Volvo 2001 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

2001 was also positively affected by capital-

ization of development costs amounting to

SEK 1,586 M and gain on divestment of

shares in Mitsubishi Motors Corporation

amounting to SEK 574 M.

Lower volumes and low capacity utiliza-

tion, particularly in the North American

plants, were mainly responsible for the oper-

ating loss in Buses of SEK 524 M excluding

restructuring costs, (2000: income of SEK

440 M). Construction Equipment reported

operating income, excluding restructuring

costs, of SEK 891 M compared with SEK

1,594 in the year earlier. The lower earnings

was primarily explained by significantly

lower demand in North America and changes

in the product mix.

Operating income in 2001 for Volvo

Penta was the best ever and amounted to

SEK 658 M (484). In Volvo Aero, operating

income amounted to SEK 653 M which was

higher than the preceding year (SEK 621 M)

despite the downturn in air traffic during the

end of the year.

Operating income within Financial

Services amounted to SEK 325 M (1,499).

The income in 2001 was charged with sig-

nificant losses in the US truck financing

portfolio, of which SEK 670 M in the second

quarter. Toward the end of the year, the losses

and repossessions in the US portfolio were

decreasing, although still at a high level. The

operating income of Financial Services in

2001 included a gain on the divestment of

Volvia’s insurance operations amounting to

SEK 562 M, while income in 2000 included

gains of SEK 610 M relating to Volvia's secu-

rities portfolio.

Group operating income in 2001 was nega-

tively affected by provisions of SEK 292 M

relating to a deficit within the Volvo Group’s

Swedish pension foundation for securing

commitments in accordance with the ITP

plan. The deficit was a result of the down-

turn on the stock markets. Operating income

in 2000 included a positive impact of SEK

683 M relating to surplus funds from the

Alecta (previously SPP) insurance company.

Operating income in 2000 also included an

adjustment of the gain on divestment of

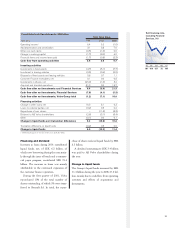

Consolidated income statements

SEK M 1999 2000 2001

Net sales 116,382 120,392 180,615

Cost of sales (92,772) (97,131) (149,477)

Gross income 23,610 23,261 31,138

Research and development expenses (4,525) (4,876) (5,391)

Selling expenses (8,117) (9,285) (14,663)

Administrative expenses (4,632) (4,651) (6,474)

Other operating income and expenses (587) 309 (3,071)

Income from Financial Services 1,066 1,499 325

Income from investments in shares 648 411 1,322

Income from divestment of Volvo Cars 26,695 – –

Restructuring costs – – (3,862)

Operating income (loss) 34,158 6,668 (676)

Interest income and similar credits 1,812 1,588 1,653

Interest expenses and similar charges (1,505) (1,845) (2,653)

Other financial income and expenses 131 (165) (190)

Income (loss) after financial items 34,596 6,246 (1,866)

Taxes (2,270) (1,510) 326

Minority interests (104) (27) 73

Net income (loss) 32,222 4,709 (1,467)

Income (loss) per share, SEK 73.00 11.20 (3.50)

Change of operating income

SEK billion

Operating income 2000 6.7

Restructuring costs (3.9)

Decreased volumes, changes

in product and market mix etc. (2.8)

Higher selling and administrative expenses (1.1)

Acquired and divested operations +0.6

Changes in currency exchange rates +0.5

Capitalization of development costs +2.0

Credit losses in US truck financing portfolio (0.7)

Gain on divestment of shares

in Mitsubishi Motors +0.6

Deficit in Swedish pension foundation (0.3)

Alecta surplus funds 2000 (0.7)

Gains on sale of securities portfolio

in Volvia 2000 (0.6)

Other (1.0)

Operating income 2001 (0.7)