Volvo 2001 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

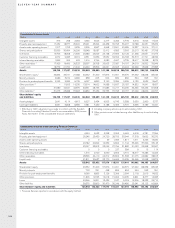

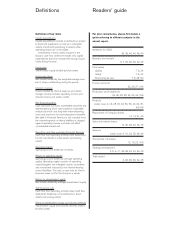

Definitions

Definition of key ratios

Capital expenditures

Capital expenditures include investments in proper-

ty, plant and equipment, as well as in intangible

assets. Investments pertaining to assets under

operating leases are not included.

Investments in fixed assets included in the

Group’s cash flow statement include only capital

expenditures that have reduced the Group’s liquid

funds during the year.

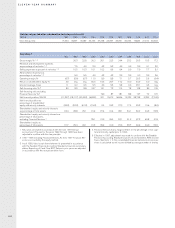

Equity ratio

Shareholders’ equity divided by total assets.

Income per share

Net income divided by the weighted average num-

ber of shares outstanding during the period.

Interest coverage

Income divided by interest expense and similar

charges. Income includes operating income and

interest income and similar credits.

Net financial position

Cash and bank accounts, marketable securities and

interest-bearing short- and long-term receivables

reduced by short- and long-term interest-bearing

loans and provisions for post-employment benefits.

Net debt in Financial Services is not included since

the interest expense on these liabilities is charged

against operating income and does not affect

consolidated interest net.

Operating cash flow, excluding Financial Services

Cash flow from operating activities with deductions

for net investments in fixed assets and leasing

assets.

Operating margin

Operating income divided by net sales.

Return on operating capital

Operating income divided by average operating

capital. Operating capital consists of operating

assets (tangible and intangible assets, receivables

and inventories) reduced by non interest-bearing

current liabilities. This ratio is used only for Volvo’s

business areas, not for the Group as a whole.

Return on shareholders’ equity

Net income divided by average shareholders’ equity.

Self-financing ratio

Cash flow from operating activities (see Cash flow

statement) divided by net investments in fixed

assets and leasing assets.

Share of shareholders’ equity and minority interests

Shareholders’ equity and minority interests divided

by total assets.

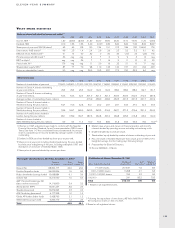

Readers’ guide

For your convenience, please find below a

guide referring to different subjects in the

annual report.

Ambitions for 2002

35, 38, 40, 44, 46, 49

Business environment

6, 7, 34, 36, 39, 42, 45

Core values

Quality 7, 8, 24

Safety 7, 8, 24

Environmental care 7, 8, 28–30

Human resources

22, 26, 27, 106

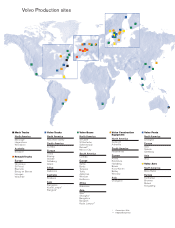

Production and investments

20, 30, 35, 38, 40, 44, 46, 108

Products

inside cover, 4, 24, 28, 32, 34, 36, 39, 40, 42, 45,

48,108

Repurchase of Company shares

12, 14, 21, 69

Sales and market shares

16, 35, 38, 40, 44, 45

Services

inside cover, 9, 10, 24, 25, 48, 49

Shareholder information

12, 13, 22, 103

Strategic development

4, 5, 6–11, 35, 38, 40, 44, 46, 49

Total market

4, 34, 36, 39, 42, 45