Volvo 2001 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE VOLVO GROUP · NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

70

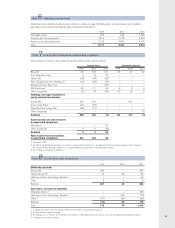

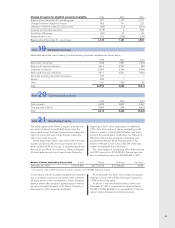

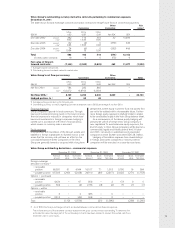

Restricted Unrestricted Total share-

Change in shareholders’ equity Share capital reserves reserves holders’ equity

Balance at December 31, 1998 2,649 17,100 49,626 69,375

Cash dividend – – (2,649) (2,649)

Net income – – 32,222 32,222

Effect of equity method of accounting 1–271 (271) –

Transfer between unrestricted and restricted equity – 523 (523) –

Transfers between unrestricted and restricted equity

as a result of the sale of Volvo Cars – (5,063) 5,063 –

Translation differences – (292) (501) (793)

Accumulated translation differences related

to the sale of Volvo Cars – – (598) (598)

Other changes – 14 121 135

Balance at December 31, 1999 2,649 12,553 82,490 97,692

Cash dividend – – (3,091) (3,091)

Net income – – 4,709 4,709

Effect of equity method of accounting 1–119 (119) –

Transfer between unrestricted and restricted equity – (261) 261 –

Translation differences – 1,385 (417) 968

Repurchase of own shares – – (11,808) (11,808)

Other changes – 8 (140) (132)

Balance at December 31, 2000 2,649 13,804 71,885 88,338

Cash dividend – – (3,356) (3,356)

Net income – – (1,467) (1,467)

Effect of equity method of accounting 1–21(21) –

Transfer between unrestricted and restricted equity – (3,410) 3,410 –

Translation differences – 1,850 (828) 1,022

Repurchase of own shares – – (8,336) (8,336)

New issue of shares to Renault S.A – – 10,356 10,356

Minimum liability adjustment for post-employment

benefits 2––(1,417) (1,417)

Other changes – 32 13 45

Balance at December 31, 2001 2,649 12,297 70,239 85,185

1Mainly associated companies’ effect on Group net income,

reduced by dividends received.

2Defined benefit plans for pensions in Volvo’s subsidiaries in

the United States are accounted for in accordance with U.S.

GAAP (FAS87). In accordance with these rules, a minimum

liability adjustment should be charged to shareholders’ equity

with an amount that corresponds to the unfunded part of

accrued benefit obligations less accrual for prior service costs.

See further in Note 33.

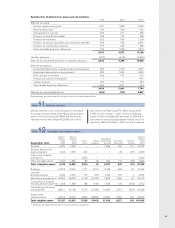

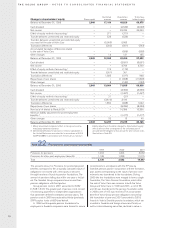

1999 2000 2001

Provisions for pensions 1,002 1,294 3,632

Provisions for other post-employment benefits 1,128 1,338 11,015

Total 2,130 2,632 14,647

The amounts shown for Provisions for post-employment

benefits correspond to the actuarially calculated value of

obligations not insured with a third party or secured

through transfers of funds to pension foundations. The

amount of pensions falling due within one year is includ-

ed. The Swedish Group companies have insured their

pension obligations with third parties.

Group pension costs in 2001 amounted to 3,332

(1,548; 1,541). The greater part of pension costs consist

of continuing payments to independent organizations

that administer defined-contribution pension plans. The

pension costs in 2000 was reduced by Alecta (previously

SPP) surplus funds of 683 (see below).

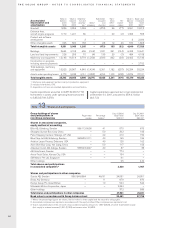

In 1996 two Groupwide pension foundations for

employees in Swedish companies were formed to secure

commitments in accordance with the ITP plan (a

Swedish pension plan). In conjunction with the formation,

plan assets corresponding to the value of pension com-

mitments was transferred to the foundations. During

2000 the two foundations were merged to form a single

foundation, The Volvo Pension Foundation, which after

the sale of Volvo Cars was common to both the Volvo

Group and Volvo Cars. In 1999 and 2001, a net of 58

and 40 was transferred to the pension foundation while

in 2000 a net of 105 was received. The accumulated

benefit of Volvo Group pension obligations secured by

this foundation at year-end 2001 amounted to 3,918.

Assets in Volvo’s Swedish pension foundation, which are

invested in Swedish and foreign shares and funds, as

well as interest-bearing securities, declined in value in

Note 22 Provisions for post-employment benefits