Volvo 2001 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

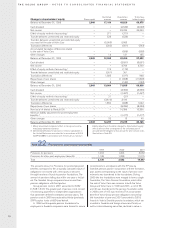

Minority interests in net income (loss) and in sharehold-

ers’ equity consisted mainly of the Henlys Group’s partici-

pation in Prévost Holding BV (49%) and the minority

interests in Volvo Aero Norge AS (22%) and in Volvo

Aero Services LP (previously The AGES Group, ALP)

(14%). As from October 1, 2001, Volvo’s participating

interest in Prévost Holding BV amounted to 50% and is

accounted for using the proportionate method. As a con-

sequence, effective October 1, 2001 minority is reported.

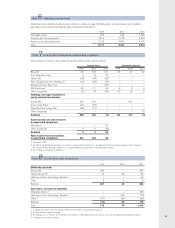

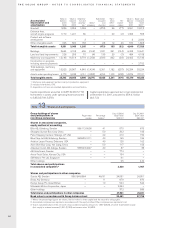

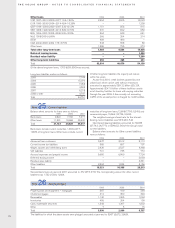

Specification of deferred tax assets and tax liabilities

1999 2000 2001

Deferred tax assets:

Tax-loss carryforwards, gross 1,031 1,698 5,464

Other tax deductions 154 303 501

Internal profit on inventory 223 221 359

Provision for doubtful receivables 186 157 596

Provision for warranties 552 555 1,203

Provision for pensions and other post-employment benefits 653 708 4,641

Provision for restructuring measures 277 206 895

Other deductible temporary differences 705 1,029 3,510

3,781 4,877 17,169

Valuation allowance (379) (613) (2,676)

Deferred tax assets after deduction for valuation allowance 3,402 4,264 14,493

Deferred tax liabilities:

Accelerated depreciation on property, plant and equipment 989 1,180 2,081

Accelerated depreciation on leasing assets 855 1,432 2,542

LIFO valuation of inventory 206 167 916

Product and software development – – 571

Untaxed reserves 900 721 543

Other taxable temporary differences 1,004 1,501 1,143

3,954 5,001 7,796

Deferred tax assets (liabilities), net (552) (737) 6,697

Deferred taxes are recognized after taking into account offsetting possibilities.

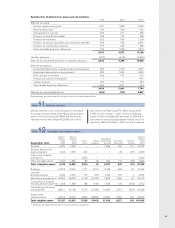

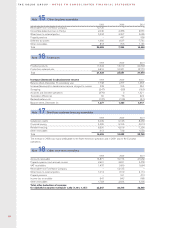

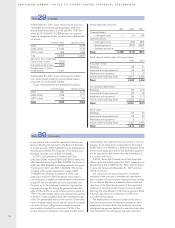

Value in Value in Value in

balance balance Subsidaries balance

sheet sheet Invest- Sales/ acquired and Translation Reclassi- sheet

Acquisition costs 1999 2000 ments scrapping divested differences fications 2001

Goodwill 6,929 7,323 – – 7,848 702 101 15,974

Entrance fees, aircraft

engine programs 1,293 1,678 450 – – 28 (67) 2,089

Product and software

development – – 2,039 – – – – 2,039

Other intangible assets 1,727 1,889 85 (4) 239 110 (56) 2,263

Total intangible assets 9,949 10,890 2,574 (4) 8,087 840 (22) 22,365

Buildings 10,575 12,044 1,177 (231) 3,198 824 37 17,049

Land and

land improvements 2,633 2,790 170 (73) 1,428 273 4 4,592

Machinery and equipment 124,235 26,976 4,178 (1,542) 7,835 1,596 92 39,135

Construction in progress

including advance payments 1,368 1,388 188 (142) 1,638 120 (440) 2,752

Total buildings, machinery

and equipment 38,811 43,198 5,713 (1,988) 14,099 2,813 (307) 63,528

Assets under

operating leases 16,516 19,254 5,852 (3,954) 16,959 3,464 502 42,077

Total tangible assets 55,327 62,452 11,565 (5,942) 31,058 6,277 195 105,605

1 Machinery and equipment pertains mainly to production equipment.

Note 11 Minority interests

Note 12 Intangible and tangible assets