Volvo 2001 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

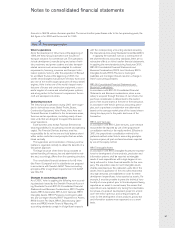

THE VOLVO GROUP · NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

58

RR16 Provisions, Contingent Liabilities

and Contingent Assets

In accordance with RR16 Provisions, Contingent

Liabilities and Contingent Assets, a provision for decided

restructuring measures is reported first when a detailed

plan for the implementation of the measures is complete

and when this plan is communicated to those who are

affected. In accordance with Volvo’s previous accounting

principles, a provision for restructuring measures was

reported in connection with the measures being decided

by the company’s management.

Income from investments in shares

Effective in 2001, Income from investments in associat-

ed companies and Income from other investments are

included as a part of the operating income rather than as

earlier as a part of the financial net. The change has

been made as an adaption to Volvo’s internal business

control model in connection with the new organization.

Comparable figures for previous years have been re-

stated to conform to the changed classification.

Financial income and expenses in the Financial Services

business area

In connection with the formation of the Financial

Services business area January 1, 2000, there has been

a modification of the principles used to classify financial

income and expense in Volvo’s insurance and real estate

businesses. Effective in 2000, financial income and

expense in these operations are reported in the Volvo

Group’s operating income. Earlier, these items were

included in the Volvo Group’s net interest

income/expense. Comparable figures for 1999 have

been adjusted to conform to the revised classification

principle. As a result of the above, the definition of the

Volvo Group’s net financial assets has also been modi-

fied. Effective in 2000, the Volvo Group’s net financial

assets have been calculated excluding the Financial

Services business area since financial income and

expense in Financial Services is reported in consolidated

operating income. As of January 1, 2000, as a result of

the new definition, Volvo’s net financial assets were

reduced by SEK 2.2 billion.

Effective in 2000, Volvo Treasury’s income is reported

as part of the operating income in the Financial Services

business area. Volvo Treasury’s income includes interest

income and similar income, interest expense and similar

expenses, as well as overhead costs of Volvo Treasury’s

operations. However, income excludes the effects of the

equity-capital base in Volvo Treasury. Based on the

above definition, Volvo Treasury’s income for 2000

amounted to SEK 151 M. Of this amount, SEK 183 M

was formerly included in interest income in accordance

with the earlier principle, and a deficit of SEK 32 M was

included in Other financial expenses.

Change in identification of overhead costs

in Volvo’s spare-parts operations

Effective in 2000, the method of calculating Volvo’s

product costs related to spare parts has been revised.

Beginning in 2000, overhead costs of the Volvo Group’s

spare-parts business, which earlier were included among

administrative costs, are being included among cost of

sales. Comparable figures for 1999 have been adjusted

to conform to the changed classification.

Consolidated accounts

The consolidated accounts comprise the Parent

Company, all subsidiaries and associated companies.

Subsidiaries are defined as companies in which Volvo

holds more than 50% of the voting rights or in which

Volvo otherwise has a controlling influence. However,

subsidiaries in which Volvo’s holding is temporary are not

consolidated. Associated companies are companies in

which Volvo has long-term holdings equal to at least

20% but not more than 50% of the voting rights.

The consolidated accounts are prepared in accord-

ance with the principles set forth in the Recommen-

dation of the Swedish Financial Accounting Standards

Council, RR1:00, Consolidated Financial Statements and

Business Combinations.

All business combinations are accounted for in accord-

ance with the purchase method.

Companies that have been divested are normally

included in the consolidated accounts up to and includ-

ing the date of divestment. However the measurement

date for divestment of Volvo Cars was January 1, 1999.

Companies acquired during the year are consolidated as

of the date of acquisition.

Holdings in associated companies are reported in

accordance with the equity method. The Group’s share

of reported income before taxes in such companies,

adjusted for minority interests, is included in the consoli-

dated income statement in Income from investments in

associated companies, reduced in appropriate cases by

amortization of goodwill. The Group’s share of reported

taxes in associated companies, is included in Group tax

expense.

For practical reasons, most of the associated compa-

nies are included in the consolidated accounts with a

certain time lag, normally one quarter. Dividends from

associated companies are not included in consolidated

income. In the consolidated balance sheet, the book value

of shareholdings in associated companies is affected by

Volvo’s share of the company’s income after tax, reduced

by the amortization of goodwill and by the amount of

dividends received.

Accounting for hedges

Loans and other financial instruments used to hedge an

underlying position are reported as a hedge. In order to

apply hedge accounting, the following criteria must be

met: the position being hedged is identified and exposed

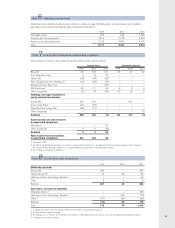

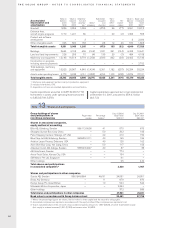

Exchange rates Average rate Jan–Dec Year-end rate

Country Currency 1999 2000 2001 1999 2000 2001

Denmark DKK 1.1864 1.1334 1.2403 1.1505 1.1870 1.2670

Japan JPY 0.0731 0.0850 0.0850 0.0835 0.0832 0.0813

Norway NOK 1.0604 1.0414 1.1485 1.0605 1.0715 1.1840

Great Britain GBP 13.3834 13.8620 14.8763 13.7950 14.2200 15.4800

United States USD 8.2742 9.1581 10.3272 8.5250 9.5350 10.6700

Euro EUR 8.8245 8.4494 9.2434 8.5635 8.8570 9.4240