Volvo 2001 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

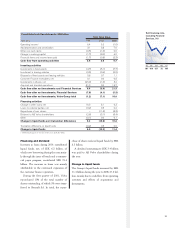

Financial targets

In order to achieve the strategy for growth

and wanted position in 2005, as well as a

competitive return to the shareholders,

Volvo has set a number of financial targets to

support the targeted strategic direction.

These financial targets cover growth, operat-

ing margin, return on equity and capital

structure. The financial targets are set over a

business cycle.

Growth

In order to achieve the strategy for growth as

well as the wanted position in 2005, Volvo’s

ambition is that net sales should increase by

more than 10% per year. The objective

should be achieved through both organic

growth and acquisitions. As of 2001, Mack

and Renault Trucks are part of the Volvo

Group. During the period 1997 to 2001, the

average growth rate was 21.8% per year.

Operating margin

The objective for the operating margin is

that it should be between 5 and 7% over an

economic cycle. The average operating mar-

gin for the Volvo Group during 1997 to

2001 was 5.8% per year.

Return on equity

Over time, the return on shareholders’ equi-

ty should more than compensate for infla-

tion as well as for industrial and financial

risk. The objective is to achieve a return on

shareholders’ equity of between 12 and 15%

over an economic cycle. Return on sharehold-

ers’ equity during 1997 to 2001 averaged

13.7% per year.

Capital structure

The Group’s objective is to have a capital

structure that enables financial flexibility

and long-term stability. At the same time,

the aim is to conduct operations using capi-

tal in an efficient manner.

The equity ratio, including minority inter-

ests but excluding Financial Services, should

not be lower than 40%. The equity ratio in

Financial Services should not be lower than

10%. On December 31, 2001, the equity

ratio for the Group, excluding Financial

Services was 41.8%. Financial Services’ equi-

ty ratio was 10.3% at the same date.

The Group’s objective is also to maintain

a net financial position ratio, excluding

Financial Services, between a net financial

assets position of 15% and a net debt posi-

tion of 30%.

0

5

7

97 98 99 00 01

9.6 7.9 6.4 5.5 (0.4)

* Excluding divested operations

Operating margin* %

97 98 99 00 01

Equity ratio, %

53 51 67 61 42

40

97 98 99 00 01

Net financial position

as percentage of

shareholders’ equity, %

27.0 17.4 29.3 10.6 (8.2)

15

–30

0

97 98 99 00 01

Return on

shareholders equity, %

17.2 13.0 34.9 5.0 (1.7)

12

15

0

97 98 99 00 01

Net sales growth*, %

24.0 23.5 8.1 3.4 50.0

* Excluding divested operations

10