Volvo 2001 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

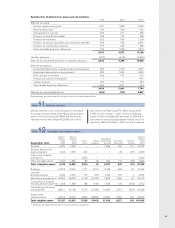

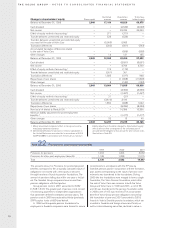

1999 2000 2001

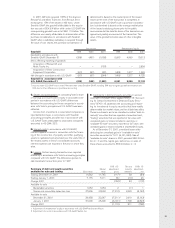

Number of of whom, Number of of whom, Number of of whom,

Average number of employees employees women, % employees women, % employees women, %

AB Volvo

Sweden 137 60 115 55 105 53

Subsidiaries

Sweden 24,802 19 24,737 18 24,463 17

Western Europe 10,392 15 10,316 17 26,043 13

Eastern Europe 1,239 11 1,734 10 1,862 13

North America 11,860 19 11,875 33 13,450 18

South America 1,924 11 2,084 10 2,071 11

Asia 2,344 14 2,616 13 2,599 10

Other countries 450 12 787 14 1,438 10

Group total 53,148 17 54,264 20 72,031 15

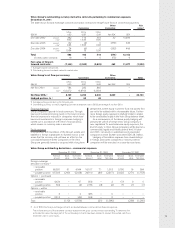

provide that, when employment is terminated by the

Company, an employee is entitled to severance pay equal

to the employee’s monthly salary for a period of 12 or 24

months, depending on age at date of severance. In cer-

tain contracts, replacing contracts concluded earlier, an

employee is entitled to severance payments amounting

to the employee’s monthly salary for a period of 30 to 42

months. In agreements concluded after the spring of

1993, severance pay is reduced, in the event the em-

ployee gains employment during the severance period,

in an amount equal to 75% of income from new em-

ployment. An early-retirement pension may be received

when the employee reaches the age of 60. A pension is

earned gradually over the years up to the employee’s

retirement age and is fully earned at age 60. From that

date until reaching the normal retirement age, the retiree

will receive a maximum of 70% of the qualifying salary.

From the age of normal retirement, the retiree will receive

a maximum of 50% of the qualifying salary.

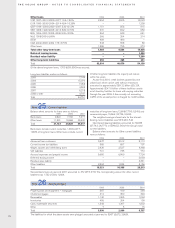

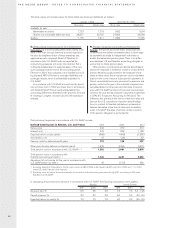

Volvo currently has two option programs for senior

executives. The option programs have no dilutive effect

on Volvo’s outstanding shares.

In October 1998, Volvo announced a call option

program with two subscriptions, one in 1999 and one

in 2000. For the first subscription in May 1999, options

were subscribed to approximately 100 senior executives.

For the second subscription in April 2000, options were

subscribed to approximately 60 senior executives.

The call options subscribed in May 1999, which can

be exercised from May 18, 1999 until May 4, 2004, give

the holder the right to acquire 1.03 Series B Volvo shares

for each option held from a third party. The exercise price

is SEK 290.70. The price of the options is based on a

market valuation and was fixed at SEK 68.70 by Trygg-

Hansa Livförsäkrings AB. The number of options corre-

sponds to a part of the executive’s bonus earned. A total

of 91,341 options were subscribed. The options are

financed 50% by the Company and 50% from the

option-holder’s bonus.

The second subscription took place in April 2000.

These options can be exercised from April 28, 2000 until

April 27, 2005, and give the holder the right to acquire

one Series B Volvo share for each option held from a

third party. The exercise price is SEK 315.35. The price

of the options is based on market valuation by UBS

Warburg and was fixed at SEK 55.75. The number of

options corresponds to a part of the executive’s bonus

earned. A total of 120,765 options were subscribed. The

options are financed 50% by the Company and 50%

from the option holder’s bonus.

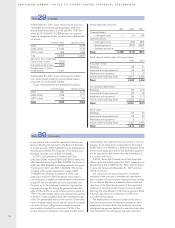

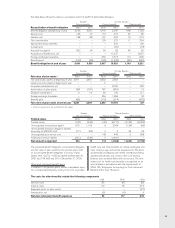

In January 2000, a decision was made to implement a

new incentive program for senior executives within the

Volvo Group in the form of so-called employee stock

options. The decision covers allotment of options for

2000 and 2001. Accordingly, during January 2000, a

total of 595,000 options were allotted to 62 senior exec-

utives, including President and CEO Leif Johansson, who

received 50,000 options. The executives has not made

any payment for the options. The employee stock options

allotted in January 2000 give the holders the right, from

March 31, 2002 through March 31, 2003, to redeem

their options or alternatively receive the difference

between the actual price at that time and the exercise

price determined at allotment. The exercise price is SEK

239.35, which is equal to 110% of the share price at

allotment. The theoretical value of the options at allot-

ment was set at SEK 35, using the Black & Scholes pric-

ing model for options. Volvo has hedged the committ-

ments (including social costs) relating to a future

increase in share price, through a Total Return Swap.

Should the share price be lower than the exercise price

at the closing date, Volvo will pay the swap-holder the

difference between the actual share price and the exer-

cise price at that time for each outstanding option.

In May, 2001, the second allotment within the em-

ployee stock option program took place. The allotment

which was based on the fulfillment of financial goals, cov-

ered a total of 163,109 options to 71 senior executives,

including President and CEO Leif Johansson, who

received 13,600 options. The executives has not made

any payment for the options. These employee stock

options give the holders the right, from May 4, 2003

through March 31, 2004, to redeem their options or

alternatively receive the difference between the actual

price at that time and the exercise price determined at

allotment. The exercise price is SEK 159, which is equal

to 110% of the share price at allotment. The theoretical

value of the options at allotment was set at SEK 22,

using the Black & Scholes pricing model for options.

Volvo has hedged the committments (including social

costs) relating to a future increase in share price, through

a Total Return Swap. Should the share price be lower

than the exercise price at the closing date, Volvo will pay

the swap-holder the difference between the actual share

price and the exercise price at that time for each out-

standing option.

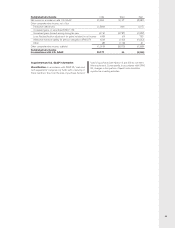

Profit-sharing payments to employees for 2001, 2000

and 1999 amounted to –, – and 185.