Volvo 2001 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

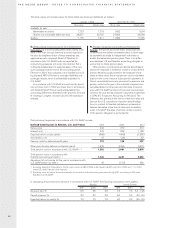

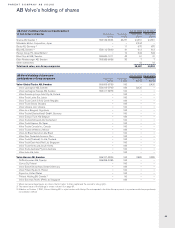

On January 2, the acquisition of all the shares of

Renault’s truck operations – Mack and Renault V.I. – in

exchange for 15% of AB Volvo’s shares became effec-

tive. During the beginning of the year, Volvo repurchased

10% of the Company’s outstanding shares. As a result, a

total of SEK 8.3 billion was transferred to the share-

holders of AB Volvo.

On February 9, half of these shares were transferred

to Renault SA as final payment for the shares of

Renault V.I. Volvo thus holds own shares corresponding

to 5% of share capital and 5% of voting rights.

In June, Volvo received USD 297 M (SEK 3,182 M)

as a payment for the sale of shares together with rights

and obligations relating to Mitsubishi Motors Corporation.

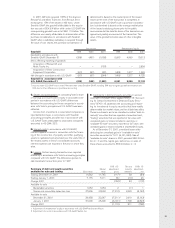

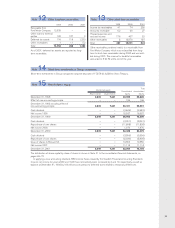

Income from investments in Group companies

includes dividends in the amount of 24,814 (589; 996),

write-down of shares of 12,217 (372; 910) and net

group contributions delivered totaling 3,450 (received

928; 1,416). Income from other shares and participa-

tions includes a dividend from Scania AB of 637 (637;

180) and capital gain of 595 from the sale of shares in

Mitsubishi Motors Corporation.

The book value of shares and participations in Group

companies amounted to 38,140 (39,729; 33,528), of

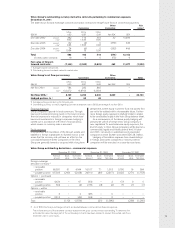

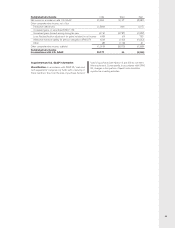

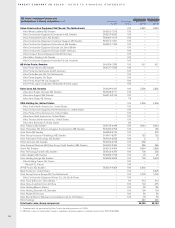

SEK M 1999 2000 2001

Net sales 459 377 500

Cost of sales (459) (377) (500)

Gross income –––

Administrative expenses Note 1 (550) (393) (424)

Other operating income and expenses Note 2 (38) 93 0

Operating income (588) (300) (424)

Income from investments in Group companies Note 3 18,728 1,558 9,599

Income from investments in associated companies Note 4 (11) (166) 22

Income from other shares and participations Note 5 195 663 1,258

Interest income and similar credits Note 6 564 266 455

Interest expenses and similar charges Note 6 (570) (353) (467)

Other financial income and expenses Note 7 72 (44) (163)

Income after financial items 18,390 1,624 10,280

Allocations Note 8 (227) (133) 2

Taxes Note 9 394 (115) 832

Net income 18,557 1,376 11,114

which 37,725 (39,314; 33,321) pertained to shares in

wholly owned subsidiaries. The corresponding share-

holders’ equity in the subsidiaries (including equity in

untaxed reserves but excluding minority interests)

amounted to 39,752 (63,636; 55,594).

Shares and participations in non-Group companies

included 659 (679; 24,028) in associated companies

that are reported in accordance with the equity method

in the consolidated accounts. The portion of share-

holders’ equity in associated companies accruing to

AB Volvo totaled 844 (616; 24,669). Shares and partici-

pations in non-Group companies included listed shares

in Scania AB, Bilia AB, Deutz AG and Henlys Group Plc

with a book value of 26,157. The market value of these

holdings amounted to 18,465 at year-end. No write-

downs were deemed necessary since the decline is not

considered permanent.

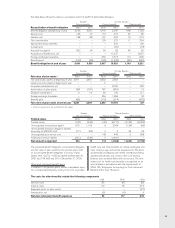

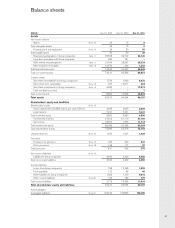

Financial net assets/debt amounted to 12,207

(–5,178; 15,503).

AB Volvo’s risk capital (shareholders’ equity plus

untaxed reserves) amounted to 73,682 corresponding to

82% of total assets. The comparable figure at year-end

2000 was 76%.

Corporate registration number 556012-5790.

Board of Directors’ report

Parent Company AB Volvo

Income statements