Volvo 2001 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

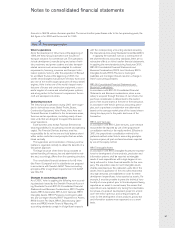

THE VOLVO GROUP · NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

62

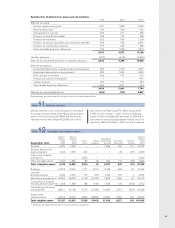

Net sales per business and market area are shown in tables on page 16.

Other operating income and expenses include losses on forward and options contracts of 2,044 (700; 620), amortiza-

tion of goodwill amounting to 1,058 (491; 398), surplus funds from Alecta (previously SPP) 43 (683; –), gain on sale

of Volvia’s operations 562 (–; –) and adjustment of the gain on sale of Volvo Cars 90 (520; –).

Restructuring costs in 2001 amounted to 3,862 of which

3,106 for Global Trucks, 392 for Buses and 364 for

Construction Equipment.

Restructuring costs in Global Trucks included costs for

the integration of Mack Trucks and Renault Trucks in order

to secure coordination gains made possible through the

acquisition. The integration measures included reduction

of the North American production capacity through a

decision to close Mack’s Winnsboro plant and transfer of

production to Volvo’s New River Valley plant. Integration

measures further included restructuring of the global

distribution system and production structure. In addition

to the integration measures, restructuring costs in Global

Trucks included significant personnel reductions due to

the prevailing business conditions, especially in North

America. Restructuring costs in Buses were attributable to

the shut down of Nova Bus’ plant for city buses in Roswell,

United States. In Construction Equipment, restructuring

measures were pertaining to close down of fabrication

in the Asheville plant, United States, and to an overall

redundancy program.

Of the total restructuring costs, 2,259 was attributable

to contractual pensions and excess personnel, 573 was

attributable to writedowns of assets and the remainder,

1,030 to other restructuring costs.

Note 3Net sales

Note 4Other operating income and expenses

Note 5Restructuring costs

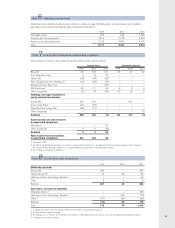

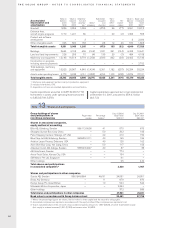

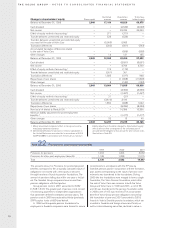

The effects during 2001, 2000 and 1999 on the Volvo

Group’s balance sheet and cash flow statement in con-

nection with the divestment of subsidiaries and

other business units are specified in the following

table:

1999 2000 2001

Intangible assets (46) (17) (354)

Property, plant and

equipment (17,915) (132) (288)

Assets under

operating leases (12,324) – –

Shares and participations (100) 7 –

Inventories (11,600) (69) (939)

Customer-financing

receivables (19,288) – –

Loans to external parties 10,474 – –

Other receivables (13,203) (93) (12,139)

Liquid funds (1,602) (7) (1,824)

Minority interests 49 10 176

Provisions for post-

employment benefits 866 – –

Other provisions 11,054 158 2,922

Loans 28,682 38 420

Other liabilities 17,622 172 583

Divested net assets (7,331) 67 (11,443)

Liquid funds received 33,661 506 11,860

Liquid funds, divested

companies (1,602) (7) (1,824)

Effect on Group

liquid funds 32,059 499 10,036

The effects during 2001, 2000 and 1999 on the Volvo

Group’s balance sheet and cash flow statement in con-

nection with the acquisition of subsidiaries and

other business units are specified in the following

table:

1999 2000 2001

Intangible assets 480 125 8,914

Property, plant and

equipment 147 68 9,126

Assets under operating

lease – – 10,195

Shares and participations – (9) 433

Inventories 365 348 9,361

Current receivables 233 300 8,774

Liquid funds 51 2 4,059

Other assets 43 1 7,674

Shareholders’ equity – – (10,356)

Minority interests 335 – –

Provisions (72) (7) (14,524)

Loans (256) (89) (2,543)

Current liabilities (264) (237) (30,020)

Acquired net assets 1,062 502 1,093

Liquid funds paid (1,062) (502) (1,093)

Liquid funds according to

acquisition analysis 51 2 4,059

Effect on Group

liquid funds (1,011) (500) 2,966

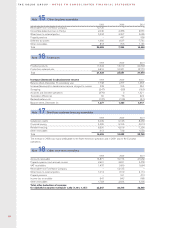

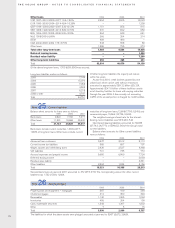

For comparability the adjoining table includes net sales

and operating income in 2000 and 1999 for the Volvo

Group Proforma, including Mack Trucks and Renault V.I.

The proforma amounts have been prepared by the use

of information included in Renault V.I.’s annual report for

the year 2000. No adjustment has been made for

purchase accounting or for differences in accounting

1999 2000 2001

Net sales 177,682 185,988 189,280

Operating income 34,586 8,742 (676)

principles between the Volvo Group and Renault V.I. The

proforma calculation has not been audited by AB Volvo’s

auditors.