Volvo 2001 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shareholders in focus

The continuing dialogue with shareholders is

of high importance to Volvo. In addition to

the Annual General Meeting in April, a large

number of activities took place in 2001

geared towards professional analysts and

investors and also addressed directly to

Volvo’s private shareholders. The Internet is

an important tool in the shareholder

dialogue. It makes it possible for all share-

holders to obtain relevant and timely infor-

mation about Volvo.

Volvo’s dividend policy states that the

effective return (the dividend combined

with the change in share price over the long

term) should exceed the average for the

industry. If the future capital level in the

Group is determined to be too high and not

necessary for the growth of operations, the

annual dividend could also be supplemented

by measures such as the repurchase of com-

pany shares. For the fiscal year 2001, the

Board of Directors proposes that the share-

holders at the Annual General Meeting

approve an unchanged dividend of SEK 8.00

per share, a total of approximately SEK

3,356 M, based on the number of shares out-

standing, corresponding to a direct return of

4.5%.

Dow Jones Sustainability Index

Volvo has a history of corporate citizenship

based on its three core values; quality, safety

and care for the environment. As of 2002,

the Volvo share is part of the newly launched

Dow Jones STOXX Sustainability Indexes.

Launched in 1999, the Dow Jones

Sustainability World Index is the first global

index tracking the performance of the lead-

ing sustainability-driven companies world-

wide. It covers the top 10% of the largest

2,500 companies in the Dow Jones Global

Index in terms of economic, environmental

and social criteria.

Delisting

In December 2001, as a result of deregula-

tion of the international capital markets and

the increased foreign ownership of shares on

the Stockholmsbörsen, the Board of Directors

decided to apply for a delisting of the Volvo

share from the Tokyo stock exchange.

Repurchase of shares

During 2001, the Board of Directors of AB

Volvo decided to acquire a maximum of

10% of the Company’s shares on the Stock-

holmsbörsen, corresponding to 44,152,088

shares. The repurchase was carried out on

the Stockholmsbörsen during the spring of

2001. Of the repurchased shares, 5% were

transferred to Renault SA as final payment

for the shares in Mack and Renault V.I. The

remaining 5% is held by AB Volvo.

The stock market in 2001

The year 2001 was initially characterized by

declining share prices on stock markets

worldwide, however there was a notable

recovery during the later part of the year.

The leading US Index, the Dow Jones

Industrial Average, decreased by 7% and

NASDAQ (Volvo listed since 1985), where

high-technology shares dominate, closed at

21% down. In Sweden, Stockholmsbörsen

All Share Index decreased by 17%.

Continued uncertainties about the macro-

economic development in the US affected

the General Index.

THE VOLVO SHARE

Exchange listings of Volvo shares

Stockholm 1935

London 1972

Frankfurt am Main,

Düsseldorf, Hamburg 1974

USA (NASDAQ) 1985

Brussels 1985

Tokyo 11986

1 Volvo's Board of Directors has applied for delisting from

the Tokyo Stock Exchange. The delisting will be effective

as of May 22, 2002.

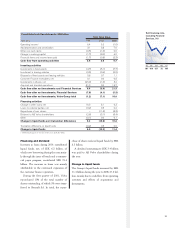

Share capital Dec 31 2001

Registered number

of shares 1441,520,885

of which, Series A shares 2138,604,945

of which, Series B shares 3302,915,940

Par value, SEK 6

Share capital, SEK M 2,649

Number of shareholders 214,000

with shares held in own name 126,000

with shares held by trustees 88,000

1Following the repurchase of own shares, the number of

outstanding shares was 419,444,842.

2Series A shares carry one vote each.

3Series B shares carry one tenth vote each.

The Volvo share