Volvo 2001 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE VOLVO GROUP · NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

82

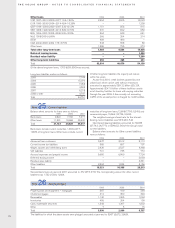

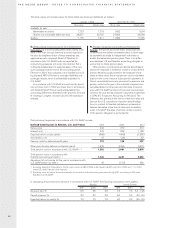

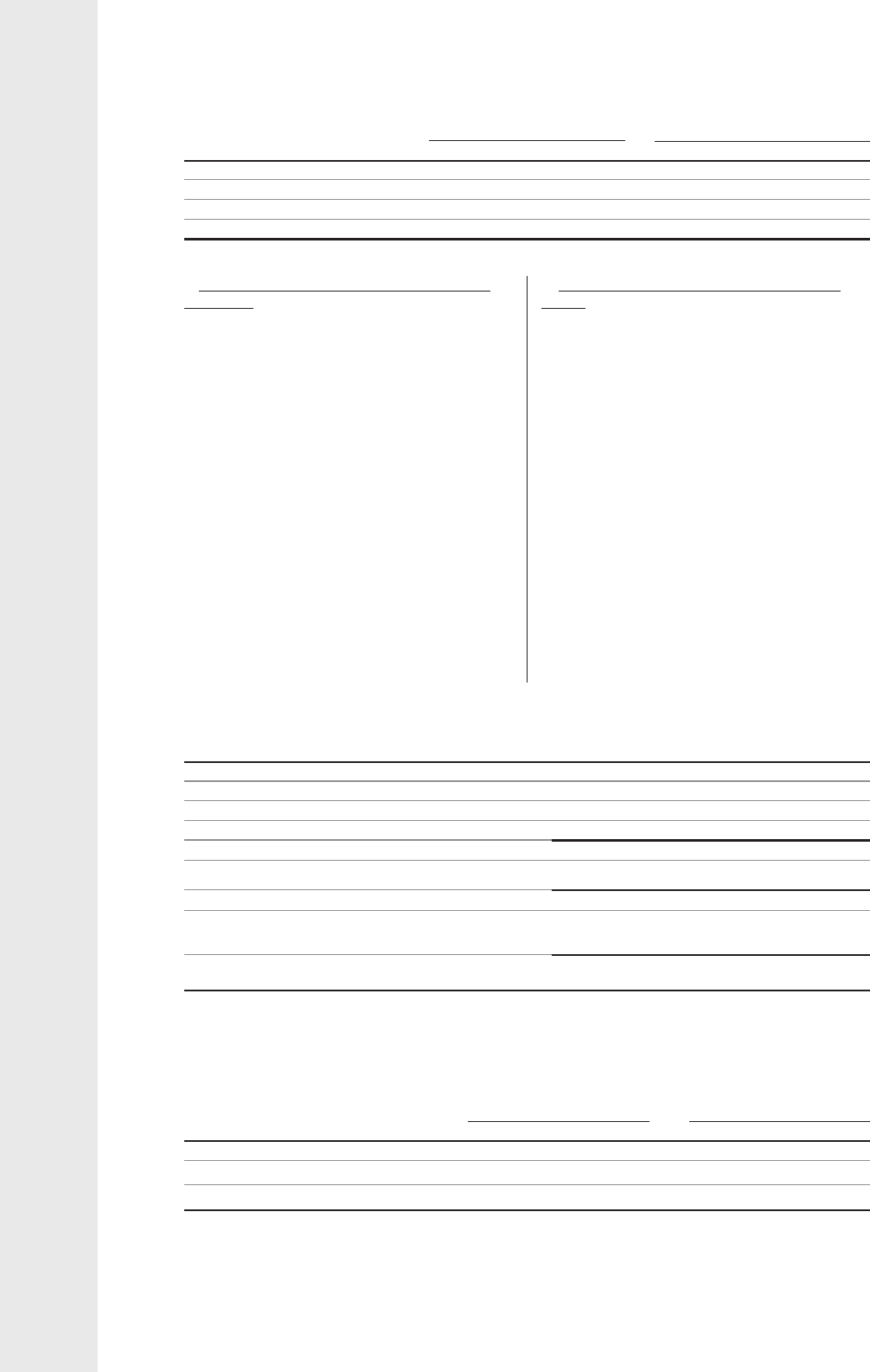

In calculating the provisions for pensions in accordance with U.S. GAAP, the following assumptions were applied:

