Volvo 2001 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

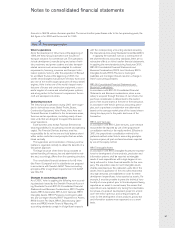

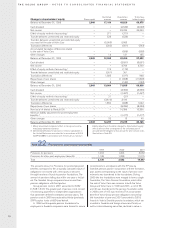

THE VOLVO GROUP · NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

60

Parent Company holdings of shares in subsidiaries as of

December 31, 2001 are shown on pages 95–96.

Significant acquisitions, formations and divestments

within the Group are listed below.

Prévost Holding BV

On October 1, 2001 Volvo Buses divested 1% of

Prévost Holding BV, a Canadian and North American bus

manufacturer, to Henlys Group Plc. Thereafter Volvo and

Henlys Group Plc own 50% of Prévost Holding BV

each. Thus, effective on October 1, 2001, Prévost

Holding BV is a joint venture and reported in the Volvo

Group accounts in accordance with the proportinate

consolidation method.

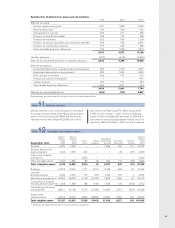

Note 2Acquisitions and divestments of shares in subsidiaries

Inventories

Inventories are stated at the lower of cost, in accordance

with the first-in, first-out method (FIFO), or net realizable

value. Provisions are made for obsolescence.

Marketable securities

Marketable securities are stated at the lower of cost or

market value in accordance with the portfolio method.

Liquid funds

Liquid funds include Cash and bank balances and mar-

ketable securities. Marketable securities to some extent

consist of interest bearing securities with maturities

exceeding three months. However, these securities have

high liquidity and can easily be converted to cash.

Post-employment benefits

Most of the Volvo Group’s pension commitments are met

through continuous payments to independent authorities

or bodies that administer the plans. Pension expense

corresponding to the fees paid for these defined-contri-

bution pension plans is reported continuously. In certain

of Volvo’s subsidiaries, mainly in Sweden and the U.S.,

there are defined benefit plans covering pensions and

healthcare benefits. For these plans, a provision and

annual pension expense are calculated based on the

current value of the earned future benefits. Provisions for

pensions and annual expenses related to defined pen-

sion and healthcare benefits are reported in Volvo’s con-

solidated balance sheet and income statement by apply-

ing the local rules and directives in each country.

Net sales

The Group’s reported net sales pertain mainly to rev-

enues from sales of goods and services. Net sales are

reduced by the value of discounts granted and by

returns.

Income from the sale of goods is recognized when

the goods are delivered to the customers. If however the

sale of goods is combined with a buy-back agreement or

a residual value guarantee, the sale is accounted for as

an operating lease transaction if significant risks are

retained in Volvo. Income from the sale of workshop ser-

vices is recognized when the service is provided. Rental

revenues and interest income in conjunction with finan-

cial leasing or installment contracts is recognized over

the contract period.

Research and development expenses

and warranty expenses

Effective in 2001, Volvo has adopted RR15 Intangible

Assets (see changes in accounting principles above). In

accordance with the new accounting standard, expendi-

tures for development of new products and production

systems shall be reported as intangible assets if such

expenditures with a high degree of certainty will result in

future financial benefits for the company. The acquisition

value for such intangible assets shall be amortized over

the estimated useful life of the assets. Volvo’s application

of the new rules means that very high demands are

established in order for these development expenditures

to be reported as assets. For example, it must be possi-

ble to prove the technical functionality of a new product

prior to this development being reported as an asset. In

normal cases, this means that expenditures are capital-

ized only during the industrialization phase of a product

development project. Other research and development

expenses are charged to income as incurred.

Estimated costs for product warranties are charged to

cost of sales when the products are sold.

Restructuring costs

Restructuring costs are reported separately in the

income statement if they relate to a considerable change

of the Group structure. A provision for decided restruc-

turing measures (see changes in accounting principles

above) is reported when a detailed plan for the imple-

mentation of the measures is complete and when this

plan is communicated to those who are affected.

Deferred taxes, allocations and untaxed reserves

Tax legislation in Sweden and other countries sometimes

contains rules other than those identified with generally

accepted accounting principles, and which pertain to the

timing of taxation and measurement of certain commer-

cial transactions. Deferred taxes are provided for on

differences which arise between the taxable value and

reported value of assets and liabilities (temporary differ-

ences) as well as on tax-loss carryforwards. However,

with regards to the valuation of deferred tax assets (the

value of future tax deductions), these items are recog-

nized provided that it is probable that the amounts can

be utilized in connection with future taxable income.

Tax laws in Sweden and certain other countries allow

companies to defer payment of taxes through allocations

to untaxed reserves. These items are treated as tempo-

rary differences in the consolidated balance sheet, that

is, a division is made between deferred tax liability and

equity capital (restricted reserves). In the consolidated

income statement an allocation to, or withdrawal from,

untaxed reserves is divided between deferred taxes and

net income for the year.

Application of estimated values

In preparing the year-end financial statements in accord-

ance with generally accepted accounting principles,

company management makes certain estimates and

assumptions which affect the value of assets and liabili-

ties as well as contingent liabilities at the balance sheet

date. Reported amounts for income and expenses in the

reporting period are also affected. The actual results may

differ from these estimates.