Volvo 2001 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

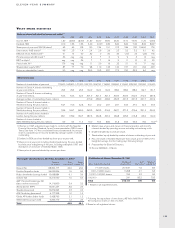

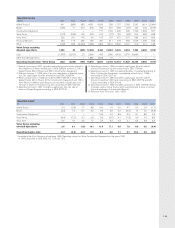

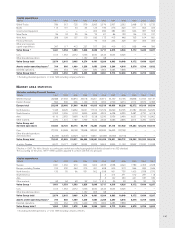

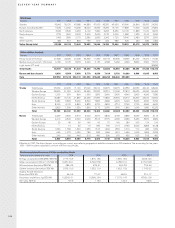

ELEVEN-YEAR SUMMARY

1Operating income in 2001 included restructuring costs mainly related to

the integration of Mack and Renault of SEK 3,862 M of which 3,106 in

Global Trucks, 392 in Buses and 364 in Construction Equipment.

2Effective January 1, 1999, Volvo Cars was reported as a divested opera-

tion. The capital gain from the divestment was SEK 26,695 M.

3Restructuring costs in 1998 amounted to SEK 1,650 M of which 46 in

Global Trucks, 422 in Buses, 910 in Construction Equipment and 158 in

Volvo Penta. In addition operating income included a capital gain from

the sale of shares in Pharmacia UpJohn amounting to SEK 4,452 M.

4Operating income in 1997 included a capital gain from the sale of

shares in Pripps Ringnes amounting to SEK 3,027 M.

5Operating income in 1996 included a capital gain from the sale of

shares in Pharmacia UpJohn amounting to SEK 7,766 M.

6Operating income in 1995 included write-down of goodwill pertaining to

Volvo Construction Equipment, consolidated as from July 1, 1995,

amounting to SEK 1,817 M.

7Operating income in 1994 included a capital gain from the sale of

shares in Investment AB Cardo amounting to SEK 2,597 M and AB

Custos amounting to SEK 916 M.

8Operating income in 1993 included a provision of SEK 1,600 M relating

to excess value in Volvo Trucks, which was estimated to arise in connec-

tion with exchange of shares with Renault.

9Refers to Volvo Trucks for 1991–2000.

