Volvo 2001 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

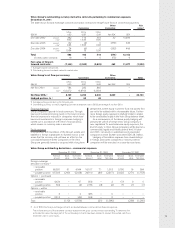

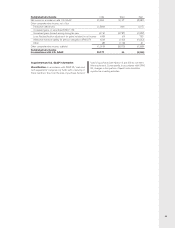

Comprehensive income 1999 2000 2001

Net income in accordance with U.S. GAAP 31,690 3,127 (3,981)

Other comprehensive income, net of tax

Translation differences (1,389) 966 1,015

Unrealized gains on securities (SFAS 115):

Unrealized gains (losses) arising during the year (419) (3,787) (1,532)

Less: Reclassification adjustment for gains included in net income (43) (1) 733

Additional minimum liability for pension obligations (FAS 87) (54) (132) (1,622)

Other (8) (119) 41

Other comprehensive income, subtotal (1,913) (3,073) (1,365)

Comprehensive income

in accordance with U.S. GAAP 29,777 54 (5,346)

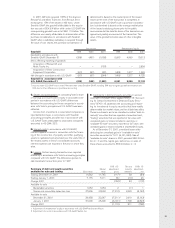

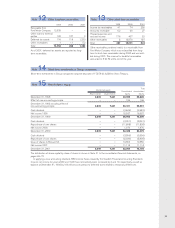

Supplementary U.S. GAAP information

Classification. In accordance with SFAS 95, “cash and

cash equivalents” comprise only funds with a maturity of

three months or less from the date of purchase. Some of

Volvo’s liquid funds (see Notes 19 and 20) do not meet

this requirement. Consequently, in accordance with SFAS

95, changes in this portion of liquid funds should be

reported as investing activities.