Volvo 2001 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2001 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE VOLVO GROUP · NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

76

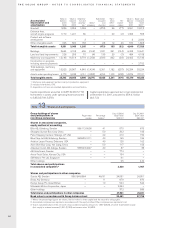

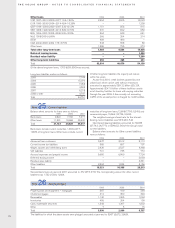

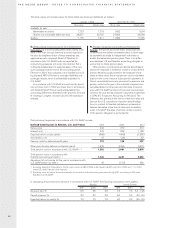

Wages, salaries

and other 1999 2000 2001

remunerations, Board and of which, Other Board and of which, Other Board and of which, Other

SEK M Presidents1bonuses employees Presidents1bonuses employees Presidents1bonuses employees

AB Volvo

Sweden 27.8 5.9 77.0 23.9 1.0 73.2 24.4 1.9 70.3

Subsidiaries

Sweden 63.3 9.3 6,969.0 64.4 11.7 7,272.5 64.4 11.3 7,277.4

Western Europe 149.7 20.9 3,203.0 112.7 8.8 3,290.6 356.0 14.2 7,661.3

Eastern Europe 1.1 0.2 102.2 3.2 0.4 144.8 11.7 3.8 214.4

North America 60.9 1.9 3,137.2 103.5 16.3 3,484.6 174.5 14.3 7,135.9

South America 29.6 0.0 292.9 27.9 0.0 376.5 48.5 2.7 355.3

Asia 33.0 0.5 493.1 36.6 1.4 610.5 47.7 1.2 660.1

Other countries 6.4 0.5 106.0 5.5 – 134.7 13.0 – 231.1

Group total 371.8 39.2 14,380.4 377.7 39.6 15,387.4 740.2 49.4 23,605.8

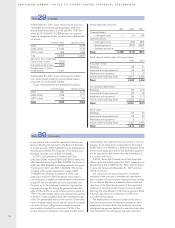

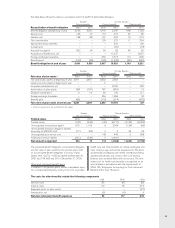

Wages,

salaries other 1999 2000 2001

remunerations Wages, of which, Wages, of which, Wages, of which,

and social- salaries, re- Social pension salaries, re- Social pension salaries, re- Social pension

costs, SEK M munerations costs costs munerations costs costs munerations costs costs

AB Volvo 2104.8 78.5 54.3 97.1 90.4 70.3 94.7 111.9 92.5

Subsidiaries 14,647.4 5,001.7 1,486.8 15,668.0 5,654.2 1,477.9 24,251.3 8,995.1 3,239.7

Group total 314,752.2 5,080.2 1,541.1 15,765.1 5,744.6 1,548.2 24,346.0 9,107.0 3,332.2

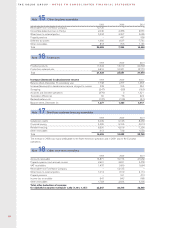

The Volvo Group is exposed to various types of financial

risks. Group-wide policies form the basis for each Group

company’s action program. Monitoring and control is

conducted continuously in each company as well as

centrally. Most of the Volvo Group’s financial transactions

are carried out through Volvo’s in-house bank, Volvo

Treasury, which conducts its operations within

established risk mandates and limits.

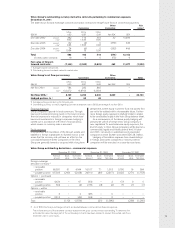

Foreign exchange risks

Volvo’s currency risks are related to changes in contract-

ed and projected flows of payments (commercial expo-

sure), to payment flows related to loans and investments

(financial exposure), and to the translation of assets and

liabilities in foreign subsidiaries (equity exposure). The

objective of the Volvo Group Currency Policy is to mini-

mize the short-term impact of adverse exchange rate

fluctuations on the Volvo Group’s operating income, by

hedging the Group’s firm transaction exposure.

The objective is also to reduce the Group’s balance

sheet exposure to a minimum. Volvo Group Companies

individually should not assume any currency risk.

Commercial exposure

According to the Volvo Group Currency Policy, forecast-

ed currency flows representing firm exposure and fore-

casted exposure with a pre-fixed price in local currency

should be hedged. Volvo uses forward exchange con-

tracts and currency options to hedge these flows. In

accordance with the Group’s currency policy, between

50% and 80% of the net flow in each currency is

hedged for the coming 6 months, 30% to 60% for

months 7 through 12 and firm flows beyond 12 months

should normally be hedged. The notional value of all for-

ward and option contracts as of December 31, 2001

was SEK 12.1 billion (16.7; 25.0).

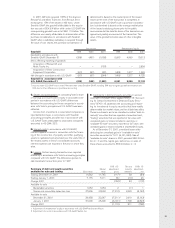

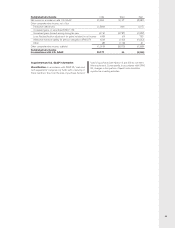

Fees and other remuneration to external auditors for

fiscal year 2001 amounted to 195, (130; 90), of which

74 (51; 55) for auditing, distributed between Pricewater-

houseCoopers, 60 (38; 34) and others, 14 (13; 21), and

121 (79; 35) pertaining to non-audit services from

PricewaterhouseCoopers.

Auditing assignments involve examination of the

annual report and financial accounting and the adminis-

tration by the Board and the President, other tasks relat-

ed to the duties of a company auditor and consultation

or other services that may result from observations noted

during such examination or implementation of such other

tasks. All other tasks are defined as other assignments.

1 Including current and former Board members, Presidents and

Executive Vice Presidents.

2Of the Parent Company’s pension costs, 21.9 (51.3; 14.6)

pertain to Board members and Presidents. The Company’s

outstanding pension obligations to these individuals amount to

319.1 (301.8; 287.9).

3Of the Group’s pension costs, 100.3 (116.1; 60.0) pertain to

Board members and Presidents. The Group’s outstanding

pension obligations to these individuals amount to 442.3

(397.6; 368.2).

Note 31 Fees to the auditors

Note 32 Financial risks