Sweden Outside Sweden

1999 2000 2001 1999 2000 2001

Discount rate, % 5.5 5.5 5.5 7.5 7.5 5.5 - 7.25

Payroll increase, % 3.0 3.0 3.0 6.0 6.0 3.0 - 5.0

Expected return on assets, % 7.0 7.0 7.0 9.0 9.0 8.5 - 9.5

Post-retirement expenses in accordance with U.S. GAAP include:

Defined-benefit plans in Sweden, U.S. and France 1999 2000 2001

Service cost 242 279 412

Interest cost 279 328 1,188

Expected return on plan assets (366) (445) (1,335)

Amortization, net 15 (14) 32

Pension costs for defined benefit plans 170 148 297

Other plans (mainly defined contribution plans) 1,332 2,253 2,579

Total pension costs in accordance with U.S. GAAP 1, 2 1,502 2,401 2,876

Total pension costs in accordance with

Swedish accounting principles 1, 2 1,542 2,231 3,332

Adjustment of net income for the year in accordance with

U.S. GAAP before tax effect 40 (170) 456

1Excluding deduction attributable to Alecta surplus funds of 683 in 2000 under Swedish GAAP and 160 in 2000 and 111 in 2001

under U.S. GAAP. See (I) in this footnote.

2Excluding costs for special termination benefits in connection with restructuring measures during 2001 amounting to 402 under

Swedish and U.S. GAAP.

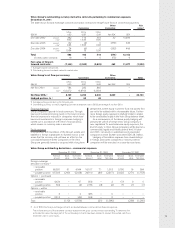

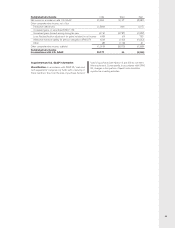

G. Restructuring costs and income from divestment of

Volvo Cars. Up to and including 2000, restructuring costs

were in the Volvo Group’s year-end accounts reported in

the year that implementation of these measures was

approved by each company’s Board of Directors. In

accordance with U.S. GAAP, costs are reported for

restructuring measures only under the condition that a

sufficiently detailed plan for implementation of the mea-

sures is prepared at the end of the accounting period.

Effective in 2001, Volvo adopted a new Swedish account-

ing standard, RR16 Provisions, contingent liabilities and

contingent assets, which is substantially equivalent to

U.S. GAAP.

In accordance with U.S. GAAP, income from the divest-

ment of Volvo Cars in 1999 was lower than in accordance

with Swedish GAAP. This is mainly attributable to the

accounting differences described under points A, D, G and

H resulting in a higher net asset value for the operations

divested.

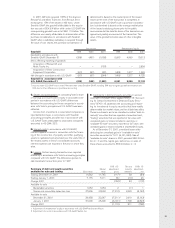

H. Provision for pensions and other post-employment

benefits. The greater part of the Volvo Group’s pension

commitments are defined contribution plans in which regu-

lar payments are made to independent authorities or

bodies that administer pension plans. There is no differ-

ence between U.S. and Swedish accounting principles in

accounting for these pension plans.

Other pension commitments are defined-benefit plans;

that is, the employee is entitled to receive a certain level of

pension benefits, usually related to the employee’s final

salary. In these cases the annual pension cost is calculated

based on the current value of future pension payments. In

Volvo’s consolidated accounts, provisions for pensions and

pension costs for the year in the individual companies are

calculated based on local rules and directives. In accord-

ance with U.S. GAAP, provisions for pensions and pension

costs for the year should always be calculated as specified

in SFAS 87, “Employers Accounting for Pensions.” The

difference lies primarily in the choice of discount rates and

the fact that U.S. calculations of pension benefit obliga-

tions, in contrast to Swedish calculations, are based on

salaries calculated at the time of retirement. In addition,

under U.S. GAAP, the value of pension assets in excess

of the pension obligation is accounted for.

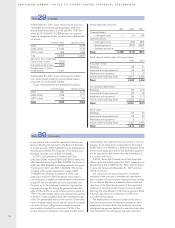

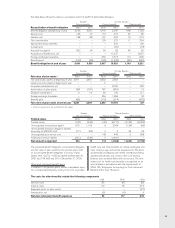

January 1, 2001 December 31, 2001

Book value Market value Book value Market value

Available for sale

Marketable securities 1,723 1,718 1,652 1,654

Shares and convertible debenture loan 29,877 23,781 27,806 20,593

Trading 7,175 7,211 11,862 11,745

The book values and market values for these listed securities are distributed as follows: