Volvo 2001 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

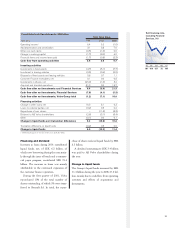

13

0

97 98 99 00 01

■ Net income,

SEK per share

■ Dividend,

SEK per share

23.2 19.1 73.0 11.2 (3.5)

5.0 6.0 7.0 8.0 8.0

Net income and

dividend per share

97 98 99 00 01

Effective return, %

46 (10) 22 (23) 18

0

97 98 99 00 01

Direct return, %

2.3 3.2 3.2 5.1 4.5

The Volvo share in 2001

Volvo’s market value amounted to SEK 73.0

billion and the Volvo Series B shares

increased by 12.5% in 2001.

Stockholmsbörsen accounts for the largest

percentage of turnover, with an average of

1.7 million Volvo shares traded each day.

During 2001, Volvo was the 14th most

actively traded share in terms of volume,

with a 1.6% share of the total market volume.

Related to the market value, Volvo was num-

ber nine, with a 2.7% share of the total mar-

ket value. Apart from Stockholmsbörsen,

most trading occurs in London and on the

NASDAQ. Trading in Volvo shares in the US

is in the form of ADRs,American Depositary

Receipts, representing Series B shares. The

number of ADR’s traded on the NASDAQ

declined by 8% during the year, and the

number of outstanding ADRs at December

31, 2001, fell by 12% to 8.3 million.

During 2001, the percentage of non-

Swedish shareholders increased from 40% to

47% of the share capital (from 32% to 37%

of the voting rights). Shares held by Swedish

owners were distributed among institutions

(59%), equities funds (16%) and private per-

sons (25%). Of Volvo’s 214,000 sharehold-

ers, the 50 largest accounted for approxi-

mately 70% of the voting rights and 60% of

the share capital, excluding shares held by

Volvo.

Price trend, Volvo Series B shares SEK

Turnover, Volvo Series B shares Millions

Source: Stockholmsbörsen

For more information related to the Volvo share,

see page 103.

Source: Stockholmsbörsen

0

97 98 99 00 01

■ Return on equity, %

■ Shareholders’ equity

per share, SEK

140 157 221 222 203

17.2 13.0 34.9 5.0 (1.7)

ROE and Equity

per share

Number of Volvo Series B shares

traded on the Stockholmsbörsen

90

80

70

60

50

40

30

20

10

0

97 98 99 00 01

Highest and lowest price per month

on the Stockholmsbörsen

97 98 99 00

500

450

400

350

300

250

200

150

100

50

0

01

General Index