Volvo 2001 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

Net sales

Net sales in 2001 totaled SEK 180,615 M

(120,392), an increase of 50% compared

with 2000. Adjusted for acquired companies

and changes in foreign currency exchange

rates, net sales decreased by 5%.

Including Mack and Renault Trucks, net

sales of Volvo’s truck operations nearly doub-

led and amounted to SEK 120,140 M.

Despite the significant decline in deliveries,

Volvo Global Trucks was able to increase its

share of the market in North America. In

Europe, the combined heavy-truck market

share for Volvo and Renault was maintained

at the same level as in 2000, while market

shares increased in the medium-heavy seg-

ment.

Net sales for Volvo CE reached a record

level, in part due to a favorable currency

trend but also as a result of successfully

launched products. Volvo Penta’s sales

remained strong with an increase of 12% in

a declining market. As a result of increasing

sales of components and spare parts for com-

mercial aircraft, Volvo Aero’s net sales rose

by 10%.

During 2001, the Group’s net sales

increased in all market areas compared with

the year-earlier period. Net sales in Western

Europe rose by 50%, most of which was

attributable to the acquisition of Renault

Trucks. Excluding acquired companies, Group

net sales in Western Europe increased by 2%.

The decline in demand in North America

had an adverse effect on net sales. Excluding

acquired companies Group net sales in

North America declined by 8%. Net sales in

Volvo’s growth markets – Asia, Eastern

Europe and South America – increased by

35% compared with a year earlier and

accounted for 13% of the Group’s total sales.

Excluding Mack and Renault Trucks, net

sales on these markets rose by 19% com-

pared with the preceding year.

During 2001, Western Europe and North

America accounted for 82% of the Group’s

total sales, compared with 83% in the preced-

ing year.The distribution of net sales by mar-

ket is further specified in the adjoining table.

Income from investments in shares

Income from investments in shares for the

year amounted to SEK 1,322 M (411),

attributable mainly to a dividend received

from Scania and a capital gain from the

divestment of shares in Mitsubishi Motors.

Income from investments in shares during

2000 included income from the investment

in Scania reported in accordance with the

equity method during the first quarter. In

March 2000, the European Commission

rejected Volvo’s application for approval of

the proposed acquisition of Scania. As a

result, effective in the second quarter of

2000, Volvo’s holding in Scania is no longer

reported in accordance with the equity

method.

Operating income

Operating loss for the Volvo Group in 2001

amounted to SEK 676 M, compared with

operating income of SEK 6,668 M in the

preceding year. The decrease in income was

mainly attributable to restructuring costs of

SEK 3,862 M and losses in the North

American operations partially offset by capi-

talization of development costs of SEK

2,038 M in accordance with new Swedish

accounting standards.

Global Trucks’ operating income in 2001,

excluding restructuring costs, amounted to

SEK 1,040 M (2000: Volvo Trucks operating

income of SEK 1,414 M). The earnings of

Global Trucks was negatively affected by

lower volumes and low capacity utilization

in North America. Total deliveries in North

America decreased by 40% compared with a

year earlier. In Western Europe, the total

market showed gradual weakening during

the year and the number of trucks delivered

was down by 9%. The integration of Renault

Trucks and Mack Trucks succeeded in line

with the plan and contributed positively to

the result. The income of Global Trucks in

Financial performance

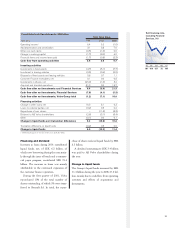

Net sales by market area

SEKM 1999 2000 2001 %1

Western Europe 59,858 61,942 93,147 +50

Eastern Europe 2,714 3,676 6,383 +74

North America 41,382 38,029 54,630 +44

South America 3,487 4,730 6,018 +27

Asia 6,027 8,765 10,862 +24

Other markets 2,914 3,250 9,575 +195

Volvo Group 116,382 120,392 180,615 +50

1Percentage change pertains to 2001/2000.

Operating margin1

%1999 2000 2001

Global Trucks25.2 2.3 0.9

Buses 1.5 2.6 (3.1)

Construction Equipment 9.1 8.0 4.2

Volvo Penta 5.5 7.3 8.9

Volvo Aero 5.9 5.8 5.5

Volvo Group 6.4 5.5 1.8

1Excluding income from sale of Volvo Cars and restructuring

costs

21999 and 2000 refer to Volvo Trucks

Net sales by business area

SEKM 1999 2000 2001 %2

Global Trucks163,010 62,196 120,140 +93

Buses 14,713 17,187 16,675 (3)

Construction

Equipment 18,882 19,993 21,135 +6

Volvo Penta 5,761 6,599 7,380 +12

Volvo Aero 9,953 10,713 11,784 +10

Other 11,934 12,669 13,630 +8

Eliminations (7,871) (8,965) (10,129) –

Volvo Group 3116,382 120,392 180,615 +50

11999 and 2000 figures refer to Volvo Trucks.

2Percentage change pertains to 2001/2000.

3Excluding acquired companies and changes in foreign

currencies’ exchange rates, net sales decreased by 5%.

Operating income (loss) by

business area

SEKM 1999 2000 2001

Global Trucks13,247 1,414 1,040

Buses 224 440 (524)

Construction

Equipment 1,709 1,594 891

Volvo Penta 314 484 658

Volvo Aero 584 621 653

Financial Services 1,066 1,499 325

Other 319 616 143

Operating income 27,463 6,668 3,186

Income from divestment

of Volvo Cars 26,695 – –

Restructuring costs – – (3,862)

Operating income

(loss) 34,158 6,668 (676)

11999 and 2000, Volvo Trucks.

2Excluding income from sale of Volvo Cars and restructur-

ing costs.

THE VOLVO GROUP YEAR 2001