Volvo 2001 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE VOLVO GROUP · NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

78

Credit risks in financial instruments

Credit risk in financial investments

The liquidity in the Group is invested mainly in local cash

pools or directly with Volvo Treasury. This concentrates

the credit risk within the Group’s in-house bank. Volvo

Treasury invests the liquid funds in the money and capital

markets.

All investments must meet criteria for low credit risk

and high liquidity. In accordance with Volvo’s credit policy,

counterparties for both investments and transactions in

derivatives must have received a rating of “A” or better

from one of the well-established credit-rating institutions.

Counterparty risks

The derivative instruments used by Volvo to reduce its

foreign-exchange and interest-rate risk in turn give rise

to a counterparty risk, the risk that a counterparty will not

fulfill its part of a forward or option contract, and that a

potential gain will not be realized. Transactions with

derivative instruments are mainly conducted via Volvo

Treasury which means that the counterparty risk is con-

centrated within the Group’s in-house bank. Where

appropriate, the Volvo Group arranges master netting

agreements with the counterparty to reduce exposure.

The credit exposure in interest-rate and foreign exchange

contracts is represented by the positive fair value – the

potential gain on these contracts – as of the reporting

date. The risk exposure is calculated daily. The credit risk

in futures contracts is limited through daily or monthly

cash settlements of the net change in value of open

contracts. The estimated exposure in foreign exchange

contracts, interest-rate swaps and futures, and options

amounted to 654, 4,669 and 0 as of December 31,

2001.

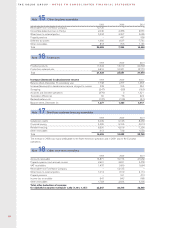

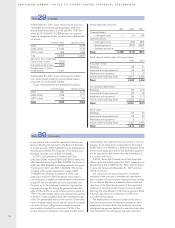

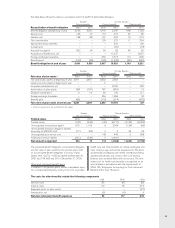

Volvo Group outstanding derivatives – financial exposure

December 31, 1999 December 31, 2000 December 31, 2001

Notional Book Estimated Notional Book Estimated Notional Book Estimated

amount value fair value amount value fair value amount value fair value

Interest-rate swaps 6

– receivable

position 87,647 486 3,055 64,345 561 2,990 62,456 3,670 4,549

– payable position 94,934 (373) (3,461) 57,488 (366) (2,969) 86,328 (3,888) (4,633)

Forwards and futures

– receivable

position 231,907 – 99 174,576 0 201 230,323 120 120

– payable position 220,640 – (61) 201,657 (28) (247) 250,390 (126) (126)

Foreign exchange

derivative contracts 5

– receivable

position – – – 32,741 34 1,046 6,306 96 100

– payable position – – – 21,668 (76) (2,894) 21,465 (428) (435)

Options purchased,

caps and floors

– receivable

position – – – 52 0 1 – – –

– payable position – – – – – – – – –

Options written,

caps and floors

– receivable

position – – – – – – – – –

– payable position – – – 55 0 0 – – –

Total 113 (368) 125 (1,873) (556) (425)

6As from 2000 interest-rate swaps in foreign currencies are reported as financial exposure contracts and are included in interest-rate

swaps. Comparative figures for 1999 have been calculated.

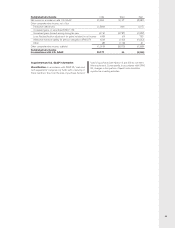

Interest-rate risks

Interest-rate risks relate to the risk that changes in inter-

est-rate levels affect the Group’s profit. By matching

fixed-interest periods of financial assets and liabilities,

Volvo reduces the effects of interest-rate changes.

Interest-rate swaps are used to change the interest-rate

periods of the Group’s financial assets and liabilities.

Exchange-rate swaps make it possible to borrow in

foreign currencies in different markets without incurring

currency risks.

Volvo also holds standardized futures and forward-

rate agreements. The majority of these contracts are

used to secure interest levels for short-term borrowing

or placement.

Liquidity risks

Volvo ensures maintenance of a strong financial position

by continuously keeping a certain percentage of sales in

liquid assets. A proper balance between short- and long-

term borrowing, as well as the ability to borrow in the

form of credit facilities, are designed to ensure long-term

financing.