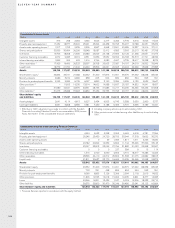

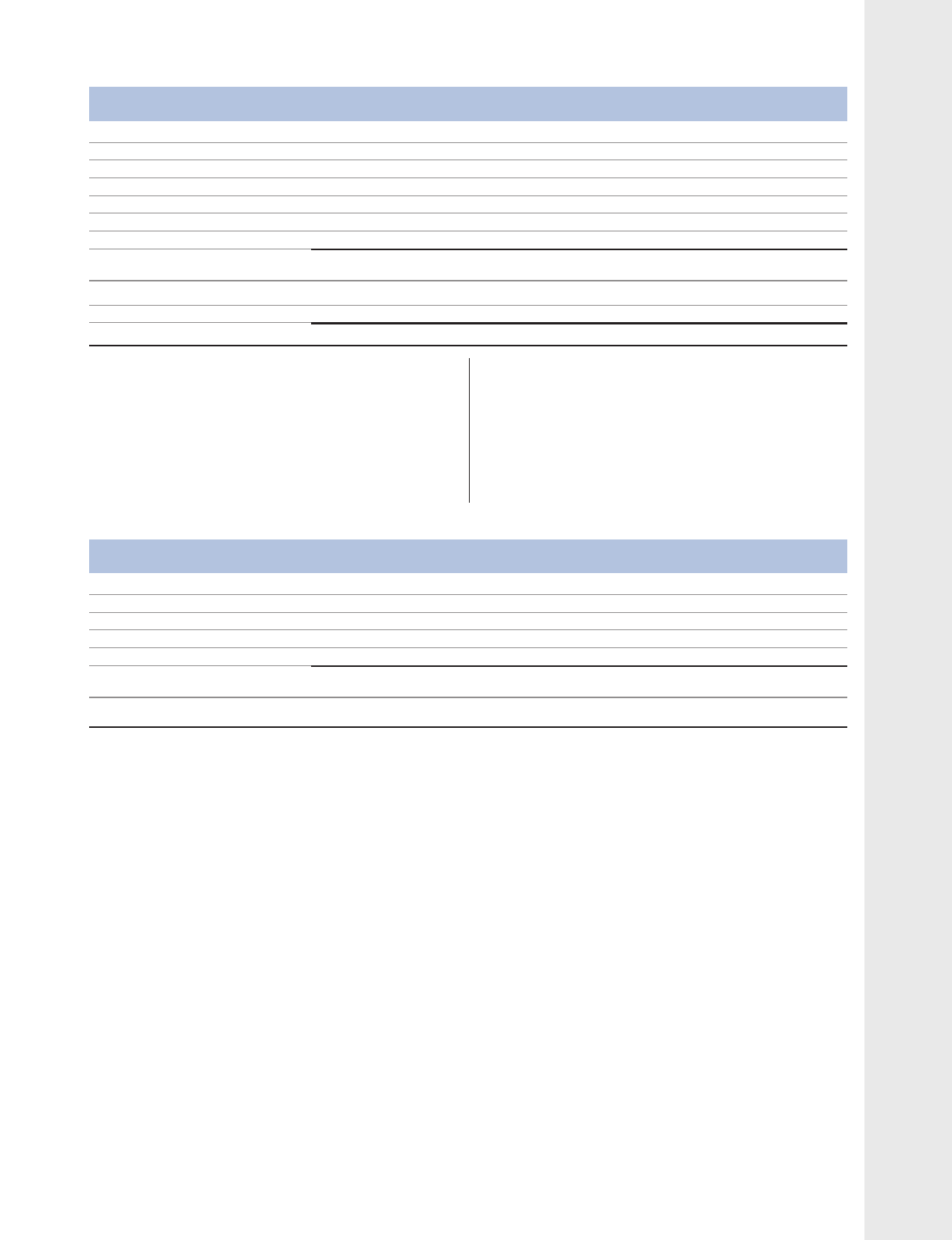

Operating income

SEKM 1991 1992 1993 81994 71995 61996 51997 41998 31999 22000 20011

Global Trucks 9941 (889) 585 4,051 5,020 783 1,707 2,769 3,247 1,414 (2,066)

Buses (166) 71 313 318 405 331 550 (37) 224 440 (916)

Construction Equipment – — — — 717 1,162 1,436 626 1,709 1,594 527

Volvo Penta (113) (184) 125 223 212 (27) 181 (63) 314 484 658

Volvo Aero 202 261 143 60 103 153 472 527 584 621 653

Financial Services 294 173 266 166 281 311 479 590 1,066 1,499 325

Other (103) 632 (2,240) 7,638 1,496 9,310 3,520 4,041 319 616 143

Volvo Group excluding

divested operations 1,055 64 (808) 12,456 8,234 12,023 8,345 8,453 7,463 6,668 (676)

Cars (1,597) (2,972) 23 2,599 490 1,080 4,409 3,375 26,695 — —

Other divested operations — — — 1,885 4,563 91 — — — — —

Operating income (loss) Volvo Group (542) (2,908) (785) 16,940 13,287 13,194 12,754 11,828 34,158 6,668 (676)

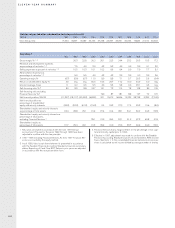

Operating margin

%1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

Global Trucks 3.4 (3.4) 1.7 8.8 10.6 1.9 3.6 4.7 5.2 2.3 (1.7)

Buses (4.3) 1.6 5.7 5.2 5.3 3.9 5.2 (0.3) 1.5 2.6 (5.5)

Construction Equipment 1–———10.4 9.1 8.6 3.2 9.1 8.0 2.5

Volvo Penta (4.4) (7.2) 4.2 6.0 5.5 (0.7) 4.1 (1.3) 5.5 7.3 8.9

Volvo Aero 5,5 7.6 3.9 1.7 2.7 3.7 6.3 6.1 5.9 5.8 5.5

Volvo Group excluding

divested operations 2.4 0.1 (1.5) 18.1 11.4 17.1 9.6 7.9 6.4 5.5 (0.4)

Operating margin, total (0.7) (3.6) (0.7) 11.0 8.0 8.8 7.1 5.7 29.3 5.5 (0.4)

1Included in the Volvo Group as of mid-year 1995. Operating margin for Volvo Construction Equipment for the years 1991

to 1995 amounted to (2.3), (5.5), 5.2, 13.4 and 12.3.