 (0; 0)

from Renault V.I.

Note 17 Provisions for pensions

Note 18 Other provisions

Note 19 Non-current liabilities

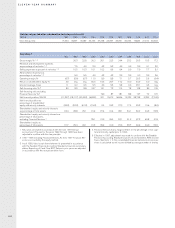

Value in Value in Value in

The composition of, and changes balance sheet Allocations balance sheet Group internal Allocations balance sheet

in, untaxed reserves: 1999 2000 2000 transfer 2001 2001

Tax allocation reserve 1,275 250 1,525 – – 1,525

Tax equalization reserve 114 (114) – – – –

Accumulated extra depreciation

Land – – – – 3 3

Machinery and equipment 5 (3) 2 – (2) 0

Replacement reserve – – – 3 (3) –

Total 1,394 133 1,527 3 (2) 1,528

Note 16 Untaxed reserves