Volvo 2001 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

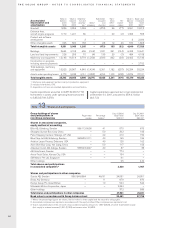

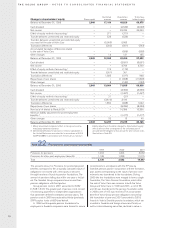

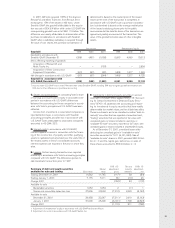

Other items not affecting cash pertain to surplus funds

from SPP – (–508; –), capital gains on the sale of sub-

sidiaries and other business units, –829 (–573; –26,900),

risk provisions and losses related to doubtful receivables

and customer-financing receivables 1,541 (522; 766)

and other –173 (–120; 17).

Net investments in customer-financing receivables

resulted in 2001 in a negative cash flow of SEK 3.7 billion

(4.5; 7.1). In this respect, liquid funds were reduced by

SEK 16.6 billion (15.5; 14.2) pertaining to new investments

in financial leasing contracts and installment contracts.

Investments in shares and participations, net in 2001

amounted to SEK 3.9 billion, mainly related to the sale of

Volvo’s holding in Mitsubishi Motors Corporation. Invest-

ments in shares and participations, net, in 2000 amount-

ed to SEK 1.6 billion, of which SEK 1.3 billion was attrib-

utable to additional investments in Scania. Net invest-

ments in shares and participations during 1999 of SEK

25.9 billion pertained in entirety to future investments, of

which the acquisition of shares in Scania AB and

Mitsubishi Motors Corporation amounted to SEK 23.0

billion and SEK 2.3 billion, respectively.

Acquired and divested subsidiaries and other business

units, net in 2001 amounted to SEK 13.0 billion mainly

pertained to the final payment of SEK 12.1 billion from

the sale of Volvo Cars, divestment of the insurance oper-

ation in Volvia and acquired liquid funds within Mack and

Renault V.I.

During 2001 and 2000 net investments in loans to

external parties contributed SEK 0.2 billion and SEK 0.3

billion, respectively to liquid funds. Net investments dur-

ing 1999 in loans to external parties amounted to SEK

3.2 billion, of which SEK 2.0 billion pertained to payment

of the convertible debenture loan in Henlys group and

SEK 1.3 billion new investment in corporate bonds.

The change during the year in bonds and other loans

generated liquid funds of SEK 6.2 billion (8.1; 16.3).

New borrowing during the year, mainly the issue of bond

loans and a commercial paper program, provided SEK

31.4 billion (19.5; 19.0). Amortization during the year

amounted to SEK 25.2 billion (11.4; 23.0).

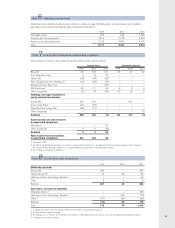

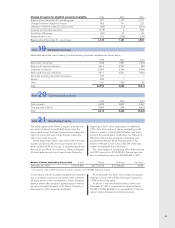

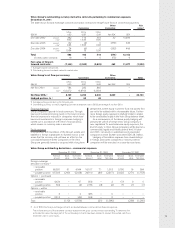

1999 2000 2001

Discounted bills 467 443 345

Guarantees:

Bank loans and trade bills – associated companies – 48 67

Bank loans – customers and others 909 1,516 3,067

Recourse obligations 46 66 2,145

Tax claims 2,754 2,071 1,151

Other contingent liabilities 2,490 2,645 3,666

Total 6,666 6,789 10,441

Note 27 Contingent liabilities

Note 28 Cash flow

The amount shown for guarantees to customers and

others pertaining to bank loans, 3,067 (1,516; 909)

includes the unutilized portion of credit facilities, 99

(623; 31). Recourse obligations pertain to receivables

that have been transferred (customer-financing opera-

tions), less reduction for recognized credit risks. Tax

liability pertains to actual or anticipated actions against

the Volvo Group for which provisions are not considered

necessary.

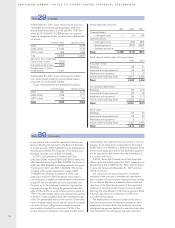

Legal proceedings

In March 1999, an FH 12 Volvo truck was involved in a

fire in the Mont Blanc tunnel. The tunnel suffered consider-

able damage from the fire, which continued for 50 hours;

39 people lost their lives in the fire, and 34 vehicles were

trapped in the tunnel. It is still unclear what caused the

fire. The Mont Blanc tunnel has been closed since the

fire.

An expert group has been appointed by the Commer-

cial Court in Nanterre, France, to investigate the cause of

the fire and the damage it caused. At present, it is not

possible to anticipate the result of this investigation or

the results of certain other French investigations now in

progress regarding the fire. One of the investigations is

being carried out by an Investigation Magistrate appointed

to investigate potential criminal liability for the fire. In

December 2000 an expert committee assisting the In-

vestigation Magistrate filed a report on the events. Certain

companies and individuals have formally been placed

under investigation. At this stage, no Volvo entity, executive

or employee has been placed under investigation.

A lawsuit has been filed with the Commercial Court in

Nanterre by the insurance company employed by the

French company that operates the tunnel against certain

Volvo Group companies and the trailer manufacturer in

which it demands compensation for the losses it claims

to have suffered. The plaintiff has requested that the court

postpone its decision until the expert group submits its

report. Certain Volvo Group companies have further been

involved in proceedings before the Civil Court of Bonneville

instigated by the French Tunnel operating company

against Bureau Central Francais, the owner of the truck

and its insurers. These proceedings partly overlap with

the proceedings in the Commercial Court of Nanterre.

Volvo Group companies are also involved in proceedings

regarding matters in connection with the tunnel fire

before courts in Aosta, Italy, and Brussels, Belgium. Volvo

is unable to determine the ultimate outcome of the

litigation referred to above.

AB Volvo and Renault SA have entered into arbitra-

tion regarding the final value of acquired assets and lia-

bilities in Renault V.I. and Mack. This process could result

in an adjustment in the value of the transfer. Any such

adjustment will affect the amount of acquired liquid

funds and Volvo's reported goodwill amount. The out-

come of this arbitration cannot be determined with cer-

tainty. However, Volvo believes that the outcome will not

lead to an increase in goodwill.

Volvo is involved in a number of other legal proceed-

ings incidental to the normal conduct of its businesses.

Volvo does not believe that any liabilities related to such

proceedings are likely to be, in the aggregate, material to

the financial condition of the Group.